2022-12-16 06:08 |

The Australian finance watchdog has filed a lawsuit against Finder Wallet for violating consumer protection regulations.

The Australian Securities and Investments Commission (ASIC) sued the unit of Finder.com for providing unlicensed financial services related to crypto products, per a Reuters report.

Fine Print of the LawsuitIn a federal court complaint, ASIC accused Finder Wallet of soliciting customers to deposit funds into accounts. Furthermore, turning those deposits into “stablecoins,” and then promising fixed returns. The comparison website allegedly sold the debenture product without a financial services license.

In its court filing, ASIC stated that users of Finder.com “made uninformed (or inadequately informed) investments. Which in turn exposed them to a risk of loss” since they “did not have the benefit of the regulatory regime.”

In addition, ASIC Deputy Chair Sarah Court stated that just because an offer contains a product related to crypto assets does not mean it would be exempt from the current regulatory framework.

Contrarily, a Finder.com spokeswoman told Reuters that the company disagrees with ASIC’s assessment that Finder Earn qualifies as a debenture. The company representative also claimed that all client funds were returned when the product was discontinued in November.

Australia Crypto Sector Sees Increased Legal ActionThe lawsuit against Finder is apparently ASIC’s third legal action against a provider of crypto-related products in the last two months.

Recently, Binance’s Australian unit was fined $2 million for sending unsolicited emails to customers. The Australian Communications and Media Authority (ACMA) recently discovered that Binance Australia sent over 5.7 million promotional emails. Moreover, the platform allegedly made it challenging for customers to unsubscribe from the email list.

Last month, the Australian financial authority sued Block Earner for providing unregistered cryptocurrency services.

Meanwhile, in the upcoming year, Australia reportedly plans to create a crypto framework. It will include a regime for licensing cryptocurrency service providers, along with other regulations in the sector. According to a statement released by Stephen Jones MP, Assistant Treasurer and Minister for Financial Services, the government plans to strengthen the financial market and payments infrastructure in 2023.

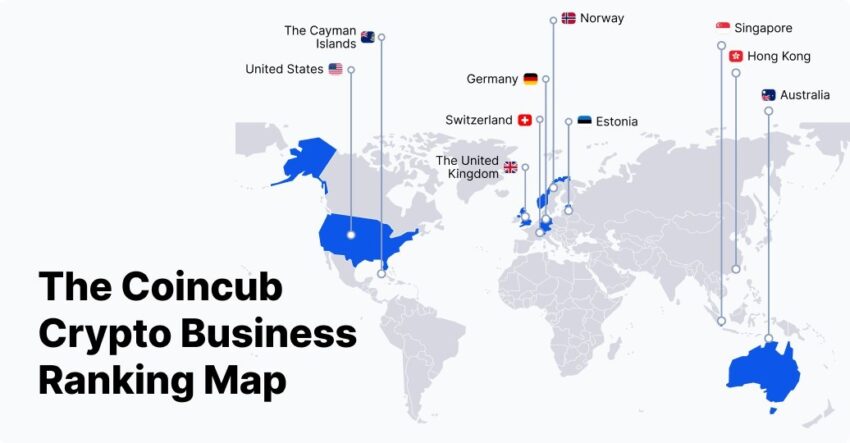

Notably, Australia is a crucial crypto economy that is ranked in the top 20 markets. Therefore, its legislative plans would also have a major impact on a global scale.

Coincub Crypto Business Ranking Map Regulatory Overhaul in the CountryThe statement indicates that a consultation paper will be released in early 2023. Which will determine if financial services laws should govern digital assets. Moreover, creating suitable custody and licensing arrangements to protect consumers is the next step in Australia’s ongoing “token mapping” work.

The Government is seeking input into the Strategic Plan for the Payments System.

Blockchain Australia's Policy Lead, Gordon Little, will consult with members on the consultation paper which seeks views from industry before 06 February 2023.https://t.co/l0ZJ88TqUT

Another report by Bloomberg highlighted that Australia could bring significant changes to its financial services legislation that would tighten safeguards for the cryptocurrency market.

According to ongoing discussions, the government will reportedly investigate whether the country’s financial laws should govern cryptocurrency tokens.

The post Aussie Watchdog Sues Another Crypto Provider Amid Regulatory Overhaul appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|