2020-8-7 16:00 |

Litecoin (LTC) has surged 42 percent in a three-week winning streak. But the rally showed signs of exhaustion upon testing a “huge falling resistance” for a breakout. LTC printed a so-called “bearish engulfing candle,” which, according to financial analyst Vince Prince, spells downside risks for the cryptocurrency.

Litecoin is at risk of breaking lower after surging three weeks in a row by 42 percent.

The silver cryptocurrency painted a “bearish engulfing candle” on August 2, a phenomenon that signals lower prices ahead. Vince Prince, the financial analyst who first spotted the bearish pattern, noted that LTC is going to visit a couple of lower levels in the sessions ahead.

Mr. Prince further supported his bearish bias with another structure: a “huge falling resistance” that this week rejected Litecoin’s upside move. Excerpts from his analysis:

“The tremendous falling resistance has confirmed [another Litecoin move] to the downside with a [significant] protracted [bearish volatility]. And not only this but also with a bearish engulfing candle which confirms this strong move.”

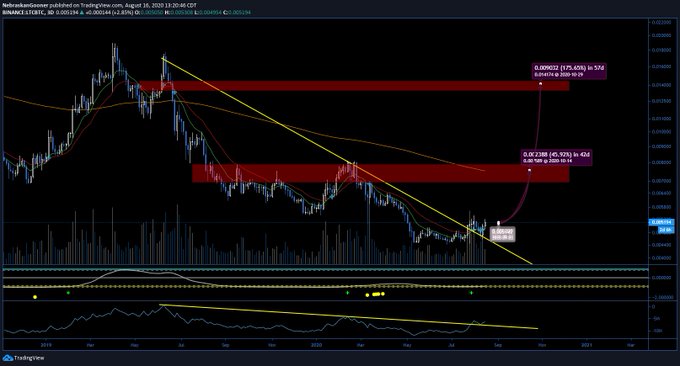

Litecoin is confirming intense selling pressure near the falling trendline. Source: TradingView.com Litecoin Support Levels to WatchMr. Prince recognized that LTC lacked the fuel required to log a breakout move above its falling trendline resistance.

Expecting a pullback, the analyst noted that the cryptocurrency would first test two of its provable support waves: the 100-period exponential moving average (red) and the 200-period exponential moving average (black).

He said Litecoin could use the levels to stabilize its short-term bearish bias. If that does not happen, then the cryptocurrency risks breaking down towards the horizontal support levels lurking between $49 and $50.

If they fail to hold the price as well, then a more significant crash would take LTC to the bearish zone, as shown in the chart above.

The lower level of the said area is at $41-mark.

“Overall, Litecoin has the potential to establish more bearishness in the short-term,” wrote Mr. Prince. “But, there are also remaining support levels where it can stabilize. Only when these supports do not hold, there can be an ongoing bearish continuation [ahead].”

Competitive ThreatsIndirectly, but Mr. Vince recognized the presence of better and slightly more bullish blockchain projects than Litecoin. The analyst recognized that traders may opt to park their capital into those attractive alternatives, adding more downside risks to Litecoin’s pullback move.

“The divergences will increase [in] the [coming] times as there is a sorting out of innovativesolid projects […] this case, it is important to differentiate the cryptocurrencies to trade them individually accordingly.”

LTC/USD was trading at $59.92 at the time of this writing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Litecoin (LTC) на Currencies.ru

|

|