2023-3-16 16:49 |

We may be heading into another financial crisis, government bailouts for reckless banks included. Bitcoin exists to fix this.

This is an opinion editorial by Julian Liniger, the co-founder and CEO of Relai, a bitcoin-only investment app.

‘On The Brink Of Second Bailout For Banks’At its core, Bitcoin is a transaction database. Every 10 minutes, a new collection of such transactions, called a block, is queued up on Bitcoin, immutable for all eternity. Satoshi Nakamoto, the mysterious mastermind behind the first and most popular cryptocurrency, created that first transaction block themself. But Bitcoin is also a political project — at least, the idea behind it was and always will be political. Nakamoto inserted a message into the code that still forms the start of the decentralized Bitcoin database: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This political message is as relevant these days as it was in early 2009 when a global financial crisis seethed anger and enraged people worldwide. The banks whose recklessness caused this crisis were not punished, but rewarded with taxpayer money. Governments have claimed since then to have learned their lesson. Janet Yellen, the U.S. secretary of the treasury, famously proclaimed in 2017 that she expects that there will be no new financial crisis “in our lifetimes.” Now, guess what: She was wrong.

Silicon Valley Bank Is Just The Tip Of The IcebergThe second-largest bank failure in U.S. history is now in full swing. After Silvergate Bank, which specialized in financing crypto startups such as the imploded FTX exchange, went belly up, the regional Silicon Valley Bank (SVB) has now been hit too. In the course of the zero-interest-rate policy and ever-higher tech startup valuations, the bank had developed from a David into a Goliath — at least in terms of the sums that were transferred and bunkered there.

Unlike in 2008, however, these banks did not speculate on the unhinged U.S. mortgage market but just adapted to the day-to-day insanity of the financial market. In other words: In the zero-interest-rate environment, they didn't really know where to go with the vast amounts of fresh money. So, they bought conservative, long-dated government bonds to earn at least a little return. The only problem with this is that the U.S. Federal Reserve has now pushed the federal funds rate up to 4.57%, the highest since October 2007.

Previously-purchased bonds, which still had low interest rates, suddenly became the worst-possible investment. When startups that had previously received exorbitant investor cash infusions in the zero-interest environment to stay afloat with even modest business models began withdrawing their money, chaos was inevitable. Of course, SVB isn't innocent either because if you specialize in a single customer segment, you're easily vulnerable in a bank run. And it is also becoming increasingly clear that the bank's general risk management left much to be desired.

The Revenge Of Cheap MoneyWithout wishing to absolve banks like SVB of their guilt, it must be stated: The fact that it could come to this point at all is a consequence of a decade of unaccountability. Although there was a lot of talk after the last financial crisis about stricter controls and the shortcomings of “fractional reserve banking,” in which banks only actually own a small percentage of customer funds, there is not much left after years of zero-interest-rate policies.

The absurdly loose monetary policy of the Federal Reserve (and also of the European Central Bank), which was given a turbo boost in the wake of the COVID-19 pandemic, is now taking its revenge. “Higher, faster, further” was the motto of the financial and real estate markets. The relenting is now coming too late and too abruptly. Emblematic of the excesses of recent years is not only crazy startup valuations but also thousands of hyped “altcoins,” absurdly-highly-valued NFTs and even increasingly-popular alternative forms of investment, such as luxury watches or even rare Lego sets. We were all forced to speculate. “Cash is trash” was the motto.

