2021-11-4 20:50 |

The Alpha Finance (ALPHA) trend is decisively bullish, and the token is likely approaching the end of its consolidation period.

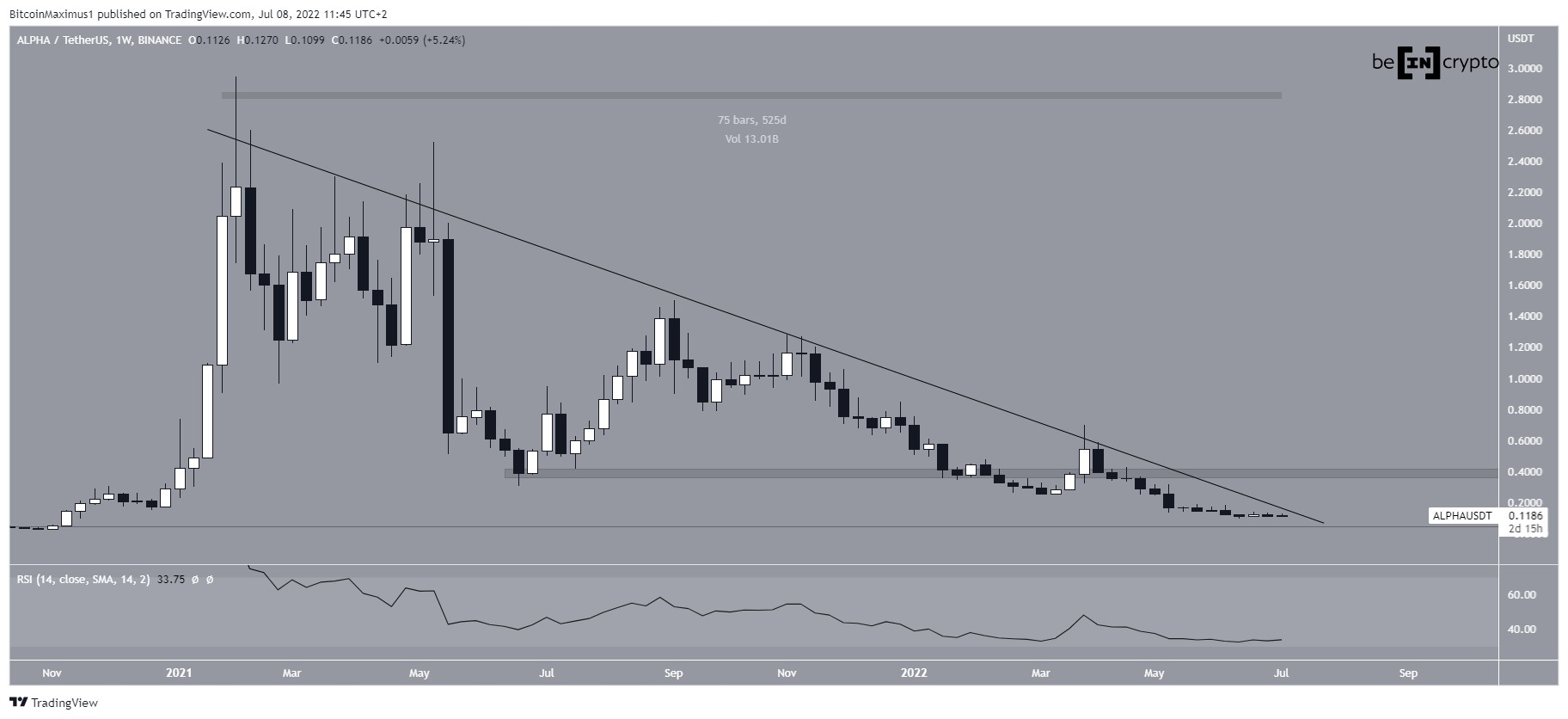

ALPHA has been increasing since June 22. At the time, it had just bounced at the support line of a descending parallel channel.

The bounce and ongoing increase hold crucial importance, since the descending channel is considered a corrective pattern. This means that after the pattern is complete, it is expected that the token will resume its prior trend, which in this case is bullish. The channel has been in place since the Feb 6 all-time high price.

In the period between Sept 23-28, ALPHA reclaimed and validated the middle of the channel as support (green circle). This further supports the possibility that the token will break out.

Technical indicators are also bullish. The RSI, which is a momentum indicator, has moved above 50. This is a sign that momentum is bullish. The previous time this occurred was just prior to the upward movement from $0.4 to $1.2.

The MACD, which is created by a short- and a long-term moving average (MA), is positive and increasing. This means that the short-term trend is increasing faster than the long-term one.

Chart By TradingView Future movementThe shorter-term six-hour chart shows that ALPHA has been rejected by the 0.618 Fib retracement resistance level (red icon) at $1.23. This is nothing out of the ordinary, since the 0.618 Fib level most commonly acts as resistance after bounces.

The main resistance area is at $1.46. It is created by the Sept highs and coincides with the previously outlined descending parallel channel.

A breakout above this level would likely accelerate the rate of increase as ALPHA would head towards a new all-time high price.

Chart By TradingView ALPHA wave countCryptocurrency trader @TheTradinghubb outlined an ALPHA chart, stating that the token is just beginning wave three and could soon accelerate its rate of increase.

Source: TwitterThe most likely count does suggests that ALPHA is in wave three (orange) of a five wave upward movement. Wave three is usually the sharpest and has the highest magnitude. The sub-wave count is given in black.

The most likely targets for the top of this wave are between $1.94-$2.04 and between $2.80-$2.95.

The former would coincide with the 0.618 Fib retracement level (black) when measuring the entire downward movement and would give waves 1:3 a 1:1 ratio. The latter would coincide with the all-time high region and would give waves 1:3 a 1:1.61 ratio

Chart By TradingViewFor BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!

The post Alpha Finance (ALPHA) Faces Resistance as it Looks to Target $3 appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Alpha Token (A) на Currencies.ru

|

|