2020-8-26 21:11 |

This month has been all about ranging for bitcoin.

The largest crypto asset entered August on a bullish note. On July 20th, BTC/USD was trading around $9,150 when the bulls came in, and bitcoin started uptrending.

On August 2nd, the digital asset went above $12,100 only to crash back to $10,500 within a few minutes. From there onwards, every Monday of this month, we have been hitting $12k level only to drop soon after.

This week, the market seems even more shaky than usual, with prices now around $11,470. The price has managed to recover somewhat from yesterday's low of about $11,110, last seen on August 5th.

However, this has been largely in line with the precious metals as everyone eagerly awaited Fed Chairman Jerome Powell's speech this Thursday during a virtual version of the Fed’s annual Jackson Hole, Wyoming, conference.

Powell is expected to outline the central bank’s most active efforts ever to spur inflation back to a healthy level. The conference matters for the crypto market as well because of Bitcoin correlation with gold and the speech being an important driver for risky markets.

Keeping SteadyMeanwhile, as the market turned red, Bakkt institutional investors took this opportunity to buy the dips.

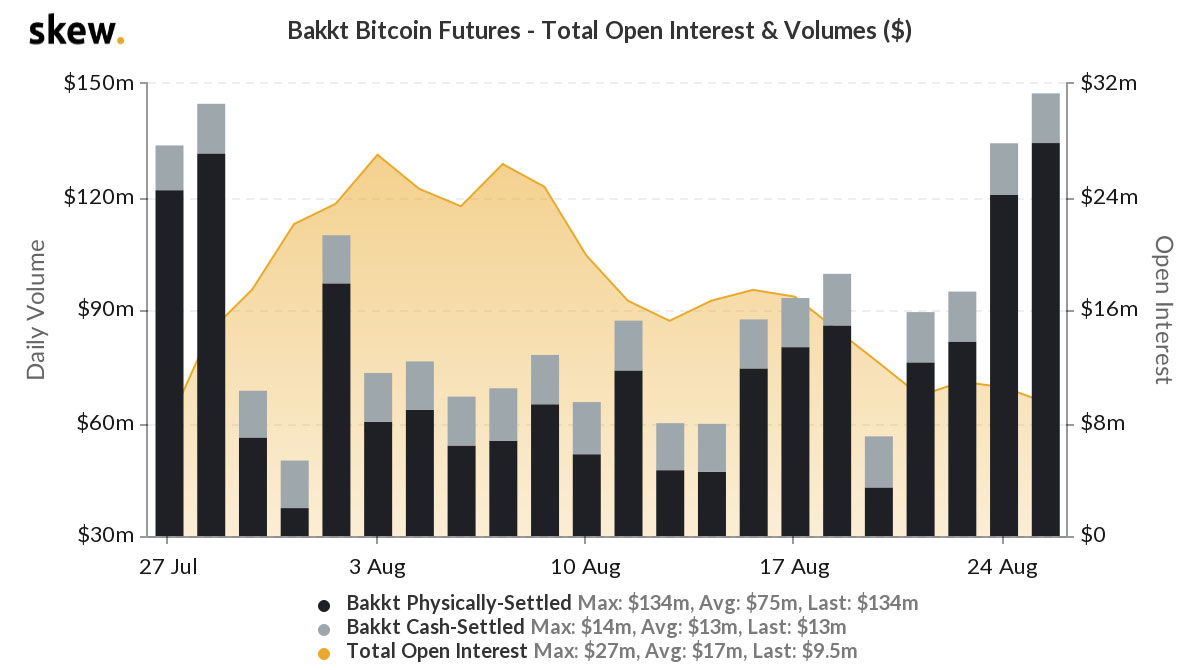

Yesterday, the ICE-backed physically delivered bitcoin futures platform’s trading volume broke into an all-time high of $147 million.

The last time Bakkt made a new record was twice in a row on July 27th and 28th at $134 million and $145 million, respectively. This volume record was the result of the price of BTC surging from $9,900 to about $11,400.

Source: SkewThis month also saw physical delivery on Bakkt recovering strongly, with the amount of bitcoin futures held in expiry increased by 133% to 135 BTC in August from the July lows at just 58 BTC.

The USD amount increased by even more, 202%, ending up at $1.6 million, as per Arcane Research.

August has been good for Bakkt as volume continues its way up. But unlike the trading volume and physical delivery of BTC, open interest has been moving in the opposite direction, downwards.

Open interest on bitcoin futures surged to $27 million on August 3rd, from $8 million on July 27th, and since then, it has been declining, reaching $9.5 million on August 25th.

Bitcoin (BTC) Live Price 1 BTC/USD =$11,471.0178 change ~ 1.65%Coin Market Cap

$211.69 Billion24 Hour Volume

$5.35 Billion24 Hour VWAP

$11.39 K24 Hour Change

$189.1307 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Bakkt Institutional Investors are Buying the Bitcoin Dips at Record Level first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|