2020-1-12 16:51 |

In this “According to CoinMarketCap 2019” report, we will share an overview of the industry in 2019. As always, we hope you get a sense of the markets with our crypto data – with the additional nuance of the activity of millions of users on the site shoring it up.

Executive Summary2019 has been a roller coaster ride for the entire cryptocurrency industry, to say the least. Coming out of the bear market in Q4 2018,

The first half of 2019 saw the rapid ascension of prices across most crypto assets. The price of BTC hit $13,796 on 26 Jun 2019, for an amazing year-to-date (YTD) performance of +259%. The overall crypto market cap achieved a high of $366B at the same time, achieving a YTD increase of +181%. The second half saw a complete flip in sentiment, and most crypto-assets failed to hold on to YTD gains. BTC has been hovering around $7200 and the Crypto Market Cap at around $193B.That said, some very interesting insights about the crypto markets have been uncovered as we dissect market cap and pricing data available on CoinMarketCap.

Bitcoin outperformed all major financial asset classes in 2019, including equities (S&P 500 Index), commodities (gold, silver), and bonds (USA treasuries). However, Bitcoin’s volatility should not be ignored. See Section 1: Bitcoin versus Traditional Financial Assets. Bitcoin contributed to most of the increase in crypto assets’ market cap value, while other crypto assets as a whole barely grew. Three observations supported this, which are further explained in Section 2: Bitcoin versus Rest of Crypto Market: The increase in Bitcoin’s market cap was more than the increase in the entire market. Bitcoin’s dominance held steady at above 65% of the market cap, despite a 46% drop in its price since its June high. Bitcoin consistently has the lowest volatility among the top 5 other crypto assets.Bonus insight: Despite Bitcoin’s stellar performance in the aspects above, people were still very interested in other crypto assets. 93% of total views across 4000+ coin pages on CoinMarketCap were still of other crypto assets!

We should not dismiss other crypto assets, especially the exchange tokens category that has consistently outperformed Bitcoin in 2019, mainly led by Binance Coin (BNB) and Huobi Token (HT). It seemed that not many were in-the-know, however. The top 5 exchange tokens were the least-viewed compared to the top 5 in other categories like smart contract platforms and privacy coins. See Section 3: BTC versus Other Crypto Assets by CategoryPlus, given our extensive reach of over millions of users and billions of page views in 2019, we have added further insights about the crypto market based on CoinMarketCap web traffic data! See Section 4: Further Crypto Market Insights Based on CoinMarketCap Web Traffic

Users turn to CoinMarketCap whenever there is a big move in prices. As it turned out, web traffic on CoinMarketCap had a correlation of 73.28% to Bitcoin volatility. Baby boomers are into crypto too, no longer just the millennials as we saw the proportion of users aged 45-54 increase from 8.6% to 10.5%. More Asian countries ranked in CoinMarketCap’s top 25 user geographies, with China moving to #13 and Malaysia as a new entrant at #23. The fourth and fifth place for most-viewed crypto asset pages changed hands quite regularly from quarter to quarter, mainly among Chainlink, Tron, Bittorrent, Litecoin and Vechain. Full ReportWe started off the year on the back foot, from the extreme bearish sentiment seen late in 2018. Bitcoin made its low nearly exactly one year ago on 15 Dec 2018, touching a price of $3191.30 with the corresponding total crypto market cap at a low of $102B.

Since that fateful day, the crypto markets started on a bullish trajectory, with the price of BTC hitting $13,796 on 26 Jun 2019, for an amazing year-to-date (YTD) performance of +259%. The total crypto market cap achieved a high of $366B at the same time, achieving a YTD increase of +181%.

Markets have since retraced significantly, with BTC hovering around $7,200 and total crypto market cap at around $193B at the time of publishing.

Section 1: Bitcoin versus Traditional Financial AssetsWhile the exuberance has definitely faded away, it is important also to take stock of how cryptocurrencies have faired versus the more commonly referenced indexes and asset classes traded around the world.

While the large retracement of crypto prices since the June 2019 high has been keenly felt by participants in the industry, a more optimistic picture can be seen once we zoom out and compare Bitcoin versus the rest of the world of assets. In general, Bitcoin has outperformed all the larger, oft-cited indexes and commodities, even though equities and commodities recorded great annual growth rates.

That said, the volatility associated with Bitcoin and crypto assets should not be ignored, as the standard deviation of the Daily % Returns show, crypto assets are by far the most volatile asset class in this quick cross-sectional comparison.

Section 2: Bitcoin versus the Rest of Crypto MarketThe bull market of 2017/8 gave rise to the popularity of the “altseason” as other crypto assets dramatically outperformed BTC with markets going on a parabolic rise (and subsequent fall.) Bitcoin Dominance reached a low of 32% as the total crypto market cap reached an all-time high of ~$800B. The fever has since subsided, and BTC Dominance has been slowly trending up since (68%).

The recent run-up in prices has been entirely different from the bull market of 2017/8, as BTC dominance grew as prices rose.

