2020-2-25 18:12 |

Coinspeaker

Alphabet (GOOGL) Stock Is in Red But It Looks Bullish in the Long Term

With a market cap over $1 trillion, Alphabet Inc. (NASDAQ: GOOGL) stock is a top tech stock and one of the world’s most valuable companies. All of the different facets of large tech companies like these make them very attractive to investors and also keeps them soaring higher. Regardless, even some of the biggest falter, as market factors do not respect a company’s size or value. Alphabet (GOOGL) stock lost some weight last week and is not doing better right now but it still has chances in the long term.

Alphabet (GOOGL) Stock Sheds WeightAt the close of the market on Friday, Alphabet stock lost more than 2% and closed at $1,483. While price swings are normal, the stock hasn’t regained its loss but has plunged deeper. Currently, premarket figures put the GOOGL stock at a further 3.05% loss, now trading at $1,438. A lot of the time, it’s difficult to properly figure out the main reason a stock plunged. However, there’s always the chance that right now, the coronavirus outbreak has affected Alphabet stock in some way.

What’s to Come for Alphabet (GOOGL) Stock in Long Term?Even with the plunge, Alphabet stock is still over 10% this year alone. In the last 1 year, GOOGL is still almost 33% up and there’s more than enough reason to believe that this could go higher. Earlier this month, Alphabet released its earnings report for Q4. The report shows that the 2019 fourth quarter was better than market estimates but somehow didn’t hit revenue targets. Regardless, the $46.07 it successfully pulled in represents an annual 17% increase. Furthermore, its $15.35 earnings per share also shows a year-over-year- increase of 20%. For the entire year, Alphabet climbed 18.3% over its 2018 figures, finishing strong at $161.86 billion.

This is probably why institutional investors are optimistic about GOOGL’s chances. In its most recent filing with the United States Securities and Exchange Commission (SEC), Great Lakes Advisors LLC increased its GOOGL position by 3.9% for Q4. Currently, Great Lakes has almost $1.7 million in GOOGL shares.

Many others made similar moves. According to a recent report, BigSur Wealth Management LLC and Cedar Mountain Advisors LLC spent $33,000 and $35,000 respectively. Others include TFO TDC LLC spending $32,000 and Roof Eidam & Maycock ADV buying shares worth $33,000 in Q3. All of these moves not only show optimism but point to analysis done by these companies that probably put Alphabet speeding up in 2020.

Alphabet Has Its Hands in Different PiesMany people believe that the best way to predict a company’s possible growth is to analyze the reach it has in the world. Going by this, Alphabet’s recent plunge might just be a tiny speck of dust that can be easily flicked away.

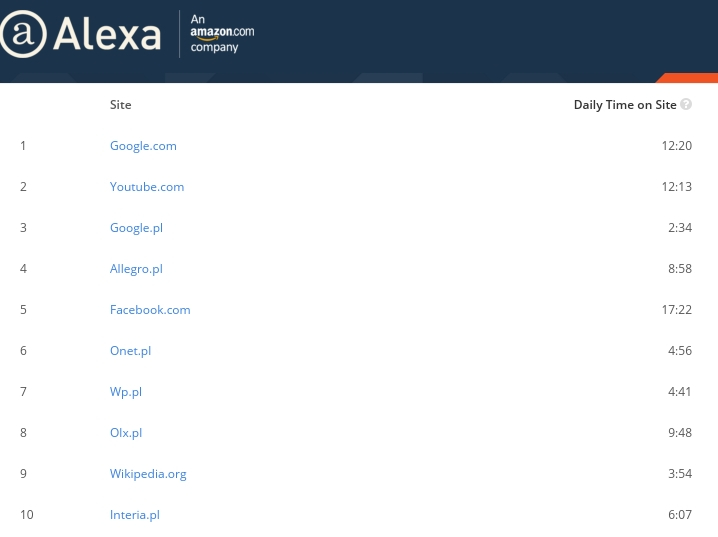

Google Search is Alphabet’s search engine. Alphabet is clearly the market leader in this department as its unlikely that any other companies can compete favorably. YouTube is the world’s most used video streaming platform, a position the company has held for a long time.

Alphabet also has its hands in pies directly tied to healthcare. It is working with heavyweights like Pfizer and Novartis to improve healthcare with drugs. For Artificial Intelligence, the company’s Waymo autonomous vehicles are also doing great. This, coupled with many other offers to come, makes it easy to see why GOOGL might be set for a bigger 2020 than previous years.

Alphabet (GOOGL) Stock Is in Red But It Looks Bullish in the Long Term

origin »Bitcoin price in Telegram @btc_price_every_hour

RedCoin (RED) на Currencies.ru

|

|