2020-8-20 18:48 |

After yesterday’s pullback from the year’s peak, high options volume gives hope for a continued bitcoin bull run.

The memory of crypto traders can be short. Yesterday’s pullback to, gasp, $11,700, turned Twitter sour. In February, bitcoin was trading near the highs seen this August, and in July, the market was happy to be under $10,000. The amount of open options interest suggests we are still in a bull run.

Scrolling down my feed and everyone is really bearish now.

Really makes you think.

— Emptybeerbottle (@Fullbeerbottle) August 19, 2020

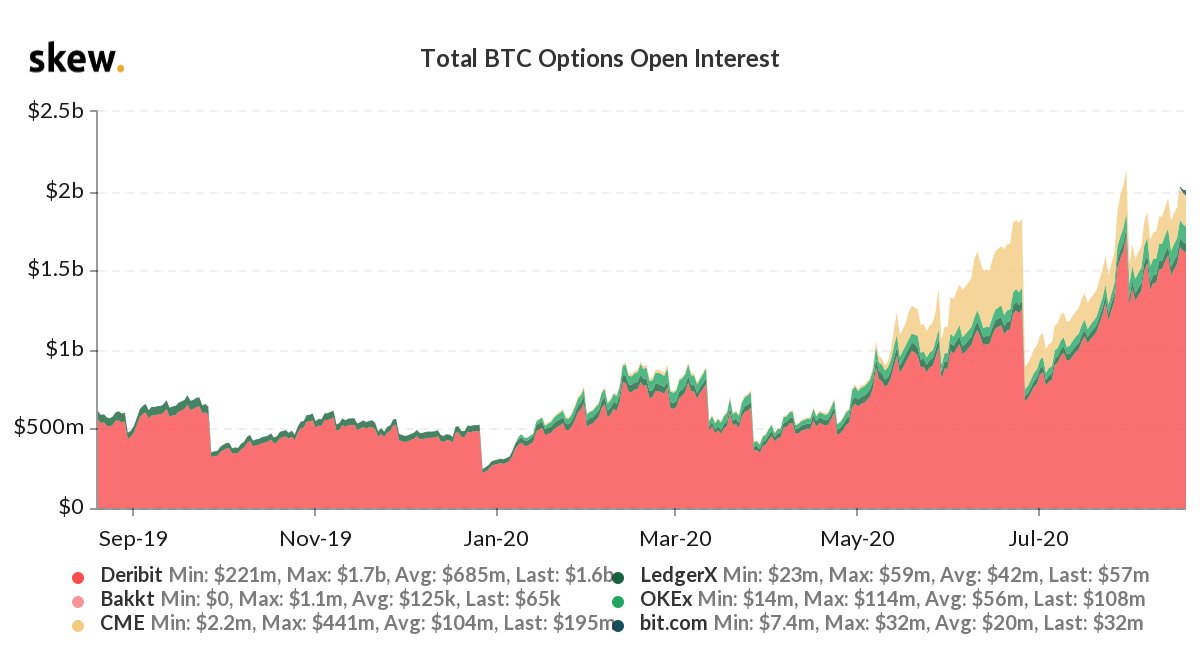

Open Says Me BTC options open interest nears $2 billion | Source: Skew.comThis measure allows traders to see exactly what it sounds like: the interest in the options market. Right now, that number is around $2 billion. Since open interest in BTC is high, and almost as high as it has ever been, it certainly indicates something. But what?

Whether the current figure is bullish or bearish is a different story. When prices go up during an uptrend while open interest increases, this, in theory, reflects a bullish trend. In other words, more derivatives traders believe that the price will continue to increase. There are more longs, a sign of confidence.

The one month BTC chart shows how small the recent pullback was | Source: CoinmarketcapOn the other hand, high open interest in a downtrend while prices are falling means just the opposite – a large amount of money wrapped up in shorting the market.

So it really depends on where bitcoin is trending, price-wise. Since bitcoin is currently holding above $11,400, most analysis would suggest the price remains in an uptrend.

Hodl on Tight BitcoinAnother metric suggesting a continued bull market is the amount of bitcoin held on exchanges. Indeed, around 2.6 million BTC is currently held.

This is significantly less than was being held during recent price peaks in July 2019 and Feb 2020. Back then, nearly 3 million BTC graced accounts, a more than 10% increase from current levels.

The decline of #BTC exchange balances signals reduced selling pressure.

Currently 2.6M BTC are being held on exchanges.

Significantly lower than the last time $BTC hit a local top a year ago (2.8M), and lower than before the sell-off in March (2.9M).https://t.co/JyYA4oPmDX pic.twitter.com/ab4wkJSnmD

— glassnode (@glassnode) August 19, 2020

In contrast to periods of previous highs, people are now more likely to hold bitcoin. They don’t have it loaded to sell when the stars align.

There are other interpretations, however. More BTC on exchanges could mean that traders want to swap for altcoins, not cash. Likewise, BTC held off exchanges could represent more BTC held in decentralized financial swapping markets.

Additionally, last year, people weren’t swapping Wrapped BTC (WBTC) on Uniswap. WBTC represents $364 million of BTC at the time of writing. That’s not to mention other wrapped and alternative ways of holding bitcoin.

At the previous February 2020 peak, only about $7 million bitcoin existed in WBTC.

The Market Cap of Wrapped BTC (WBTC) has grown | Source: Coinmarketcap.comNonetheless, with banks and corporations pouring money in, BTC looks like it has strong support. All of this comes during a period of high liquidity in global markets too. With what is (likely) a continued uptrend, the open options interest signals that bulls are still holding strong.

The post $2 Billion Open Options Interest Bullish for Bitcoin (BTC) appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|