2023-7-6 22:47 |

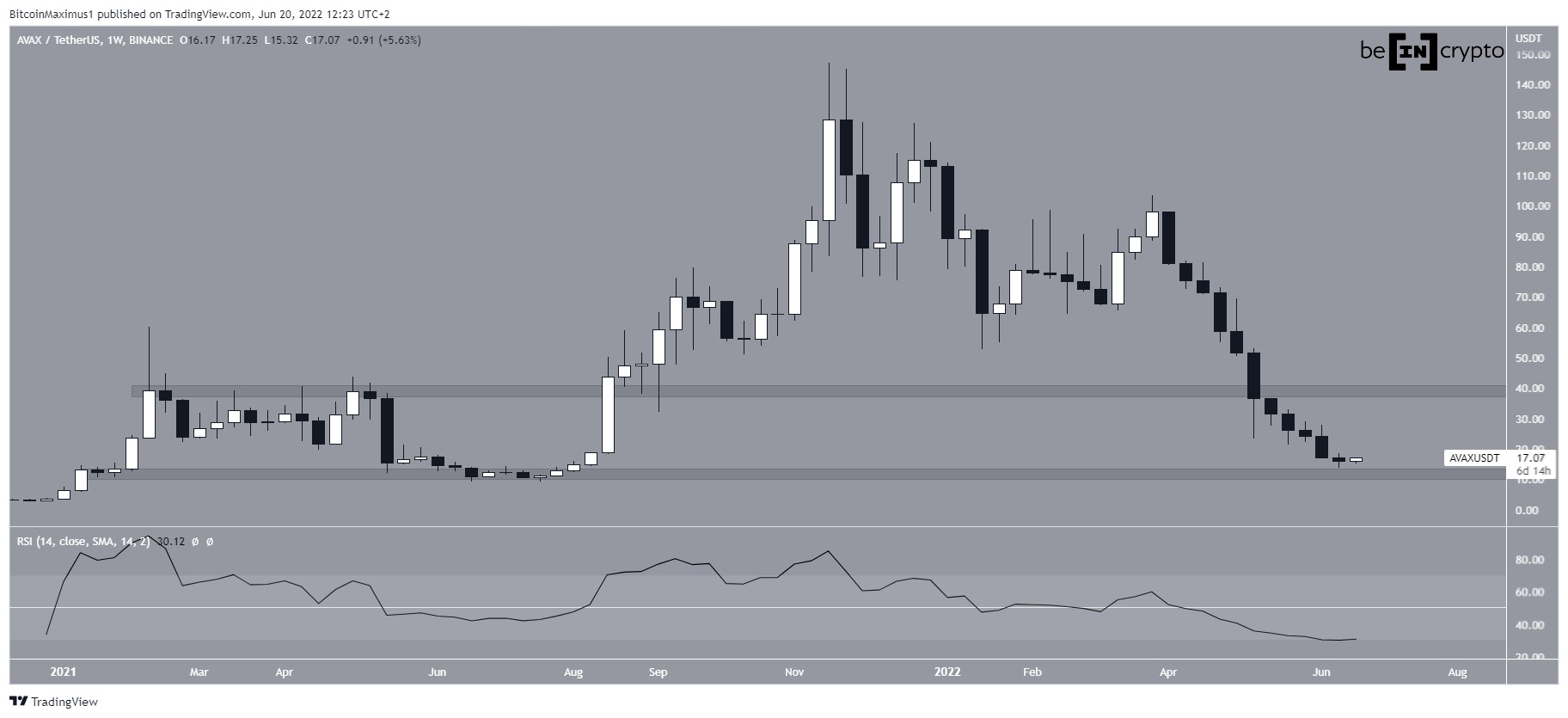

Avalanche is still looking bearish on the higher time frame. But the recent bounce off a key psychological level seems to have changed the direction of the market as it now turned bullish on the lower timeframe with a 30% gain in a month.

Avax has added a few dollars to its price since it tested the $10 psychological level in June. Although, the price got stuck at the $13.5 level last week and has been struggling to advance higher ever since.

This price level is now held as a critical resistance level for short-term bullish.

A drop in volatility has triggered a choppy price action, and if the asset continues to squeeze, a big price movement should be expected. In this case, an upward rally is expected considering the recent push from last week’s low of $12.1. It has technically formed a bullish pattern on the lower timeframe.

