2022-8-19 06:00 |

Bear market: Those who wait until the crypto winter has thawed to build the Metaverse will be late to the game, says Sam Huber, the CEO of Landvault.

The cryptocurrency market plunged into a bear market in late 2021. Even now, after a 73% drop in the value of the global market cap since November’s heady peak, there is in all likelihood more pain to come.

Amid this fall, the entire digital asset sector stands on the precipice of the emerging Metaverse. It is an interconnected network of virtual worlds where anyone can build a world of their choosing or contribute to another.

The buzz around the metaverse concept has seen numerous banks, corporations, brands, and celebrities starting to grapple with this new virtual frontier. But during the meteoric rise of the crypto space in the summer of 2021, it wasn’t easy to tell the dedicated builders from the short-term opportunists.

Now, there’s less money flowing around the crypto space than at any time in the past 18 months. So the bear market will act as a crucible that forges only the most serious, long-term metaverse projects.

The Upside For Metaverse DevelopersDespite their negative connotations, bear markets make for an opportune time for both buying assets and, perhaps more importantly, developing new projects. When crypto is down, fiat capital can go a long way in building the infrastructure for a new platform.

In fact, much of the groundwork for the NFT boom seen in 2021 was laid down in the years following the 2018 market crash. Many investors couldn’t care less at the time, but passionate creators used this lull to mint their first offerings. These saw profound increases in valuation that occurred after digital artist Beeple’s first major sale.

