2020-1-24 21:32 |

On Jan. 22nd Bitcoin started dropping and today we went to nearly $8,200 level. Currently, we are hovering around $8,400 while managing the daily trading volume of $786 million, as per Messari.

Just like price, the hash rate of the network is also staying around 118 Th/s, down from 126 Th/s on Jan. 17, the day BTC price was at $9,000, as per Bitinfocharts.

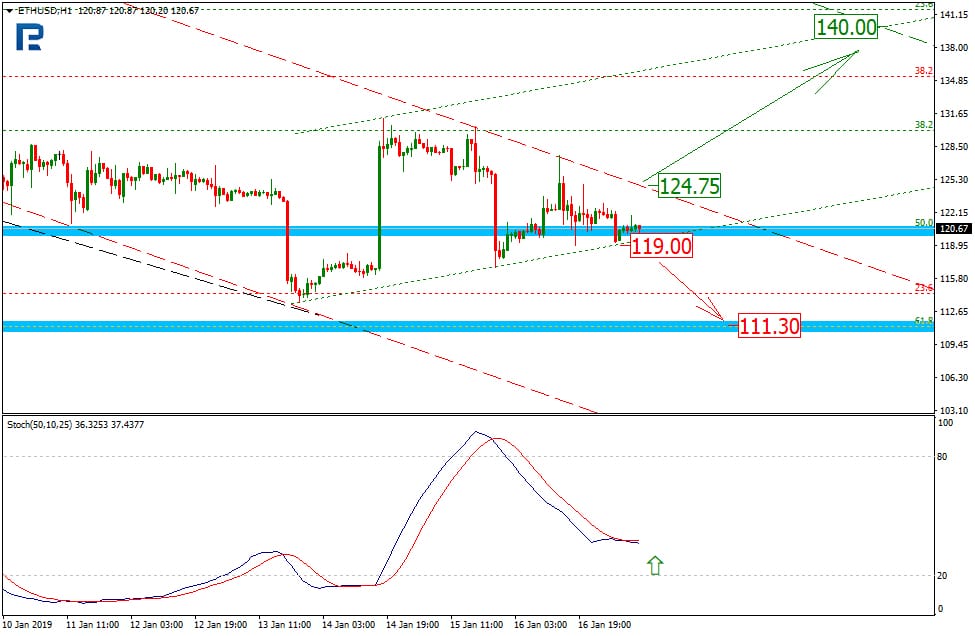

About the hash rate, analyst Ceteris Paribus makes an interesting observation. Using 7-day moving average, he found that the hash rate doubled fast in 2017. The time to double the has rate decreased from 284 days to 117 days then to 132 to 117 days at that time.

During the bear market of 2018, this time again increased, taking more than a year to double from 34 Th/s to 64 Th/s. But as we head into the halving, it has yet again picked up speed.

Starting when $BTC hit 1 EH/s Hashrate, mapping out the time it took to double each time (using 7 day moving average).

Currently sitting at ~ 111 EH/s, 201 days after hitting 64 EH/s. pic.twitter.com/KMcdDcpSvJ

— Ceteris Paribus IS RIGHT (@ceterispar1bus) January 23, 2020

Mining death spiral believers keeping us from rocketingWith the hash rate again taking to hitting new all-time highs, what will be the effect of the Bitcoin reward halving in May 2020? Will it cause a mining death spiral or miner capitulation?

According to the majority (53.8%) of the 7,734 voters, there will be no death spiral however 13.5% believe there would be a death spiral while 32.7% don’t know, revealed the twitter poll conducted by prominent analyst PlanB.

And these almost 50% are exactly what stands between Bitcoin’s current price and stock-to-flow model determined value of BTC at $50,000-$100,000 after the halving, said the analyst.

If this risk disappears, he says we would shoot up to the moon.

#bitcoin risk & return (-74% & 206%) is off the chart!

Looking at 50 years price data: bonds, gold and stocks are on the same risk & return line, consistent with EMH and CAPM. But bitcoin is far above that line. IMO that is the reason why the market overestimated bitcoin risk. pic.twitter.com/8WLCrRllij

— PlanB (@100trillionUSD) January 22, 2020

The biggest risk that investors see in terms of futures and manipulation he says is also “much less than the benefits.”

Another risk that all institutional investors talk about is another coin with super marketing skills going viral and uneducated investors piling into it. And this is a reason, explained the analyst,

“why they like XRP, smooth talk, super marketing, and great connections with banks. They also like central bank coins. IMO “the next bitcoin” is no risk at all: Lindy and network effects.”

But “effectively zero,” possibility of that happeningThe possibility of a mining death spiral is “effectively zero,” says PlanB. This is because that would mean major mining firms closing down one after another causing the hash rate to drop to near-zero.

When it comes to miner capitulation, it occurs when smaller mining operations are forced to sell their BTC to keep their operations running because of the fall in bitcoin price and their mining machines becoming technologically obsolete.

But a vicious cycle of this where “undercapitalized miners panic sell, price dumps, longs get squeezed, stop losses cascade — then more miners lose their lunch,” situation reaches to a death spiral.

However, crypto proponent and researcher Andreas Antonopoulos had previously said that an abrupt drop in the Bitcoin network to near-zero is not likely to happen.

This is because miners have a “much more long-term perspective.” Also, miners can use their older and cheaper hardware with less overhead costs. And even if Bitcoin crashes to a penny, difficulty adjustment would result in it still being profitable to mine.

As a last resort, there could be a fork to manually adjust the difficulty lower. So, a big drop in hash rate can have drastic effects for BTC price in the short term but it won’t be entering a mining death spiral.

Bitcoin (BTC) Live Price 1 BTC/USD =$8,502.9163 change ~ 1.96%Coin Market Cap

$154.58 Billion24 Hour Volume

$5.19 Billion24 Hour VWAP

$8.38 K24 Hour Change

$166.6278 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|