2021-12-21 21:11 |

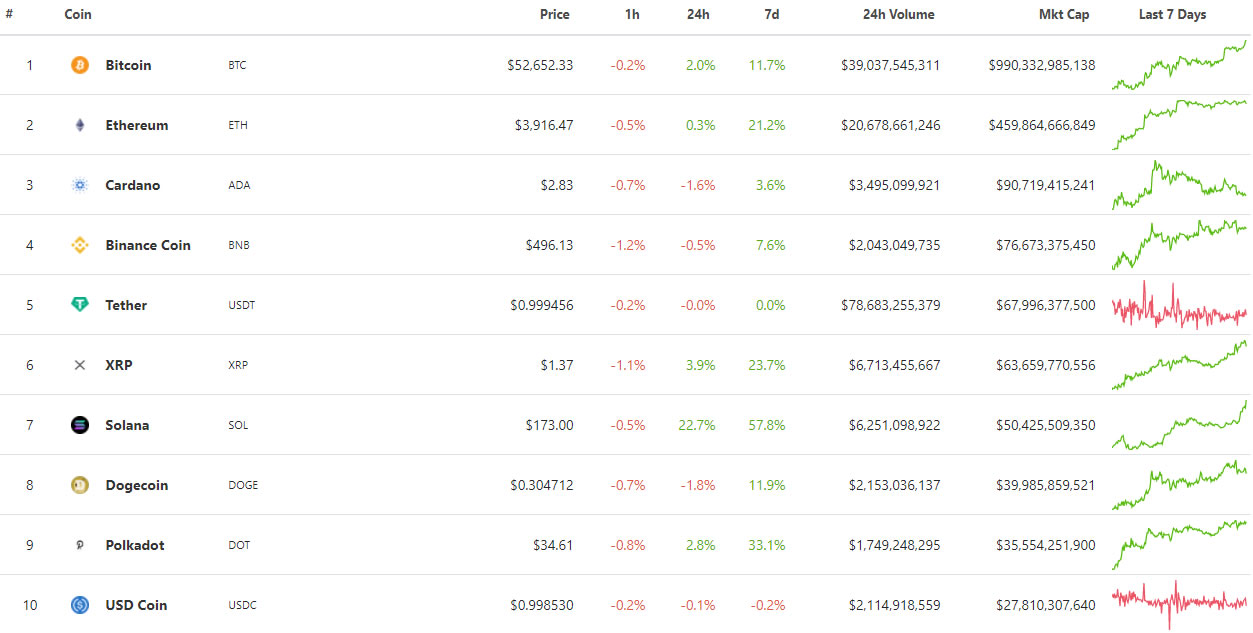

Solana (SOL) is a fully decentralised public blockchain that allows the launch and development of scalable DApps. It is regarded as one of the fastest blockchains in the world, with relatively lower gas fees. Solana has also been oftentimes compared to Ethereum. Here are some highlights:

So far, over 400 new projects have launched on Solana, with more expected to come

Solana is also highly scalable, and its network is associated with low gas fees

It is also regarded as one of the fastest blockchains in the world

So, what are some of the most exciting projects on Solana for investors? Here is a pick of the top 2 today:

Serum (SRM)Serum (SRM) is a decentralised exchange (DEX) and DApp ecosystem designed to deliver exceptional transaction speeds and low fees. Built on Solana, the DEX is completely permissionless and non-custodial. SRM is the native token for the Serum DEX. It is used for governance and platform transactions.

Data Source: Tradingview.com

At the time of publishing, SRM was trading at $3.43, which is significantly undervalued. Decentralised exchanges are expected to grow in the coming years. Besides, with the speed and scalability of Solana, and the development of a robust Serum ecosystem, the future prospects of SRM look quite positive.

Saber (SBR)Saber (SBR) is an automated market maker designed to facilitate the exchange of crypto assets on Solana. The platform allows users to swap various assets, including stablecoins. It also has liquidity pools and yield farms to help investors maximise returns.

SBR is its native token and even though at the time of writing the coin was trading way below its all-time highs this year, there is a lot of growth potential in the near term. The token was trading at $0.06407, with a market cap of around $632 million.

The post 3 Best undervalued altcoins on Solana to buy in 2022 appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Solana (SOL) на Currencies.ru

|

|