2023-8-17 18:00 |

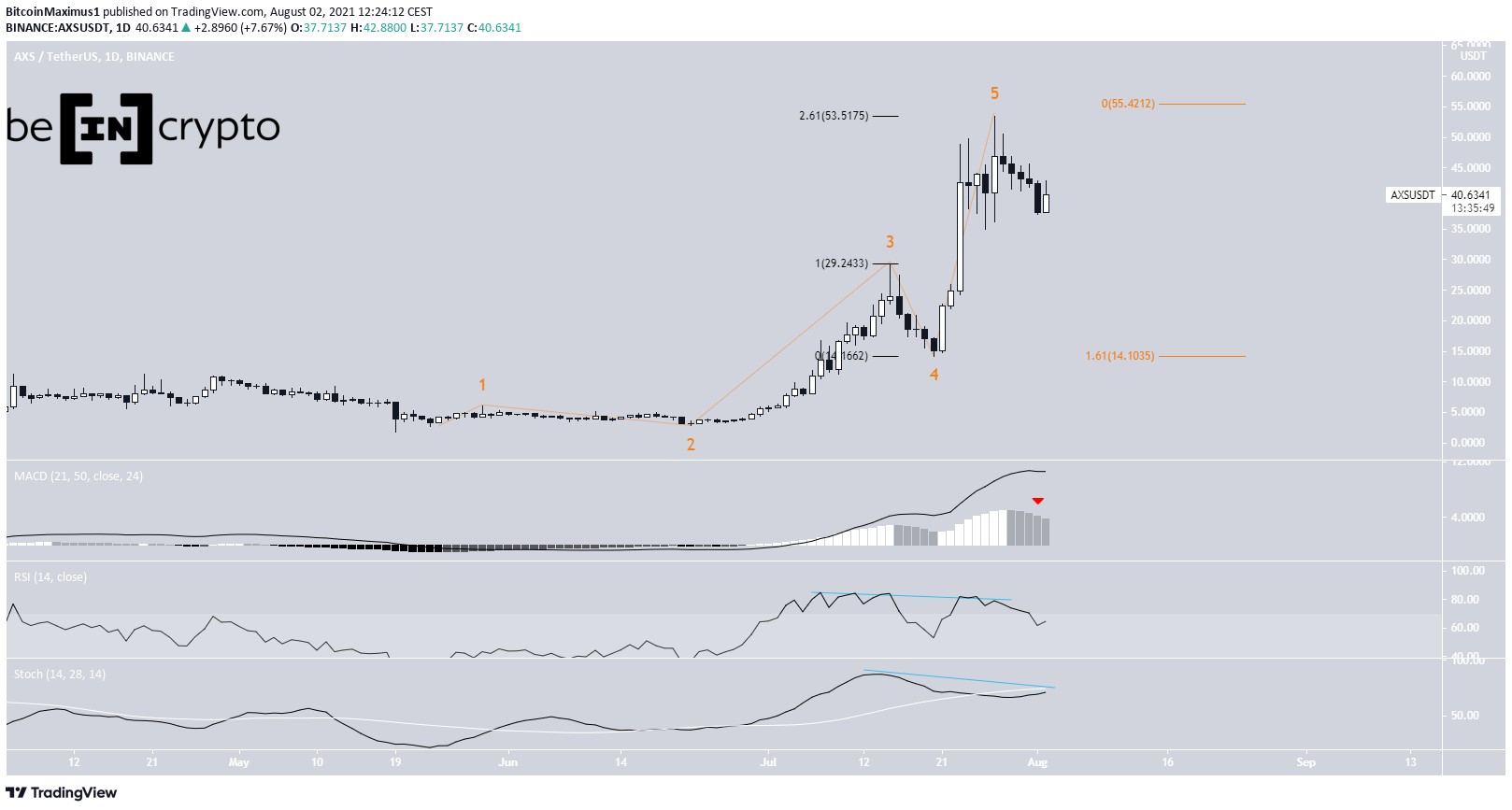

Axie Infinity (AXS) bears finally broke down the $6 support level on Aug 12 after nearly a month of multiple attempts. Amid growing bearish momentum, on-chain data examines the bulls’ chances of forcing an early AXS price rebound.

After losing the critical $6 support level, Axie Infinity (AXS) bulls are now making concerted efforts toward staging an early rebound. As losses begin to mount, will the $5 support break down, or can the bulls begin a recovery from there?

AXS is Now Approaching the Oversold RegionAXS price currently sits around $5.37, meaning the leading metaverse token has now shed 24% in value from last month’s peak of $6.90. After a month-long sell-off frenzy, AXS now appears to have entered the oversold territory.

Evidently, the Network Value to Transaction Volume (NVT) ratio has dropped rapidly since AXS retraced from the $6 support on August 12.

Between August 12, and August 16, AXS witnessed a staggering 85% drop in NVT ratio, from 3,571 to just about 507.

Will Axie Infinity (AXS) Price Rebound? | NVT ratio, August 2023. Source: SantimentThe NVT ratio examines the relationship between the current market capitalization and the underlying transactional activity on a blockchain network volume.

When it drops for an extended period, it signals that the token is now being oversold and could soon be due for a bullish reversal.

If this analysis holds true, the Axie Infinity bulls will likely stage a recovery buy-wall around the $5 region.

Empower your investments with AXS price predictions.

On-chain Data Suggests Holders Could Soon End the Sell-OffFurthermore, on-chain data suggests that most AXS holders could be unwilling to sell in the coming days due to unfavorable prices. According to the MVRV data, the current holders are now staring at double-digit losses if they continue selling.

As seen below, most investors that bought AXS in the last 30 days will book nearly 10% losses if they sell today.

Will Axie Infinity (AXS) Price Rebound? | MVRV ratio, August 2023. Source: SantimentThe Market Value to Realization ratio (MVRV) shows the net-financial position of investors who have recently bought an asset. Historical data trends show that AXS holders have not assumed more than 15% losses since mid-June

Hence, with the current holders already approaching 10% losses, this indicates that they will end the sell-off and wait till prices are more favorable.

In conclusion, while the bears still currently hold sway, AXS bulls could soon take advantage of the low prices and oversold status to stage a rebound.

Check Out the Best Upcoming Airdrops in 2023

AXS Price Prediction: Potential Rebound From $5The Axie Infinity on-chain indicators outlined above show vital signs of an imminent AXS price rebound.

The In/Out of Money (IOMAP) data shows the purchase price distribution of Axie Infinity holders within the 20% boundaries of the current market price. As seen below, it validates the prediction that AXS Price could rebound from the $5 range.

Evidently, 819 holders had bought 40,560 AXS tokens at an average price of $4.93. They could trigger an instant AXS price rebound if they hold firm as predicted.

But, if that support level fails to hold, the next supply wall at $4.50 could help prevent a panic sell-off.

Axie Infinity (AXS) Price Prediction | IOMAP data, August 2023 | Source: IntoTheBlockStill, the bulls could firmly seize control if AXS exceeds the $7 territory. However, as seen above, the cluster of 969 addresses had bought 20.7 million Axie Infinity tokens at the maximum price of $6.17. They could force a downswing if they mount a sell-wall at that territory.

But if that resistance level cannot hold, AXS could head toward $7.

Check Out the Top 11 Crypto Communities To Join in 2023

The post Axie Infinity Begins Recovery Mission – Can AXS Price Push to $6? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

AXS (AXS) на Currencies.ru

|

|