2021-7-26 15:38 |

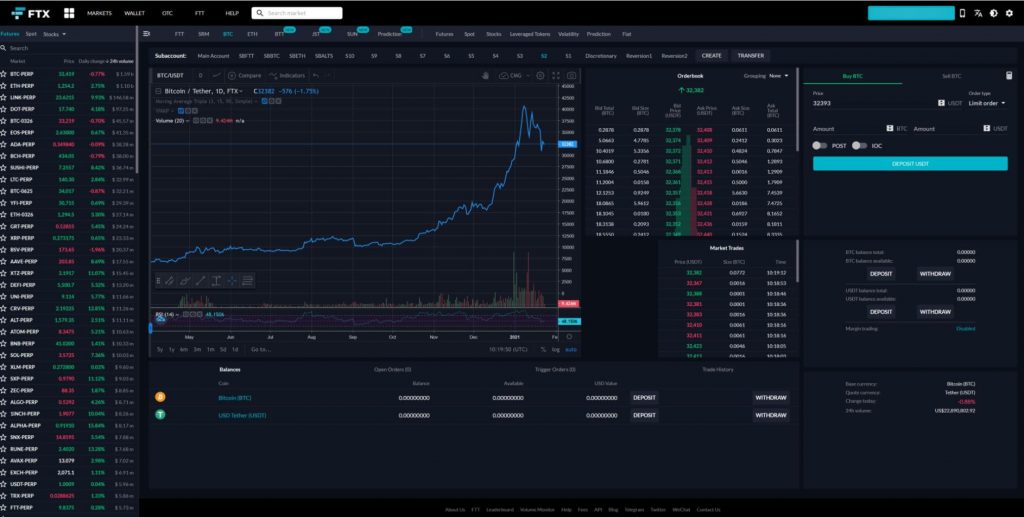

“Today, we're removing high leverage from FTX. The greatest allowable will be 20x,” down from 101x, announced Sam Bankman-Fried, the CEO and founder of cryptocurrency derivatives platform FTX over the weekend. Ceteris Paribus commented,

“No-brainer considering FTX users don't seem to be ultra degens and puts them on better standing with regulators. IMO the argument about high leverage isn't even if it's right or wrong, regulators will not allow it in the long-run. may as well front-run it.”

Just last week, FTX had announced that it had raised $900 million, with a valuation of $18 billion, from many big names, including Coinbase ventures and to whom buying financial giants like Goldman Sachs or CME is “not out of the question” either.

The decision to reduce leverage has come as the crypto market experiences a strong bounce off of lows.

Binance, which has exited its investment in FTX, has also joined in. CEO Changpeng Zhao said on Twitter that they have already started limiting new users to a maximum of 20x leverage a week ago. Previously, it offered a maximum of 125 times leverage.

“In the interest of Consumer Protection, we will apply this to existing users progressively over the next few weeks.”

Meanwhile, several hedge funds have curbed their trading on Binance amidst a growing regulatory crackdown on it, the Financial Times reported.

An Effective Margin System“After lots of back and forth, we're going to be the ones to take the first step here: a step in the direction the industry is headed and has been headed for a while,” said Bankman-Fried as he explained in one of his famous Twitter threads.

While some are not happy with this cut-down, especially as the market seems to be getting back in the bull mode, others praised this move, noting that extremely high leverage doesn't turn out to be positive in the long term. Not to mention, crypto is inherently highly volatile and sees big moves regularly.

“A great move,” said Austerity Sucks, adding, above 20x is “just marketing, and is associated w/shadiness now (“100x group”) there's no real strategic benefit to such high leverage (except maybe spreads), and can legit hurt retail.”

In the Twitter thread, Bankman-Fried further shared his reasoning behind the same, noting that their product and margin system “tend to attract sophisticated users,” and liquidation on FTX normal orders happens without any extra loss.

He further shared that, much like every other exchange, on FTX as well, liquidations are “a tiny fraction” (less than 1%) of volume and positions. And while “many users have expressed that they like having the option, very few use it,” added Bankman-Fried.

According to him, the average leverage used on FTX is about 2x, and high leverage is not an essential part of the crypto ecosystem.

“An effective margin system is integral to an efficient economic system,” said Bankman-Fried.

The post Binance and FTX Cut Down Leverage to Just 20x from Over 100x first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Leverage Coin (LVG) на Currencies.ru

|

|