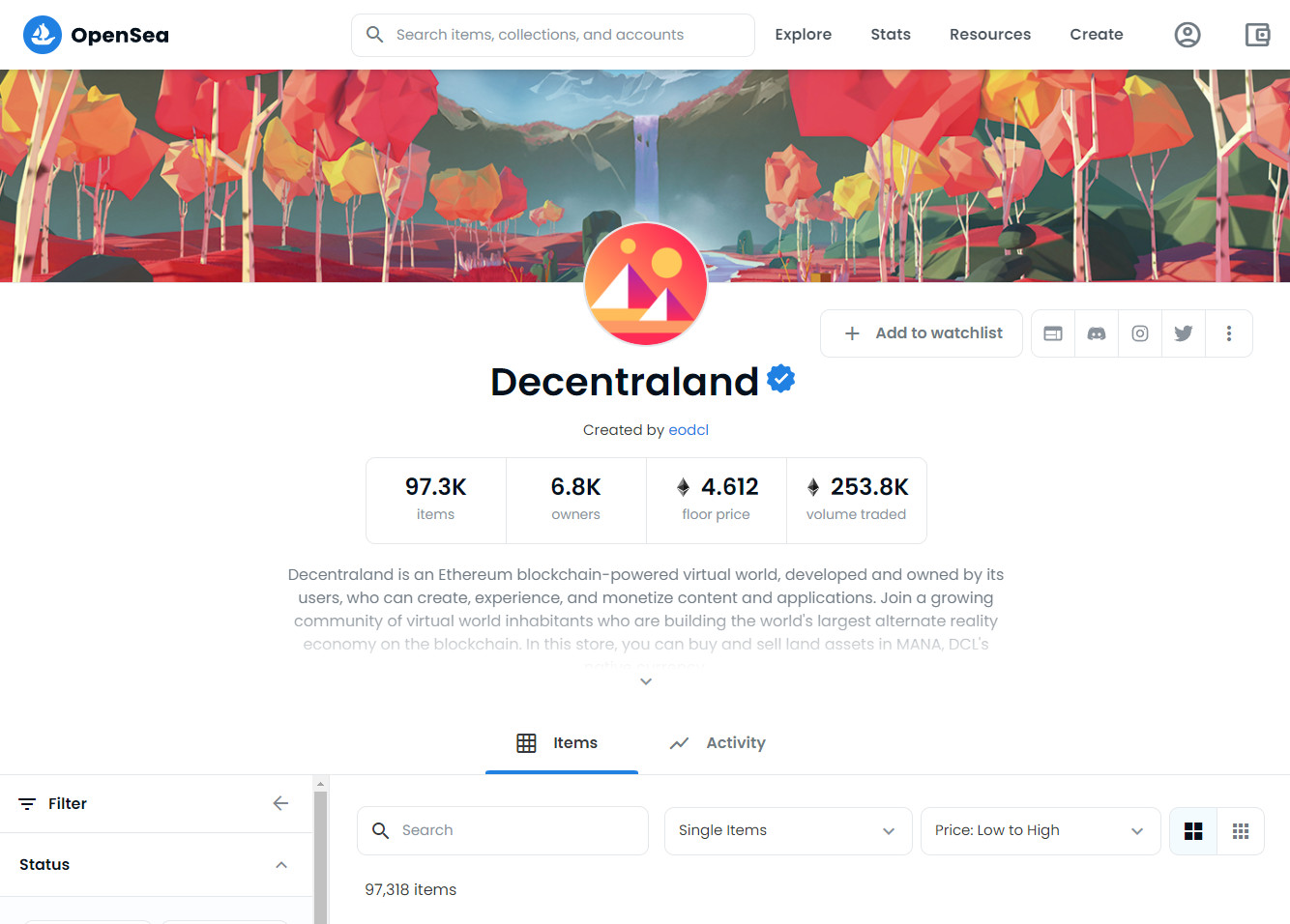

The NFT wave has already risen and rolled back somewhat, but there’s another significant development just over the horizon: The Metaverse. Powered by the developments of previous cycles, including a varied ecosystem of cryptocurrencies and NFTs, the Metaverse will be a complete, interlocking series of virtual worlds and services. It will allow for the seamless transfer of data and value between them.

Bear Market AdvantagesThe bear market means that the cost of purchasing digital land is down. The upside potential is high for those to start creating value through building now.

There may never be a better time to get involved in creating a metaverse project. Despite the state of the market, brands from Nike and Gap to Meta (formerly Facebook) and even banks like HSBC and JPMorgan are starting to build a presence in the metaverse.

The entrance of these names signals more than a transient fad; these players will have formed a long-term strategy, understanding the risks before jumping headfirst.

Moreover, Wall Street’s biggest investment banks are already placing bets on the value of the metaverse. JPMorgan believes that the metaverse could pull in over a trillion dollars in yearly revenues. And Citi takes an even more bullish stance, anticipating the metaverse to be worth $13 trillion by 2030, with a reach of over 5 billion users.

Bear Market: What Will Happen in 2022With the recent slashes to total market capitalization, the first bear market since 2018 is well and truly upon us. But even the coldest winters eventually thaw.

One silver lining comes in the form of the next Bitcoin halving event, which will see mining rewards – i.e., Bitcoin’s annual supply – cut in half once more. Bitcoin still acts as a major market mover. The shift in supply and demand brought about by these quadrennial halving events has, so far, proven to help increase the price in the months after they occur. Hence, a bear market is not all too surprising, as it fits with the typical market cycle observed over the last decade.

However, there’s also the fact that crypto has proven to be more or less correlated to many traditional investments. Years ago, it was hoped that digital assets would act more as a hedge when the stock market fell. But that hasn’t been the case. Instead, crypto is treated much like any other “high risk” investment and tends to be one of the first assets to be shed when the market worsens.

Broader Financial MarketsThe fact that the broader financial market has been in a slump lately, exacerbated by macro events such as the Fed’s ongoing commitment to interest rate hikes, has more than likely aggravated the dip that was plausibly already coming. While investors need to be ready for the bears to hang around for a while, it isn’t all bad news.

Those who wait until there is already a shift in public sentiment will be late to the game and will likely find themselves rushing to catch up. By bringing together robust talent and a strong vision for what the Metaverse can offer, developers have the potential to build generational value, which is a chance that doesn’t come around very often.

About the AuthorSam Huber is the CEO of Landvault, formerly known as Admix. Landvault is the biggest builder in the metaverse with 100+ specialist designers and developers. Sam is a blockchain investor since 2013, having personally invested in over 20 companies, and various virtual land projects since 2017. Previously, he was running an indie game studio and in a previous life, was a Formula One engineer.

Got something to say about the bear market, the Metaverse, or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

The post Bear Market: It’s Here, So Let’s Get To Work On The Metaverse appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

3X Short Bitcoin Token (BEAR) на Currencies.ru

|

|