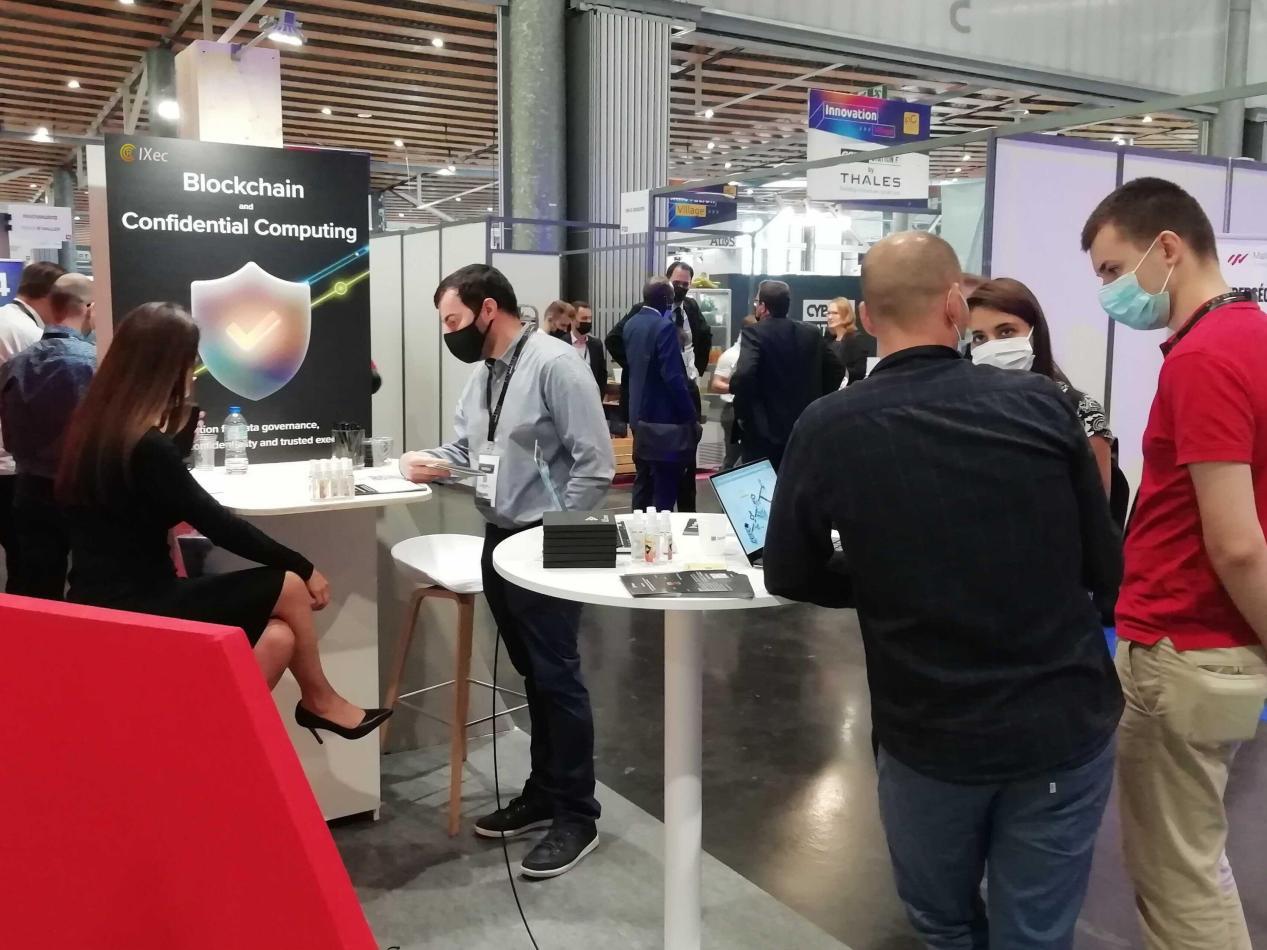

'Crypto' Is A Symptom, Not A SolutionWith all of the chaos in the financial and banking sectors, it must be noted that the crypto industry is not an alternative, but rather an even more fragile variant of the established financial system. It is not surprising that FTX, Luna and other crypto projects were the first to implode due to bank runs and loss of confidence.

Instead of the independence invoked by Nakamoto, many of the most-hyped crypto projects only exist because venture capitalists (VCs) didn't know where to put their money in recent years, because “blockchain” and “decentralized finance” were nice buzzwords during the COVID-19 pandemic, and — this is an important factor — because there was unlimited money to be made from the newly-created tokens of crypto projects. Creating money out of nothing was a reality. This was lucrative for a few insiders and VCs, but fatal for retail investors and crypto novices.

Incidentally, Silvergate Bank also went under in the wake of SVB, another bank that provided bank accounts to U.S. crypto companies. The U.S. Securities and Exchange Commission, led by Gary Gensler, seems to be serious when it says that every cryptocurrency except bitcoin is a possibly-illegal security.

