2025-12-24 12:28 |

A new analysis is reigniting one of crypto’s most critical debates: whether investors should hold or sell tokens after receiving an airdrop.

Data shared by a trader shows that most airdropped tokens lose significant value after launch, raising questions about whether selling is the more rational strategy.

Most Crypto Tokens Underperform After Launch, Analysis FindsIn a recent X (formerly Twitter) post, cryptocurrency trader Didi tracked personal airdrop receipts from the last year. The data revealed that nearly all tokens suffered significant losses after their launch. For example, M3M3 dropped 99.64%, Elixir fell 99.50%, and USUAL declined 97.67%.

Major projects lost significant value as well. Magic Eden declined 96.6%, Jupiter fell 75.9% from its TGE price, and Monad dropped 39.13% since its debut. The only token above its initial price was Avantis, with a 30.4% gain.

“Out of the 30 airdrops I’ve received since December 2024, only one is trading slightly above its TGE price today. Yet selling an airdrop at launch somehow makes you a ‘traitor.’ Let’s be honest about the game we’re playing. We’re all here to make money. Anyone telling you otherwise is lying to themselves,” the post read.

The analyst added that historical data shows holding altcoins long term is a low-probability strategy, with the likelihood of losses far outweighing the chances of sustained gains.

“Understand the environment you’re operating in and prioritize capital preservation above everything else. Profits are only real once they’re realized,” Didi said.

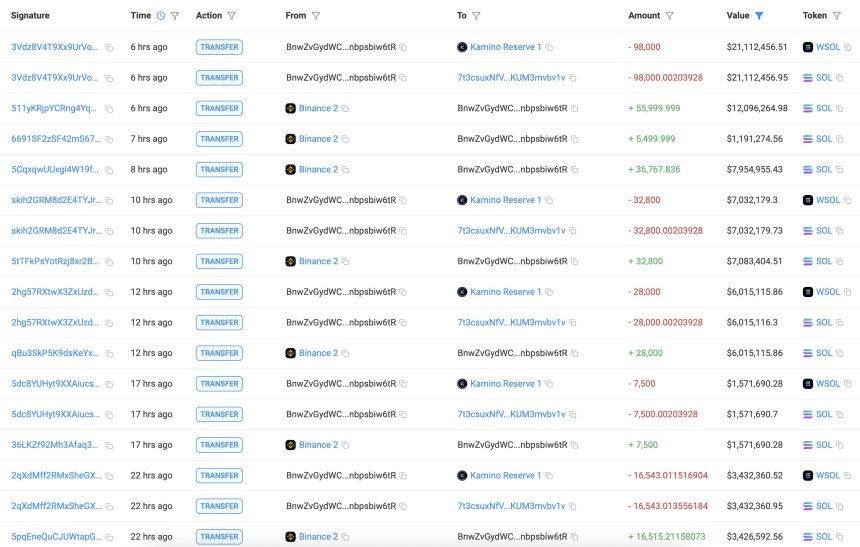

Industry-wide analysis appears to reinforce these conclusions. Memento Research analyzed 118 token generation events in 2025 and found that 84.7% of launched tokens are currently trading below their TGE valuation.

Token Performance Post TGE. Source: Memento ResearchFurthermore, 65% of those tokens have lost around 50% of their value. At the same time, over half are down 70% or more.

The report pointed out that projects that debuted with high fully diluted valuations (FDV) performed particularly poorly. Of the 28 launches that started with an FDV of $1 billion or more, none are currently green today.

“When you split the year by starting FDV quartiles, the pattern is clear: the cheapest and lowest FDV launches were the only bucket with a meaningful survival rate (40% green) and a relatively mild median drawdown (~-26%), while everything above mid-pack basically got repriced into the floor with median losses of ~-70% to -83% and almost no greens,” the report read.

An analyst noted that many crypto projects aim for billion-dollar valuations regardless of product maturity or utility. Many tokens open trading at levels far removed from their fundamental or fair value, leading to rapid repricing once market forces take over.

“Whoever isn’t selling most of this drops at tge is retarded or doesn’t understand how valuation works,” he stated.

Airdrop Fatigue Grows as Mechanics Worsen and Trust ErodesBeyond persistent price pressure, investor interest in airdrops has been fading in 2025 for structural reasons. Market participants increasingly argue that the airdrop model itself has become overly complex, exclusionary, and vulnerable to abuse.

Crypto commentator Maran illustrated this shift by contrasting past and present airdrop mechanics. In previous cycles, airdrops often required minimal participation, such as connecting a wallet, and distributed relatively large allocations.

In 2025, many projects apply stricter eligibility criteria, including longer engagement periods, technical requirements, registration windows, or vesting schedules.

“4 figures was pretty easy back then. Now 4 figures are the top,” the user added.

Another analyst claimed that airdrops are “completely broken” in 2025. Zamza Salim emphasized that Sybil attacks compromised several high-profile airdrops in 2025 despite anti-farming measures.

“Airdrop meta in 2025 is cooked. Don’t waste month grinding for scrap while farmers eat 20%,” Salim remarked.

Taken together, recent data highlights a recurring pattern of post-launch underperformance among airdropped tokens, while also pointing to broader structural challenges within the airdrop model. Although some tokens do manage to retain or grow value over time, the combination of high initial valuations, market repricing, and evolving distribution mechanics has made outcomes quite uncertain.

The post Analysts Examine Whether It’s Better to Sell or Hold Tokens After an Airdrop appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

VIP Tokens (VIP) на Currencies.ru

|

|