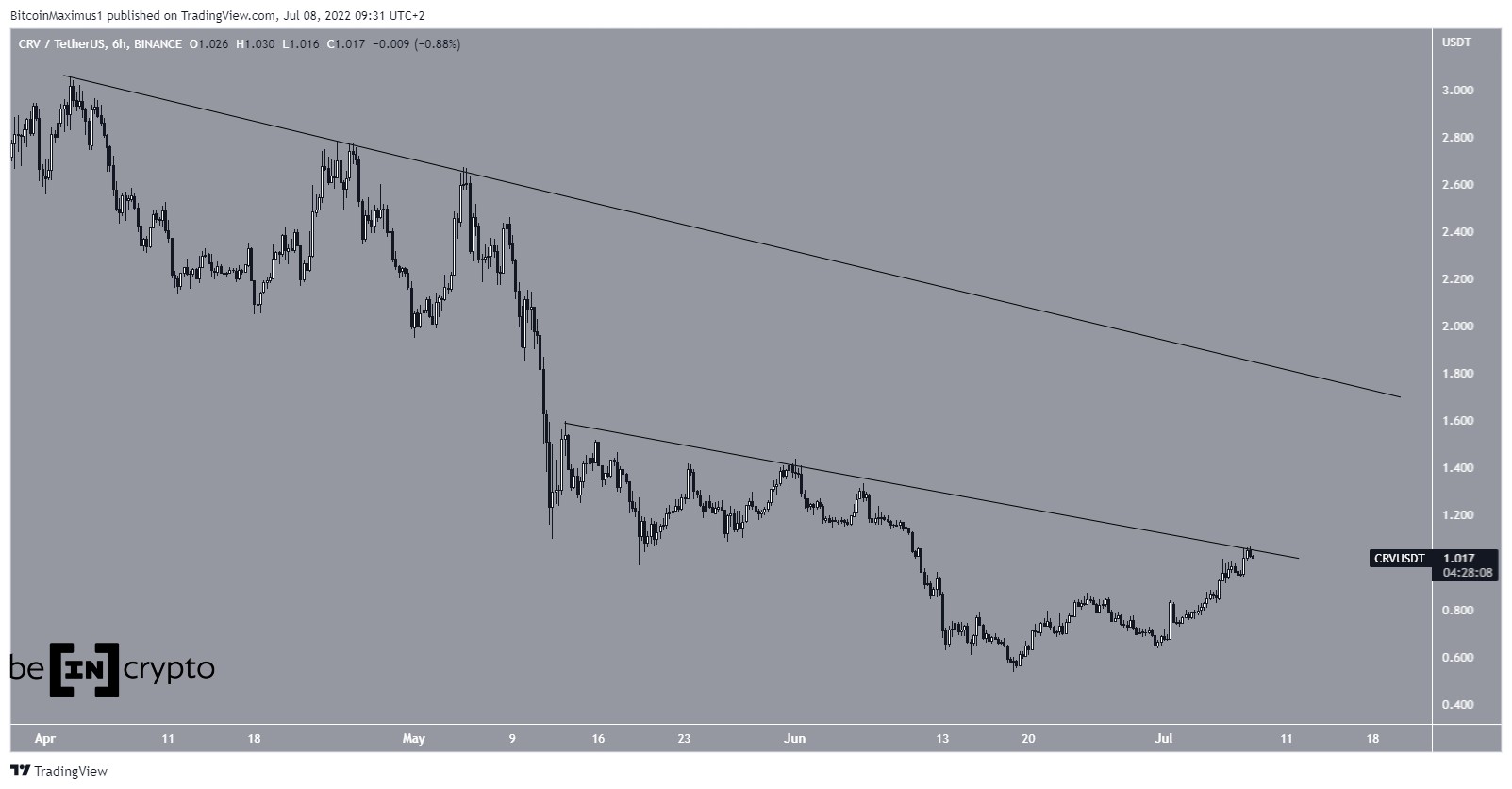

However, if the crypto finds it difficult to push through the mentioned critical resistance, the price may plummet to the lower boundary of the wedge that captures price actions for over a year.

The lack of interest has stalled the price around $13.2 for some days now. A surge from the current trading level should give a clue about the next price direction. The buyers look weak but are trying to remain in control from a technical standpoint.

Avax’s Key Level To Watch Source: TradingViewWhile the price faces critical resistance in the past week, the $14 and $15 resistance levels are the next area to watch for an increase. It is followed by $16.5 and $18.

The $13 level has been held as support since the start of the week. A fall off this support could bring the price back to the low of $12.3 and $11.11 in the near term.

Key Resistance Levels: $14, $15, $16.5

Key Support Levels: $13, $12.3, $11.11

Spot Price: $13.2 Trend: Bullish Volatility: LowDisclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Image Source: skorzewiak/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

Avalanche (AVL) на Currencies.ru

|

|