The chart above shows a few interesting observations.

2.1. Gains in BTC led the run-up in prices.BTC Dominance has been growing since the start of the year, from 51% to 68% (as of 20 Dec 2019.) It reached a high of ~70% in Sep 2019 and has been hovering around that mark since. While the BTC price has somewhat subsided since then (-46% since the June highs), BTC Dominance has held steady, never dipping below 65%.

Read together with trends of the industry (increasing amount of BTC-based derivative products and exchanges, industry thought leaders focusing on BTC above other crypto assets, etc.) the story of 2019 appears to be the narrative of BTC retaining its crown as the main crypto-asset while all other crypto assets fight for second.

2.2. Top 5 other crypto assets (excluding BTC) have a greater market cap than the rest of the crypto assets combined (and BTC has more than all of them combined).The distribution of market capitalization is trending towards being consolidated into the upper “echelons” of crypto assets. While this is by no means conclusive of future trends (a resurgent altseason may render this observation null and void), this should be a good indication of how money flowed into crypto in 2019 – mostly into BTC, with the top 5 other crypto assets receiving similar “attention” as the rest of the other crypto assets.

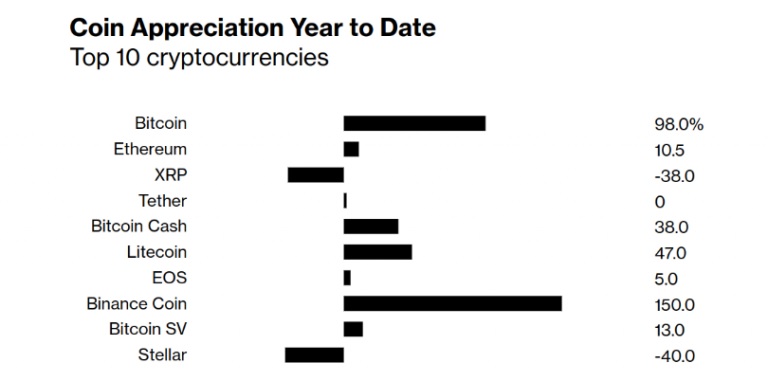

The market cap data above adds to the idea that value flowing into the crypto markets (in 2019) is overwhelmingly focused on BTC, not other crypto assets. The entire YTD increase in the market cap of the entire crypto markets can be solely attributed to BTC, while the gains and losses of value in other crypto asset balances out. The crypto asset seeing the biggest loss in market cap in 2019 was XRP, losing more than -40% of its value.

Referring to the above table, a quick overview of the YTD price performance of BTC and the Top 10 other crypto assets paints a similar picture. BTC is only outperformed by BNB and XTZ, while the rest of the Top 10 underperforms. What is also interesting to note is the volatility of crypto assets in general. As stated earlier in the report, BTC appeared to have the highest standard deviation of daily returns % as compared to major assets in the traditional financial markets. This translates to BTC being the most volatile asset when compared to the basket used to represent traditional financial markets. Yet, when compared to other crypto assets, BTC has the lowest volatility out of the Top 10 other crypto assets.

Bonus insight: Despite Bitcoin’s dominance in market cap, majority of our users are still very interested in other crypto assets. In terms of page views across over 4000 coin pages on CoinMarketCap, Bitcoin makes up 7%. That is slightly less than the combined traffic of the top 5 other crypto assets, namely XRP, Ethereum, Tron, Cardano, Litecoin that make up 9% of all coin page views.

Section 3: Price Performance of BTC against Other Crypto Assets (by Category)Next, we analyze the other parts of the crypto asset market by creating 3 categories to classify them. This taxonomy is by no means exhaustive but it serves as a good starting point to categorizing other crypto assets by their use cases for the purpose of illustration in this report.

The 3 categories we will focus on in this report are:

Exchange Coins/Tokens (BNB, HT, LEO, FTT, ZB) Smart Contract Platform Coins/Tokens (ETH, EOS, XTZ, TRX, ADA) Privacy Coins (XMR, ZEC, KMD, XVG, ZEN)We sorted all assets by market capitalization and only included the top 5 assets in each category to construct the index, as the higher the market cap, the more investor interest in the given token. Hence, we felt that only including the top 5 would give a more general depiction of the larger market sentiment towards the defined category.

The index for each respective category was constructed by averaging the top 5 included coins’ YTD % Performance.

The chart above shows a few interesting observations.

The Q1-Q2 bull market saw outperformance of Exchange Tokens and Smart Contract Platforms against BTC, but the gains of the Smart Contract Platforms gave out when the market turned bearish. Exchange Tokens consistently outperformed BTC in 2019, and that index is led by the strong performance of BNB and HT. Privacy Coins lagged the entire market, and that could be due to the increased scrutiny by regulators worldwide and pushing of some exchanges to delist privacy coins.2019 did not bode well for most Smart Contract Platforms, except for Tezos (XTZ +226%). ETH (-3%) and EOS (-3%) ended the year without any significant change to its price. TRX (-30%) and ADA (-19%) underperformed their index and BTC significantly.

