2022-12-20 22:46 |

What is Belt Finance

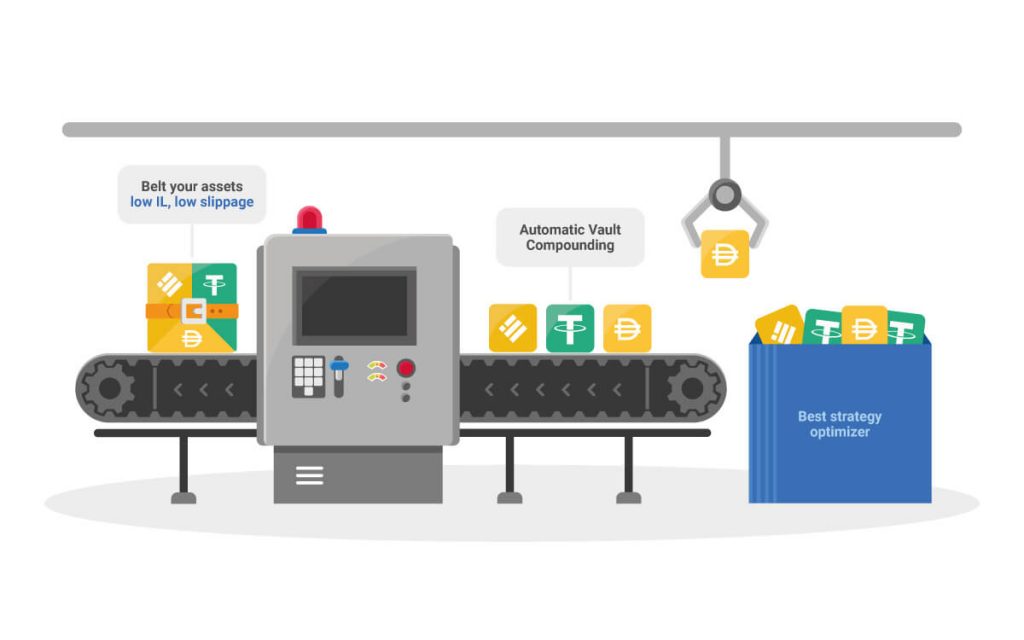

Belt Finance is an AMM protocol. It operates Binance Smart Chain (BSC) and incorporates a yield optimizing strategy to lower fees and slippage. The platform provides aggregation compounding, lending, and yield generation for maximum returns.

The at first glance, complicated jargon may be hard to understand for newbies, so let’s break it down. Belt finance is an Automated Market Maker, which means that it’s a completely decentralized protocol that matches buyers and sellers of a crypto asset. And it’s optimized for the BSC, a Binance smart contract blockchain. Simple right?

Assets on Belt.fi can be swapped instantly, unlike other more traditional exchanges. And not only this, users can with stable coins earn by yield farming while also earning BELT tokens (bTokens). And the processes go towards the liquidity of the protocol directly through BSC, without having to pass by a centralized institution.

Belt.fi is a non-custodial project-only the user and no one other than will have access to your funds.

BELT Price Prediction For the Next 90 DaysBelt Finance is an exciting project for sure. It offers an innovative approach to AMM that could potentially reach a large audience. The project had its ICO only two months on March 10th, and it was a success. The price peaked out at $196, and as the time of writing, it is now sitting at around $70. But it has to be said that the market cap has been steadily increasing, reaching as of today more than $128 million, not bad for a new project.

But what you need for a project like this is for people to see the value in its use. And as of now, around $3,922,000,000 has been locked in the system. A number has seen an enormous increase since its launch, but we will have to see if this will continue in the future.

And we must take into consideration that Belt Finance is competing with some big names. There are already many crypto decentralized projects that provide similar services, Uniswap, MDMX, and SushiSwap, to name a few. They do not function in the same way, but you have to ask yourself whether BeltFinance has a strong enough use case to be noticed among so many giants. I don’t see it happening.

Per market cap, it is the #367 biggest cryptocurrency. Impressive considering how new the project is, but there’s still a long way to go. It is only one of the many promising altcoins with potential out there. Nothing is guaranteed because, as we know, the altcoin game is extremely risky.

That said, BELT could, in my opinion, become a top #200 coin. I predict the price rising at least up to $120 by this cycle. But keep in mind that the risk is high, and is the reward worth it? That’s for you to decide. In conclusion, it’s an exciting project with potential, but I’d look elsewhere. There are better small-cap projects out there.

The whole crypto world is on a verge of a complete breakdown. Bitcoin has fallen 75% from its all-time high amid broader market declines caused by raging inflation and US Fed rate hikes. When add the most recent melt-downs of huge industry players (FTX, Celsius, Luna etc) into the equation, the horizont is murky and there will be more blood on the streets of the crypto town. Investors are selling risky assets and moving into more stable markets. Crypto is still perceived as a very risky play and hence the sell off. Our algo still sees a some green in 2023, especially in the second part of the year. This is reflected in our 2023 predictions. Right now, Bitcoin needs to find a bottom before we can move in the opposite direction and reverse the trend. Once Bitcoin settles in the new price range, altcoins will start to do the same - we have witnessed this scenario dozens of times in the distant and more recent history. Our price prediction model is bearish for the next 90 days with a hint of a bull market at the turn of the quarters from Q1 to Q2. We expect whales and other bigger players in the market to finish filling their bags around that time which will cause a typical and sudden crypto spike. CaptainAltcoin team created a price prediction model with a multi-faceted approach to crypto that takes into account both technical analysis and fundamental assessment of each project. Fundamentals that we evaluate are team, tokenomics, use case, community, marketing efforts, liquidity and exchange availability, hype & speculative potential and some other proprietary factors developed in our crypto lab.

