2020-1-22 16:38 |

Bitcoin’s latest price action brought with it a sense of optimism felt throughout the cryptocurrency market. Some of the most prominent analysts in the industry claimed that BTC had begun a new bull run, but different technical patterns estimate that a correction is underway.

A Rally Lacking VolumeLast week, Bitcoin broke out of a descending parallel channel where it had been contained since June 2019. Since then, each time the flagship cryptocurrency hit the bottom of the channel, it bounced off to the middle or the top.

Conversely, when it climbed up to the top of the channel, it plunged back to the middle or the bottom.

The recent bullish impulse that allowed BTC to move out of this consolidation pattern was perceived as a sign that a bull market could begin.

In early Dec. 2019, for instance, Peter Brandt, a 45-years trading veteran, estimated that breaking out of the channel could set the stage for the beginning of a parabolic phase. The uptrend would likely take Bitcoin to “attack” the all-time highs of 2017 and “slice” decisively through it, according to Brandt.

Despite the bullish outlook, there has not yet been a spike in demand that pushes the price of BTC on to higher highs. The lack of buying pressure behind the pioneer cryptocurrency could be a signal that a correction is coming before the continuation of the rally.

BTC/USD by TradingViewThe formation of an evening doji star candlestick pattern on BTC’s 3-day chart supports the idea that Bitcoin is about to go through a retracement. This technical pattern is considered a bearish reversal formation that usually develops at the top of an uptrend.

Evening doji stars are composed of three candlesticks: a long green candle, a short or doji candle, and a red candle. The combination of these three candlesticks prevails that Bitcoin reached an exhaustion point and is losing its bullish momentum.

BTC/USD by TradingViewIt is worth noting, however, that volume could still pick up, which may lead to a bullish breakout that validates the optimistic forecast presented by Brandt. Therefore, the trading range between the 16.18% and 23.6% Fibonacci retracement levels is a reasonable no-trade zone.

Breaking below support could be followed by an increase in the selling pressure behind Bitcoin that takes it down to the 38.2% or 50% Fibonacci retracement level. These levels of support sit at $8,140 and $7,820, respectively.

BTC/USD by TradingViewA close above the resistance barrier would likely push the price of BTC up to retest the $9,000 hurdle. The beginning of a new macro uptrend will depend on Bitcoin’s ability to slice through this significant resistance level.

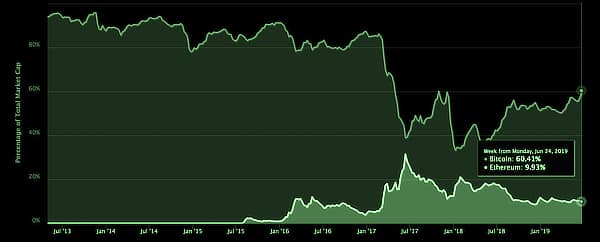

Wisdom of the CrowdThe Crypto Fear and Greed Index (CFGI) is a helpful gauge for analyzing the emotions and sentiments among market participants. This technical instrument takes into consideration different factors including volatility, volume, social media, surveys, and market dominance.

These values are then mixed into one simple value. A value of 0 means “extreme fear” while a value of 100 represents “extreme greed.”

On Jan. 14, the CFGI picked up rising levels of greed in the crypto community presenting a value of 56. The last time this index sense such high levels of greed in the market was back on Nov. 3, 2019.

During that time, Bitcoin underwent a correction that saw its price decline over 30%. The flagship cryptocurrency went from trading at a high of $9,645 to a low of $6,620 on Nov. 25, 2019.

Source: Crypto Fear and Greed IndexBased on historical data, it appears that each time the CFGI goes into “greed” a selling opportunity is presented. If that is the case this time around, then the evening doji star candlestick pattern seen in BTC’s 3-day could be validated thus pushing the price of Bitcoin down.

It remains to be seen if the pioneer cryptocurrency will indeed break below the $8,500 support level since it still looks bullish from a long-term perspective.

The post Analysis: Steep Bitcoin Retracement Still Possible appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|