2023-10-27 23:00 |

Gareth Soloway, a well-known markets analyst, has offered insights into the recent price action of Bitcoin and its potential future trajectory.

In a Thursday interview with Kitco News, Soloway discussed the factors influencing Bitcoin’s recent surge, the likelihood of a Bitcoin spot ETF approval, and what investors can expect in the near future.

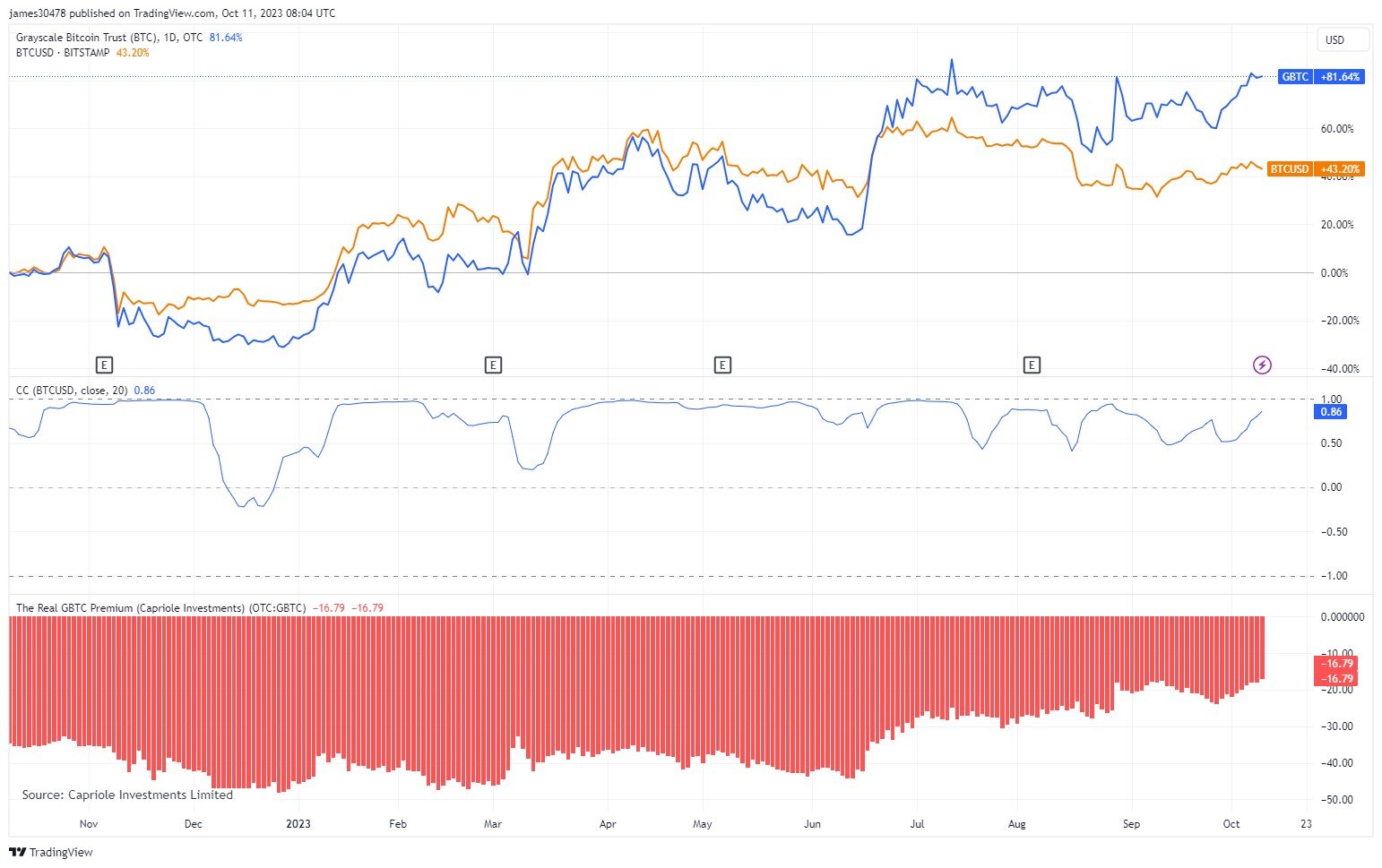

Notably, Bitcoin has experienced a significant upswing of approximately 30% in the past month. This remarkable rally has been primarily driven by optimism surrounding a potential Bitcoin spot ETF and key regulatory developments, notably involving the SEC’s case against Ripple and the Grayscale legal battle with the agency.

Soloway pointed out that these factors have been a key driver, pushing the price up by as much as 107% year-to-date. He also highlighted last week’s event when a fake news story about the approval of a Bitcoin ETF led to a rapid surge in Bitcoin’s price. However, according to him, this event made it clear that the approval of a spot ETF would have a significant positive impact, leading to short covering and an influx of buyers.

However, Soloway cautioned that if the spot ETF approval does occur while Bitcoin is trading at its current levels, Bitcoin may surge up to $47,000 before experiencing a “sell on the news” scenario, after the news is confirmed.

“I would take this high from 2019 and connect it through the bull market lows, and there’s this beautiful trend line. You can see how it connects right through these lows perfectly, and that gives us a Target of about $47,000… [I’m] actually expecting a bigger pullback off that level,” said Soloway.

Furthermore, Soloway expressed confidence in the eventual approval of a Bitcoin spot ETF, possibly by late this year or early January 2024. He highlighted the SEC’s string of losses in cases against cryptocurrencies and suggested that approval is likely.

That said, the pundit further cautioned that Bitcoin’s price could experience significant fluctuations due to external factors, such as a potential economic recession or market turmoil, which might trigger panic selling across various asset classes.

Meanwhile, Soloway also outlined his current trading strategy. He explained that when Bitcoin broke a significant trend line, he entered a long position to ride the uptrend. But as Bitcoin hit resistance around $31,000, he sold half his position. Furthermore, when the price surged to $34,000, he sold the rest and shifted to a short position at $35,175, expecting a pullback to around $31,500.

Soloway clarified that he’s a swing trader, focusing on smaller market moves. For long-term investors, he suggested accumulating Bitcoin within the current price range. He expressed optimism about Bitcoin potentially surpassing $100,000 in the next three years and aiming even higher.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|