The XTZ’s outperformance could be attributed to the listing of the token on Coinbase’s exchange (August 2019) and the ability to stake XTZ on Coinbase (November 2019).

Exchange tokens fared relatively well in 2019, with BNB (+117%) reaching a meteoric +500% at the height of the bull market. However, the gains were short-lived, and prices retraced significantly, in line with general crypto-market sentiment. BNB and HT (+144%) notably outperformed BTC in YTD % performance, and it could be due to efforts on the exchanges’ part in building out better use cases for their token.

LEO (-18%) and FTT (+19%) were two newly launched exchange tokens in 2019. LEO launched amid the bull market in Q2 2019 and nearly doubled in value at its peak within 1 month. The token has since slipped below its ICO price ($1) and looks to be closing off the year on a back foot.

Privacy coins had a mixed 2019 with the constructed index falling -15% YTD. While the top 5 privacy coins rallied in the earlier part of the year, most did not manage to hold on to their gains and actually fell below the starting price of the year. This was largely due to exchanges having to delist privacy coins to comply with the new Financial Action Task Force (FATF) guidance on regulation for crypto assets.

Major cryptocurrency exchange OKEx – Korea delisted all of its 5 privacy coins in September 2019, 3 of which make up the constructed index (XMR, ZEC, ZEN). Coinbase, too, dropped support for ZEC in the UK in August 2019.

In its June 2019 notice, FATF discussed how countries and cryptocurrency entities needed to comply with its recommendations to prevent misuse of cryptocurrencies in illicit activities. It remains to be seen how national regulators would react to the FATF’s recommendation and how the crypto landscape might change. Based on feedback, FATF would release a review report which would tentatively be released in June 2020.

Bonus insight: It seemed that the exchange tokens category is the black horse of 2019 that few people might have been aware of or watching closely. Not only are the top 5 exchange tokens less viewed than the top 5 privacy coins, but they are also almost five times less viewed than the top 5 smart contract platforms.

In short,Crypto markets in 2019 can be summarized as a year with two distinct halves. Coming out of the bear market in Q4 2018,

H1 saw rapid ascension of prices across most crypto assets. H2 saw a complete flip in sentiment, and most crypto assets failed to hold on to YTD gains.While the entire crypto market cap grew by $63B, most of the value increment could be attributed to BTC, while other crypto assets as a whole barely grew. Exchange tokens stood out amongst the rest, while privacy coins lagged due to increased regulatory scrutiny.

Section 4: Further Crypto Market Insights Based on CoinMarketCap Web Traffic 4.1. CoinMarketCap web traffic is highly correlated to Bitcoin volatility.As the leading cryptocurrency site for prices, users turn to CoinMarketCap whenever there is a big move in prices. We looked at the daily volatility of BTC and our web traffic data to find if such a correlation existed. The data has been summarized into weekly intervals. This is what we found:

As it turned out, the web traffic from CoinMarketCap is significantly correlated to BTC Volatility, having a correlation score of 73.28%. This trend has persisted since 2017, and we believe it should continue into 2020.

4.2. Baby-boomer crypto users are growing in proportion.For many years, it has been well-known that the crypto market has been dominated by enthusiasts and hobbyists aged 34 years and below. In 2019, we noticed that the ratio has slightly changed, with users aged 35 and above growing by 9% in proportion, with baby-boomers growing the most.

4.3. More Asian countries ranked among top user geographies.Our top 10 user geographies in 2019 are namely the US, Germany, United Kingdom, the Netherlands, Russia (previously in the 8th place), Vietnam, Turkey, Canada, India, and Australia.

Beyond that, we have seen an increasing number of users from Asian countries. For instance, China has risen from #20 to #13 in terms of top user geographies (excluding any effects of VPN usage), while Malaysia has newly entered in CoinMarketCap’s top 25 user geographies at the #23 placing.

4.4. The fourth and fifth place for most-viewed crypto asset pages changed hands quite regularly from quarter to quarterWe’ve seen some interesting movements in the top 5 spots for most viewed crypto-assets across the quarters. (And of course Bitcoin, XRP and Ethereum continue to dominate the top 3 spots).

Chainlink occupied fourth spot 4th in Q2, Q3, Q4. Tron was third spot in Q1, then fourth spot in Q2 and 5th in Q3. BitTorrent was 5th in Q1. Litecoin was 5th in Q2. Vechain came up 5th in Q4.That concludes “According to CoinMarketCap 2019”! What are your thoughts? We’d love to hear what you thought and what else you’d like to see in the next instalment of this report. From everyone at CoinMarketCap, we wish you a wonderful 2020 – Happy crypto-ing!

p.s. Interested in reaching our users? Find out more about the different ways you or your company can advertise on CoinMarketCap!

The post According to CoinMarketCap 2019 appeared first on CoinMarketCap.

origin »Bitcoin price in Telegram @btc_price_every_hour

Streamr DATAcoin (DATA) на Currencies.ru

|

|