2020-9-6 02:29 |

Bitcoin has sustained a heavy correction over the past few days. At the local lows, the leading cryptocurrency was trading at $9,800. At current, BTC is trading for $10,100 as buyers have stepped back in. Millions worth of futures contracts have been liquidated over recent days; Skew.com reports that $350 million worth of longs has been liquidated in the past two days on Binance alone. Bitcoin is down around $2,000 from its local highs at $12,000 and $2,500 below the year-to-date highs set a number of weeks. Analysts remain optimistic about the leading cryptocurrency’s medium-term and long-term prospects. In the short-term, there are signs that Bitcoin is poised to bounce. Bitcoin Price Is Primed to See a Bounce

Bitcoin is primed to bounce due to four technical reasons shared by a technical analyst. These are as follows:

Bitcoin has formed a four-hour bullish divergence as the asset reaches high timeframe support. There is a bullish divergence on a series of altcoins. A number of “golden pockets” have formed, which suggest Bitcoin and other cryptocurrencies have reached a healthy retracement point. BTC dominance has reached a key resistance level. BTC Remains Macro BullishEven if a bounce isn’t sustained at current prices, Bitcoin’s macro outlook remains optimistic per analysts.

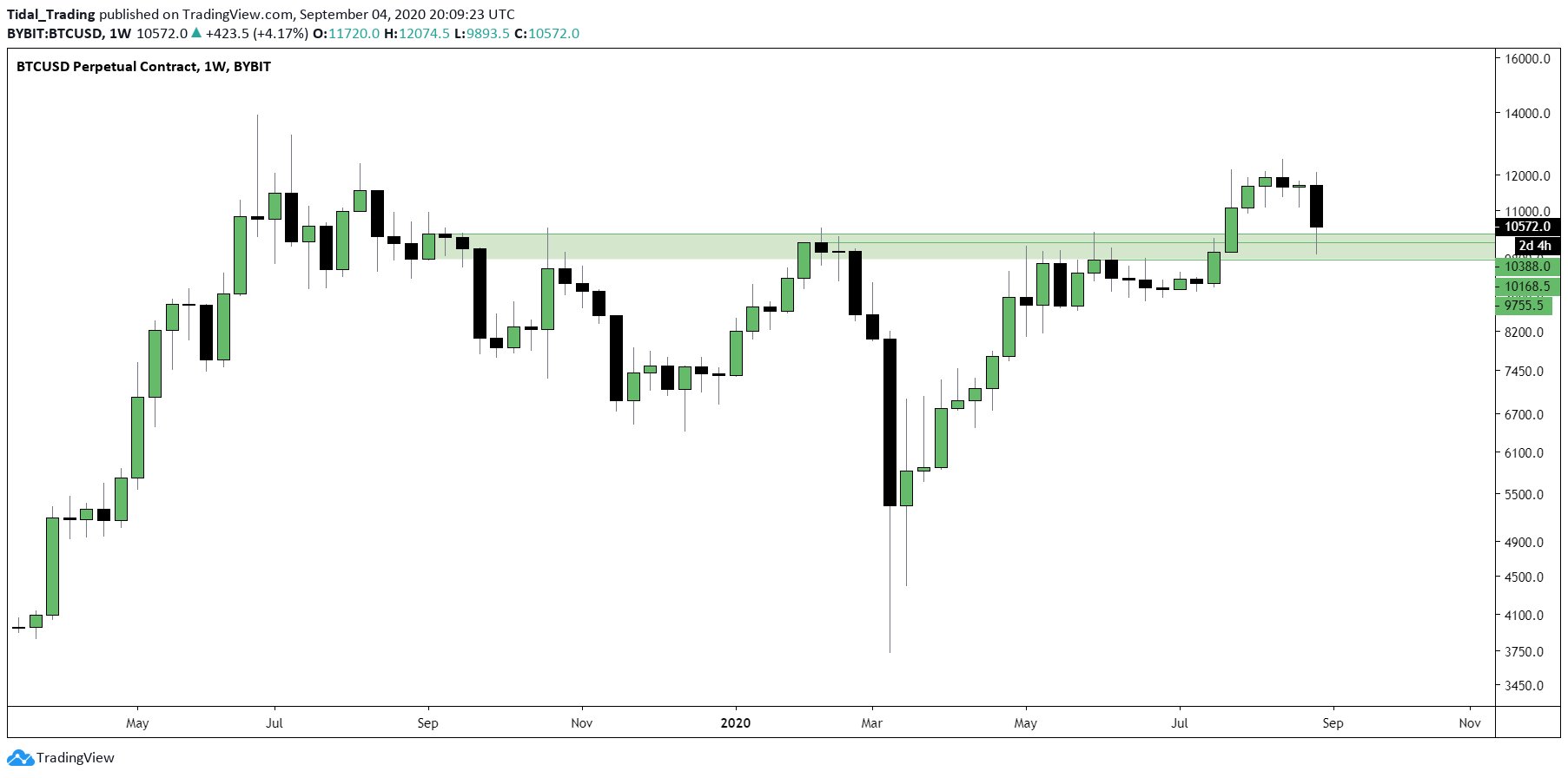

One trader shared the chart below, which shows that Bitcoin has bounced off a pivotal macro level in a sign that the bull trend remains intact:

“$BTC funding and premium index reached the lowest it had been since March 19th yesterday… Except this time we’re retesting a multi-year S/R level with a confirmed bullish break in MS all the way up to the monthly chart…”

Chart of BTC's macro price action with analysis by crypto trader HornHairs (@CryptoHornHairs on Twitter). Chart from TradingView.comThe fundamentals of BTC also remain bullish, suggesting the asset has room to rally. Raoul Pal, CEO of Real Vision, commented:

“Most people don’t understand the latter but is simply put, Powell has shown that there is ZERO tolerance for deflation so they will do ANYTHING to stop it, and that is good for the two hardest assets – Gold and Bitcoin. Powell WANTS inflation. I don’t think he gets true demand push inflation but he will get fiat devaluation, in conjunction with the other central banks all on the same mission.”

Bitcoin may see further weakness in the short term, but most analysts remain optimistic about BTC’s long-term trend.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Bitcoin Could Undergo a Strong Bounce For These 4 Reasons origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|