2022-11-19 13:43 |

Crypto exchange FTX recently filed for bankruptcy protection in the US. Authorities are investigating the cause of the tragic collapse.

In a submission to the U.K. Parliamentary Treasury Committee, Binance on Wednesday denied claims that it deliberately intended to sink competitor cryptocurrency exchange FTX.

FTX collapsed last week after the company filed for bankruptcy on November 11 following a surge of user withdrawals earlier in the month.

On Monday, November 14th, the Parliament’s Treasury Committee held a hearing to question officials from cryptocurrency firms regarding the aftermath of FTX’s downfall.

Daniel Tinder, Binance’s Vice President of Governmental Affairs of Europe, promised to submit a document after Member of Parliament Harriett Baldwin, the chairwoman of the U.K. Parliamentary Treasury Committee, questioned about Binance’s role in the FTX crisis.

On Wednesday, November 16th, Binance sent a five-page document to the Treasury Committee, highlighting the sequence of events that led to the FTX collapse.

Binance document stated that the causes of FTX’s downfall were the financial irregularities and possible fraud as initially reported by CoinDesk media on its article dated November 2.

Binance explained that potential collapse of FTX prompted it (Binance) to sell its holdings in FTX’s native token FTT to reduce its exposure to risky assets.

The US Senate Banking Committee is also “working to schedule” a hearing to investigate the cause of FTX’s fallout as well as investigating Binance over its responsibility in the collapse. The issue will be one of the key topics in a congressional hearing next month, according to U.S. Congressman Patrick McHenry, the Republican Leader of the House Financial Service Committee, The Block reported the matter.

The FTX sage implicated several crypto firms

On Wednesday, crypto financial firm Genesis Global Capital halted withdrawals and new loan originations in the wake of FTX’s collapse. Genesis spokesperson said: “The decision was made in response to the extreme market dislocation and loss of industry confidence caused by the FTX implosion.”

Later on Wednesday, the Winklevoss brothers’ Gemini exchange also suspended withdrawals on its interest-bearing Earn accounts as a result of Genesis’ announcement. Genesis is the lending partner for Gemini’s interest-bearing Earn program.

The news came a day after the crypto lending firm BlockFi also announced it is preparing to file for bankruptcy, after it emerged that FTX could no longer save it.

In June, FTX agreed to offer $250 million as a revolving credit facility to BlockFi, a crypto lender that was adversely impacted by the collapse in token prices in early this year. FTX had signed bailout deals with several failing crypto companies over the summer.

FTX, one of the world’s largest cryptocurrency exchanges, collapsed last week with reports showing an $8 billion black hole on its balance sheet. Of its 1 million users, many are now unable to withdraw their funds.

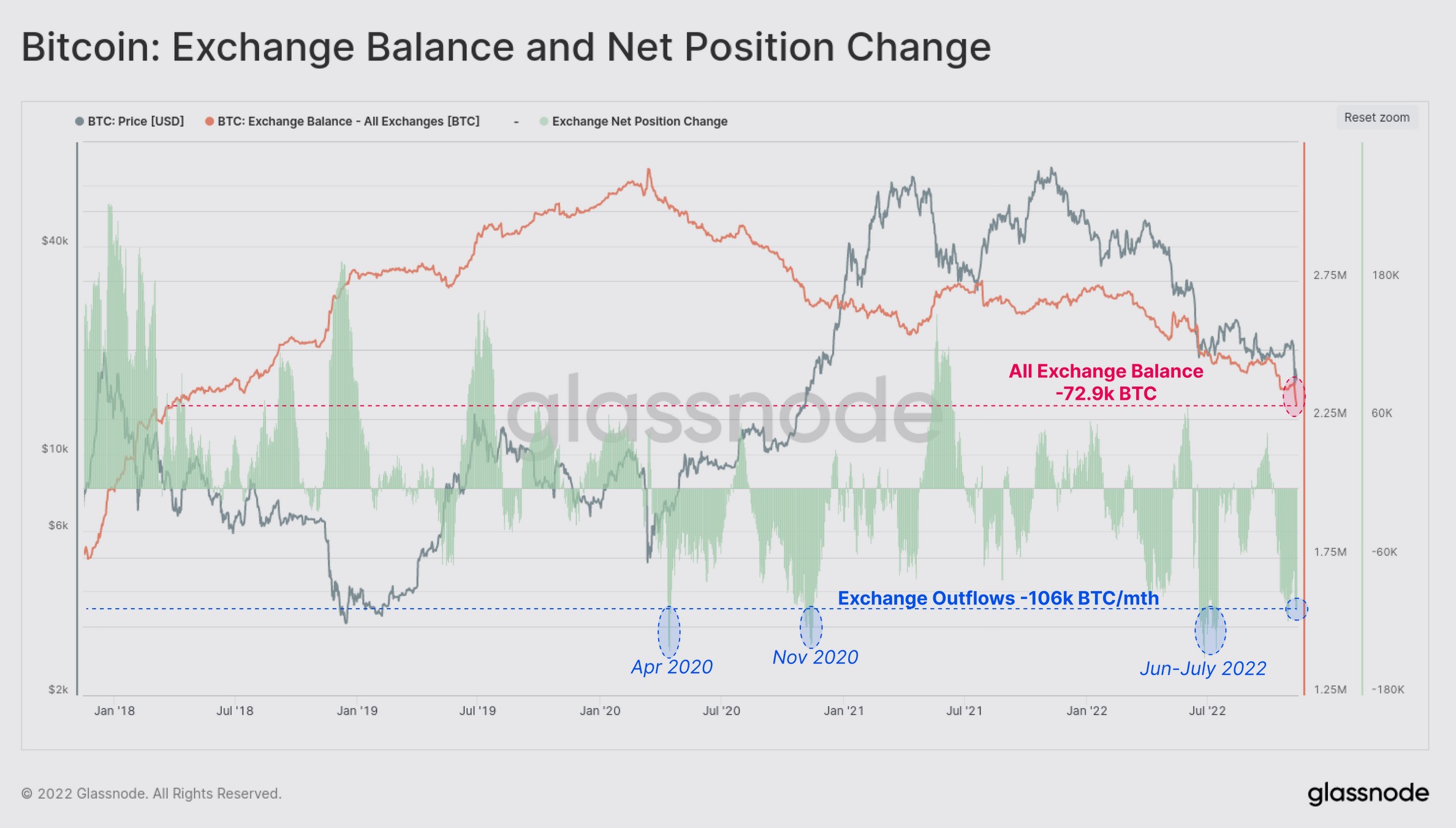

The FTX liquidity crisis has derailed an emerging positive situation in crypto markets after the significant deleveraging of May and June left few buyers in the digital assets landscape. The FTX crash led to further plunge of crypto prices, with overall market cap falling 20% in a week to $824 billion from $1.02 trillion. At time of writing, Bitcoin is trading at $16,566.23, a fall of more than 13% since last week, according to CoinMarketcap, a price-tracking platform for crypto assets.

Сообщение Binance Denies UK Lawmaker’s Allegation That It Deliberately Played a Role in FTX’s Collapse появились сначала на Coinstelegram.

origin »Bitcoin price in Telegram @btc_price_every_hour

FintruX Network (FTX) на Currencies.ru

|

|