2020-4-11 23:12 |

On Wednesday, April 8, BCH went through its first halving, increasing its prices by 12%, and its fork Bitcoin SV got a 19% increase that same day, which didn’t have the expected impact on the crypto community. But the exhilaration of BCH investors didn’t last long: Just a few hours later BCH lost almost all its gains.

The BCH halving slashed the miners’ earnings by 50%, dropping mining rewards from 12.5 BCH per block to 6.25. During that event, Bitcoin Cash managed to increase its price by 12.45%, going from $249 to a peak of $280. However, its price dropped drastically to $230 after a few hours, a price which seems to have remained stable from its halving until the time of writing.

BCHUSD Chart Via TradingViewThis caused many BCH miners to bequeath this blockchain aside and look for other more profitable currencies. According to information provided by Messari, the drop in “daily mining revenue” went “from $471,600 to $235,800.”

Bitcoin Cash just underwent its first halving.

At current prices, daily mining revenue will drop from $471,600 to $235,800.

According to Fork Monitor, in the 2 hours since forking, BCH has only mined 1 block, indicating miners may have already left the network. pic.twitter.com/kqEmlVyI4K

On the other hand, Bitcoin SV — a fork of Bitcoin Cash promoted by Craig Wright and Calvin Ayre — increased its price by more than 19%, rising from $184 to more than $221. Although the price decreased to $204 in the next hour, it settled almost immediately near the $216 zone, making ever more profitable for miners than BCH itself.

BSVUSD Chart Via TradingViewBCH and BSV recorded the highest profits during the day, but the halving event did not meet the expectations of BCH enthusiasts, despite reducing the inflationary rate of its supply, prices didn’t react as well as many expected.

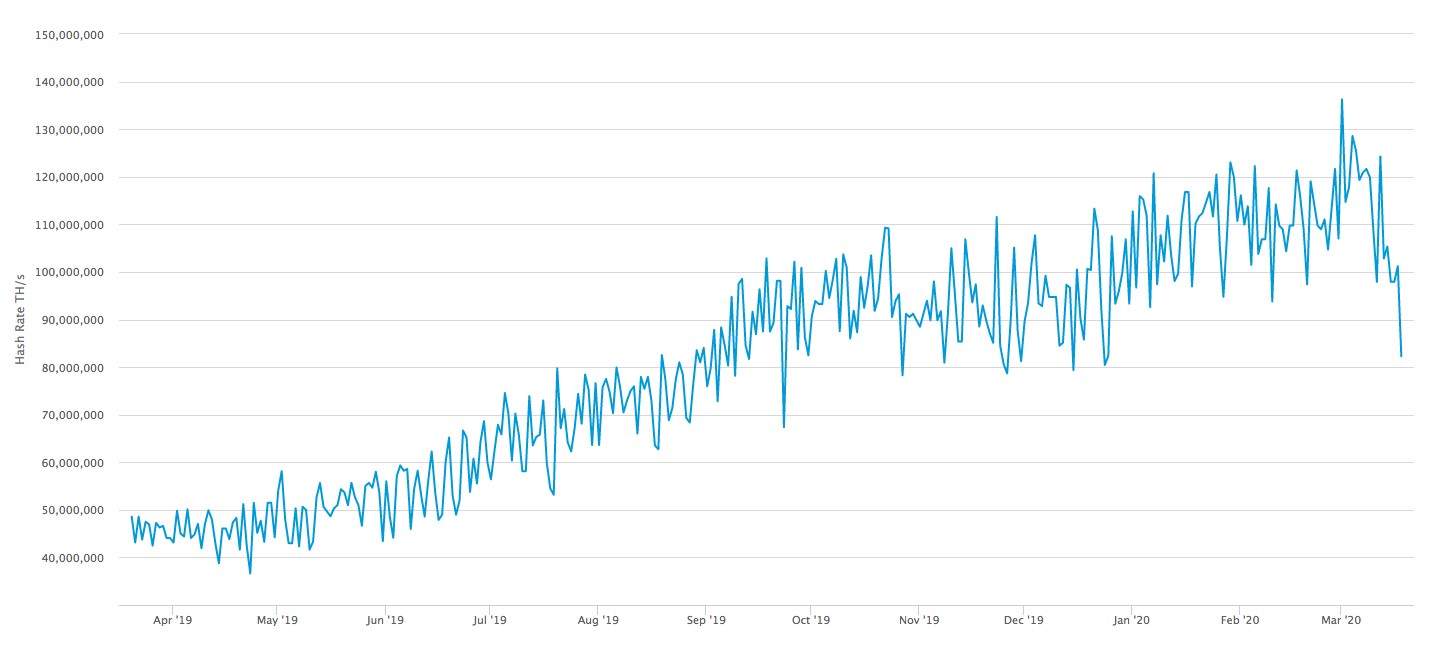

Are miners switching over to BTC?On the other hand, the Bitcoin halving will happen sometime in May. Being the currency with the highest market capitalization, it tends to attract many more investors and miners than other altcoins so it is logical that it gets so much recognition.

Bitcoin has shown a historical increase in price after every halving, even though the miners’ profits tend to decrease by 50%. Both miners and investors prepare for these events with months of anticipation, but right now, the coronavirus crisis has upended things, even reverting the bullish trend that the crypto markets experienced during the beginning of the year.

The recent Bitcoin Cash halving didn’t have the impact that many crypto maniacs expected, will the bitcoin halving do any better? It is hard to predict how the market will behave, but the recent renaissance of the prices seems to be a good sign.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|