2020-6-29 19:32 |

Twelve years after the first cryptocurrency emerged, more than 5000 others have been created. And while a good number of these have continued to thrive in demand, a generous number of digital currencies have failed greatly over the years. Even still, experts are of the opinion that more and more cryptocurrencies, both new and existing coins, will cease to survive in the nearest future.

As such, when angel investor Jason Calacanis took to Twitter to express strongly that many cryptocurrencies will indeed be flushed out of demand, it didn’t come as much of a surprise.

However, this comes across as a very bold take with Calacanis firmly stating that only 1% of cryptocurrencies against 99% are valuable.

Historically, 99% of crypto projects are garbage run by unqualified idiots, delusional but below average founders or grifters… the 1% that are not, could change the world.

I’m waiting for that 1% to deliver their product so I can talk to their customers.

you got customers?

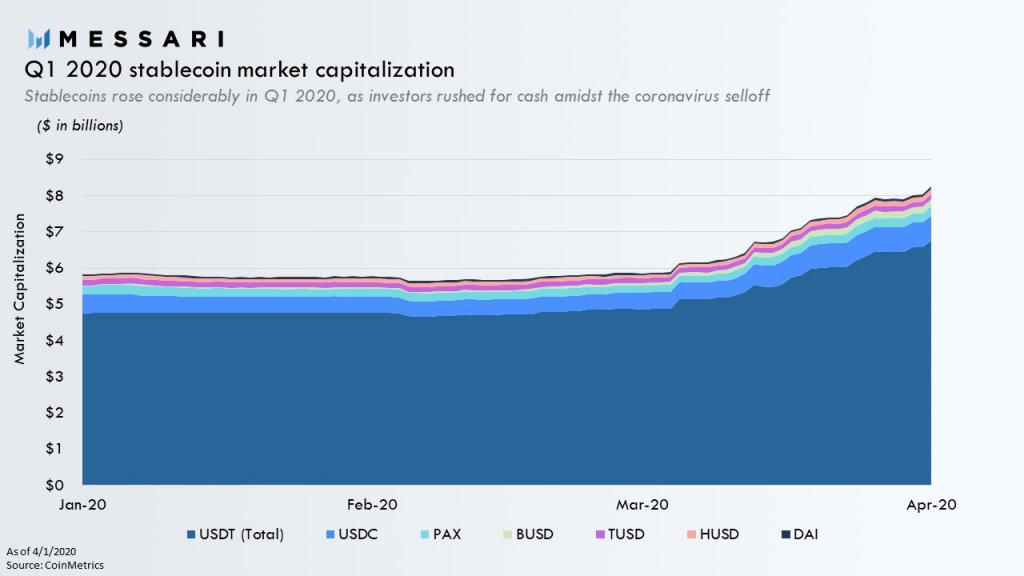

To put it into perspective, there are around 5,000 cryptocurrencies listed on coinmarketcap at present. Calacanis’s take would mean that only 50 out of the existing cryptocurrencies are likely to succeed. When losses are calculated, this would also mean that over billions of dollars will be lost in market capitalization which will certainly have a lasting effect on the rest of the market.

Although that seems like a big gamble, the Uber investor is not the only one who shares these sentiments. Similar to Jason, Kevin Rose, a partner at True Ventures had in a recent interview echoed Jason’s thoughts, saying that 99% of cryptocurrency projects are bound to fail. Rose agrees that the vast majority of these projects are created with the sole purpose of profit generation with no inherent solution model to the current financial static that paper money creates.

Even so, Rose, while recognizing the effects of these failed projects on upcoming ones, believes that a handful of cryptocurrencies are still promising. Part of his interview with Techcrunch reads: “that’s unfortunate because it really drags down the high-quality projects, and it muddies the space quite a bit.”

Both observations regardless of how extreme, reflect past events to a large extent. Between 2018 to 2019, around 1900 to 3000 cryptocurrencies emerged and barely half made to 2020. Data from Coinopsy, a platform dedicated to tracking non-functional cryptocurrencies lists over 1600 digital currencies, with 60% (ICO) backed coins getting smashed out even before getting to their birthdays or getting listed on an exchange.

The general take from critics is that most of these coins have no inherent value, but another very popular take is that even the cryptocurrencies with underlying value are imitation coins. Like the term defines itself, these coins simply imitate other existing coins and provide the same solution; a need that has already been met.

In one of YahooFinance’s 2019 published articles centered around the reason why many cryptocurrencies go to zero, writer Gavin Brown explains how imitation coins simply fail to meet the public’s demand.

“Time and again, we see launches that copy a previously successful coin–“coin x is the new Bitcoin,” for example. Yet the market already has Bitcoin, and it continues to be in demand–as evidenced by the 18 millionth Bitcoin being mined only last month.”

With digital currencies gaining global attention and investment, it is likely that the crypto-space will continue to see more and more coins sprout to life. However, Brown observes that many of these coins are indeed scams that contribute to the intensification of strict regulatory policies. But even if this makes the highly saturated market difficult to conquer, there is still room for new and authentic cryptocurrencies to thrive.

origin »Bitcoin price in Telegram @btc_price_every_hour

Goodomy (GOOD) на Currencies.ru

|

|