2026-1-19 12:54 |

Binance has reinstated direct AUD deposit and withdrawal services for its Australian users, reestablishing traditional banking connectivity that had been severed since mid-2023.

According to a Monday announcement, the service, officially relaunched for all verified users on January 16, 2026, was previously rolled out to select users over the final months of 2025.

The renewed infrastructure allows customers to fund and withdraw from their accounts using Australia’s real-time PayID system and standard BSB bank transfers.

It was a lengthy suspension that had forced users to rely on debit and credit cards or peer-to-peer channels, options often associated with higher fees and slower processing.

“Access and integration with traditional financial services directly affects participation, confidence, and trust in the market,” Matt Poblocki, General Manager of Binance Australia and New Zealand, said in a media statement.

Without these channels, both users and platforms face unnecessary limitations that suppress crypto adoption, he added.

The return of AUD services follows months of quiet testing with a smaller group of users and is now backed by a new local partner, Bolt Financial Group.

Binance says it’s upgraded its compliance setup to better align with banking expectations, citing tighter anti-money laundering controls and clearer regulatory alignment.

Binance users lost AUD access in 2023Back in May 2023, Binance users woke up to find that AUD transfers had been abruptly cut off.

Behind the scenes, payment provider Zepto had pulled support under pressure from its banking partner, Cuscal.

Zepto’s upstream bank, Cuscal, reportedly instructed the termination as part of an effort to tighten fraud controls across the sector.

Subsequently, Binance suspended all AUD trading pairs and PayID deposits, with users only able to transact through cards or crypto workarounds.

At the time, Binance Australia head Ben Rose revealed the exchange was “cut off” overnight without clear reasoning from the providers.

Binance was already navigating compliance challenges in Australia back then.

Previously, Binance’s Australian derivatives arm had surrendered its financial services license after the Australian Securities and Investments Commission (ASIC) found it had misclassified over 500 retail clients as wholesale, stripping them of key protections.

Then, in the months that followed, ASIC filed civil penalty proceedings tied to the same issue, which added to the exchange’s compliance challenges.

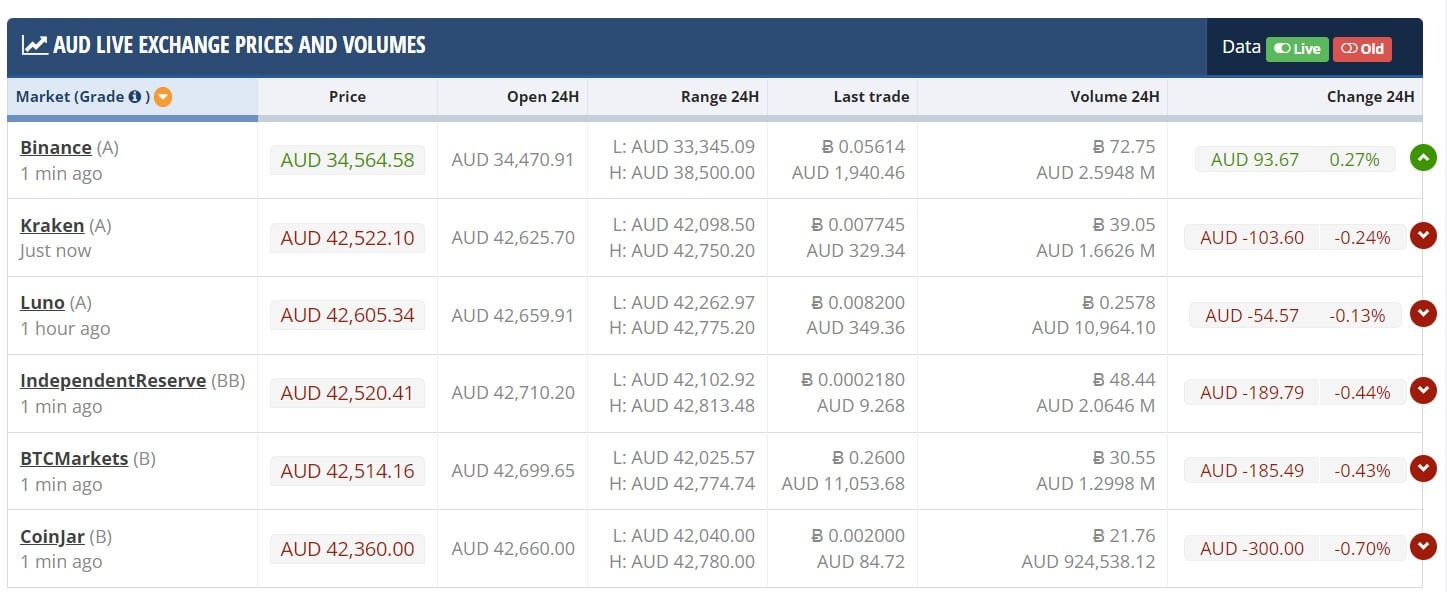

Now, with the full rollout completed, the exchange is once again operating on par with domestic rivals that maintained uninterrupted banking relationships.

To incentivise adoption of the restored services, Binance has launched a promotional campaign offering a 5 AUD token voucher to users who deposit at least 50 AUD via PayID or bank transfer.

Survey data released by Binance Australia last year suggests the return of banking support could meaningfully improve user sentiment.

A majority of respondents said they expect unrestricted access to fund their exchange accounts, while 22% admitted they had switched banks just to streamline crypto purchases.

Binance secures Abu Dhabi licenseWhile the local rebound is still fresh, it comes on the heels of Binance’s global restructuring push.

Last month, the exchange secured full regulatory approval in Abu Dhabi, which company execs said would function as the primary global operational base under the Abu Dhabi Global Market’s oversight and launched three licensed entities to separate trading, custody, and broker services.

The post Binance brings back direct AUD deposits in Australia after a two-year freeze appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Australian Dollar (AUD) на Currencies.ru

|

|