Below is a tabular overview of how will BELT develop in the short-term (for the next 90 days), according to our prediction model:

Fundamentals Key FeaturesThe main goal of the Belt.fi protocol is to allow users to keep their crypto-asset positions safe and stable while maximizing yields with minimum risk. Their main features you can expect on the platform are:

Just like traditional banks, the platform offers vault compoundingWith Belt.fi yields are maximized by strategically using vaults and compounding, more times a dayA yield optimizer that changes depending on the strategyThe bToken instantly and automatically shifts in its yield strategy so to maximize your returnsThe AMM works great for minimizing slippage as well as impermanent loss. Impermanent loss has always been an issue in the DeFi space. Belt.Fi tries its best to solve the problem by letting the user participate in the AMM process with bTokens. These tokens have almost no volatility among each other. The risks of an impairment loss or price impact are slim to none. Belt.fi manages this by using their token pools.The AMM protocol used by Belt.fi is beneficial to both Makers (liquidity providers) and Takers ( token swappers). Makers get a high yield thanks to Belt.fi’s yield optimization, compounding, and the BELT token. On the other hand, Takers benefit from the platform’s low trading fees, low slippage, and low price impact.And if all that sounds too complicated here’s the shorter version of what users get from Belt.fi is:

Stable crypto-asset positioning with very little impermanent loss.A maximalized automatically optimized yield.A completely decentralized platform.Decisions in the hands of the users with their governance BELT token. TokenomicsThe BELT token use is governance. And it does not have a hard cap supply, which makes it an inflationary token. The trait has some users preoccupied about their holding slowly eaten, fortunately though, measures exist to counter the inflation.

Deflationary mechanisms are used to make deflation higher than inflation. So, in other words, the aim is for more BELTs to leave the circulating supply than the amount produced.

They want to reach this goal in 2 ways:

Governance reducing the block emissionChanging the amount of BELT in each created block can slow inflation. A method that has not yet been tried for this project, but it looks likely that the community will reach this decision sooner or later. If BELT goes through this route, the inflation produced by BELT will be allocated to specific pools and burned.

BELT Buyback and BurningThe platform automatically burns BELT Tokens at the rate of 50% trading fees. On top of that, 8% of the yield is used for buybacks. The repurchased tokens are then burnt. So more people use Belt.fi more tokens burned, and if the numbers continue growing, it will eventually reach a point where more tokens burned than minted.

The buybacks are an essential part of the process. The word “buyback” may not sit right to some crypto user but is vital to remember that no one is collecting they are burnt.

Every time 50% trading fees and 8% of the yield is repurchased, more BELT tokens are burned. And the more this is done, the more scarcity power of the token increases.

As of today, the circulating supply of BELT is 1,804,603, while the total supply is 1,819,662.

TeamCreated by Ozys, The Belt.fi protocol a well-known blockchain technology company. The company specializes in innovative, widely used blockchain services, in particular DeFi projects.

Ozys is part of the Klaytn Governance Council. Alongside big names in the tech industry such as Binance, Huobi, MakerDAO, LG Electronics, and Kakao. On top of that, all of Ozys’ protocols totals over $700 million.

So, in other words, the company behind it is as reliable as they get.

CommunityWith the project being so new, a community of passionate users is still growing. Their Twitter page has 18.2 thousand followers, and the official Telegram has around 12 thousand members. These numbers are sure to go up as time goes by.

BELT Price Prediction 2023Our prediction model sees a temporary switch to a bear market at the beginning of 2022 before we move onto another leg up in Q3 & Q4 of 2022.

Belt Finance Market price prediction Wallet InvestorWallet Investor is very bullish on the project. According to the website, BELT could reach $205 this market cycle.

DigitalcoinDigitalcoin gives us a more bearish scenario. They predict that BELT will reach around $102 this cycle.

CoinArbitrageBotAn even more bearish prediction from CoinArbitrage, the website has set its target for BELT this cycle at only $97.

BELT Price Prediction 2025 – 2030 – 2040Our prediction model sees BELT faltering in 2025 and dropping down to $0 or almost $0.

BELT price in 2030 & 2040 could be close to zero as we don’t see a bright future for it in the distant future. The project offers no unique value to set itself apart from countless competitors, hence we don’t think it is worth investing in this coin for the long term.

Where to buy BELTInvesting in BELT is relatively straightforward. Traders can only buy the coin on three exchanges, PancakeSwap which offers WBNB/BELT and BELT/BUSD, MXC.COM, and AEX that only offer BELT/USDT.

Wrapping it all upBelt Finance is an exciting project, entering a crowded AMM crypto space. It has attracted a lot of interest considering how new the project is, but they’re still a long way to go. The platform is certainly worth checking out. But is the use case strong enough to make itself seen?

As I said before, I predict that the BELT coin could reach the top #200, but with a project like this, nothing is certain. Remember, it is competing with the likes of UniSwap. In conclusion, I like BELT. I think it has something going, but it’s nothing special. I do not believe this is the altcoin that will make you rich.

And before we go, everything I said is not financial advice. I am just talking about my opinions, which could be wrong and differ significantly from yours. Remember always to trade responsibly and never invest more than what you can afford to lose.

Read also our other prediction worth looking into this year:

Badger DAO Price Prediction Reef Finance Price PredictionHelium Price PredictionInjective Protocol Price PredictionTellor Token Price PredictionWaltonchain Price Prediction – Future Forecast For WTC PriceFuture Forecast for XRP PriceTezos Price PredictionZilliqa Price PredictionSia Coin (SC) Price PredictionThe post Belt Finance Price Prediction 2023 – 2025 – 2030 | BELT Price Forecast appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|