'Confidence Scheme' Or Absolute Transparency?And now? Inflation rates of around 10% are not uncommon in Europe, and in the U.S., too, confidence in the words and deeds of the central bank has long been shaken. The wounds of the financial crisis have not healed — on the contrary. The stock market may be facing a sell off; “crypto” is a risky proposition, especially in the U.S.; central banks have to choose between stalling the economy and continuing to drive inflation.

That the banking and monetary system is a “confidence scheme,” i.e., one where trust is essential, is being underscored once again following the recent events surrounding SVB.

Some are expressing disappointment with bitcoin, as it was touted in many quarters as a hedge against inflation. In fact, bitcoin performed excellently during the years of unbridled monetary expansion, but is now suffering relative its all-time highs, like other risk and tech stocks.

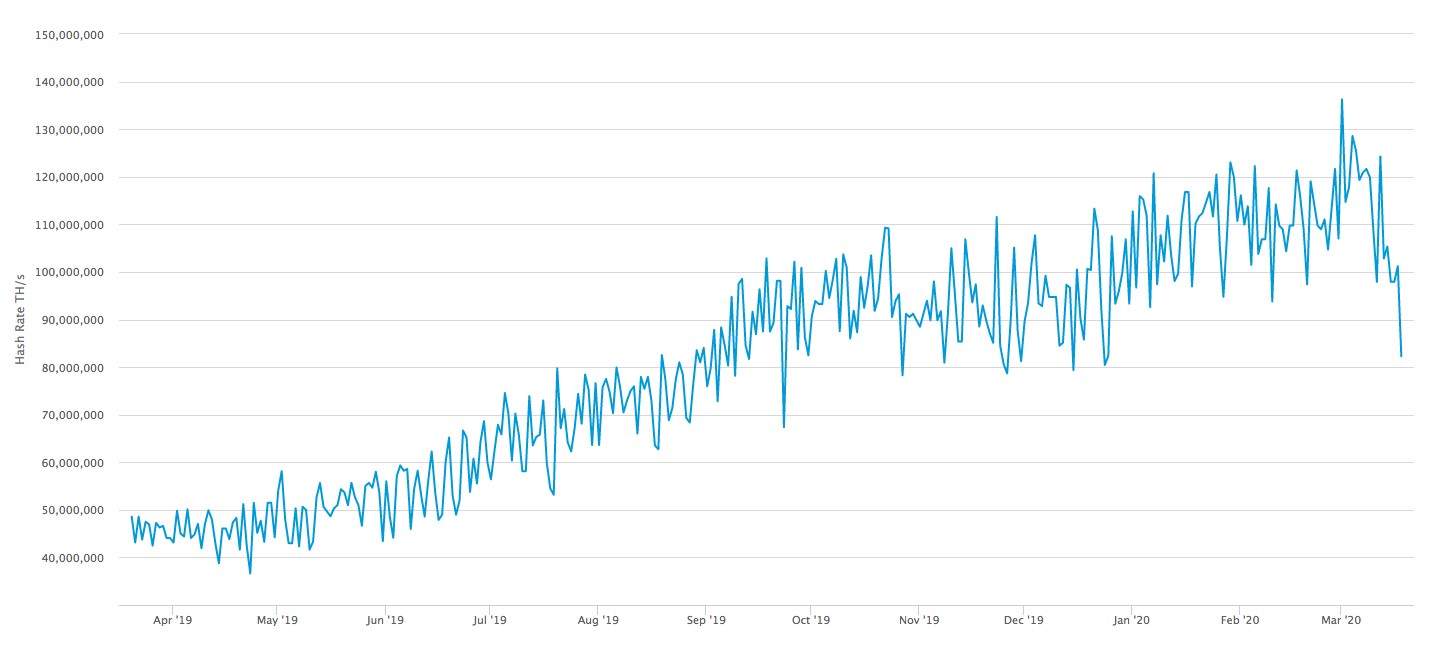

Does that mean Bitcoin has failed? Not at all! If you look beyond the day-to-day price plate, you see an increasingly-vibrant ecosystem emerging around Bitcoin, such as Bitcoin mining with green energy, pumping more computing power into the decentralized, disinflationary monetary system than ever before.

As an alternative money and payment system that has no central vulnerability, no opening hours, no CEO, no one to block an account, and is always available to everyone around the globe, Bitcoin has more relevance than ever.

This is a guest post by Julian Liniger. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|