2018-12-1 07:00 |

It’s almost the end of 2018, and here at CoinMarketCap we’re thinking of ways we can round up this tumultuous and exhilarating year. In the spirit of sharing, we’ve put together our 2018 Edition of “According to CoinMarketCap” – that phrase you see in media reports everywhere – telling you what us “mysterious folks” at CoinMarketCap really think about the market in 2018.

These slides were presented on November 28, 2018. I’ve reproduced them exactly here, with commentary (except for transition slides, which were removed to save you from confusion/boredom.)

Okay, so before we start, we are obligated to share a disclaimer that this is not investment advice! Please do your own research before investing in anything.

Now that’s done…In this presentation, we want to share some of the interesting numbers that we have access to internally, and hope that can bring you a fresh perspective of the current market at the moment…

… which, okay, doesn’t look the greatest at this point in 2018. This is the time when crypto media start writing arresting pieces about support levels and the dark days we’re in. It’s also a time when mainstream media start talking about “those crypto people” whose asset value has fallen 80% or more since the start of the year, and questioning the value of cryptocurrencies.

If we look at the total market cap for the last quarter, we’ve been mostly seeing sideways action. We even heard jokes about how Bitcoin looks like a stablecoin… until things started to go south about two weeks ago. At the time of publishing, we’re pretty close to $120 billion market cap, a low in 2018.

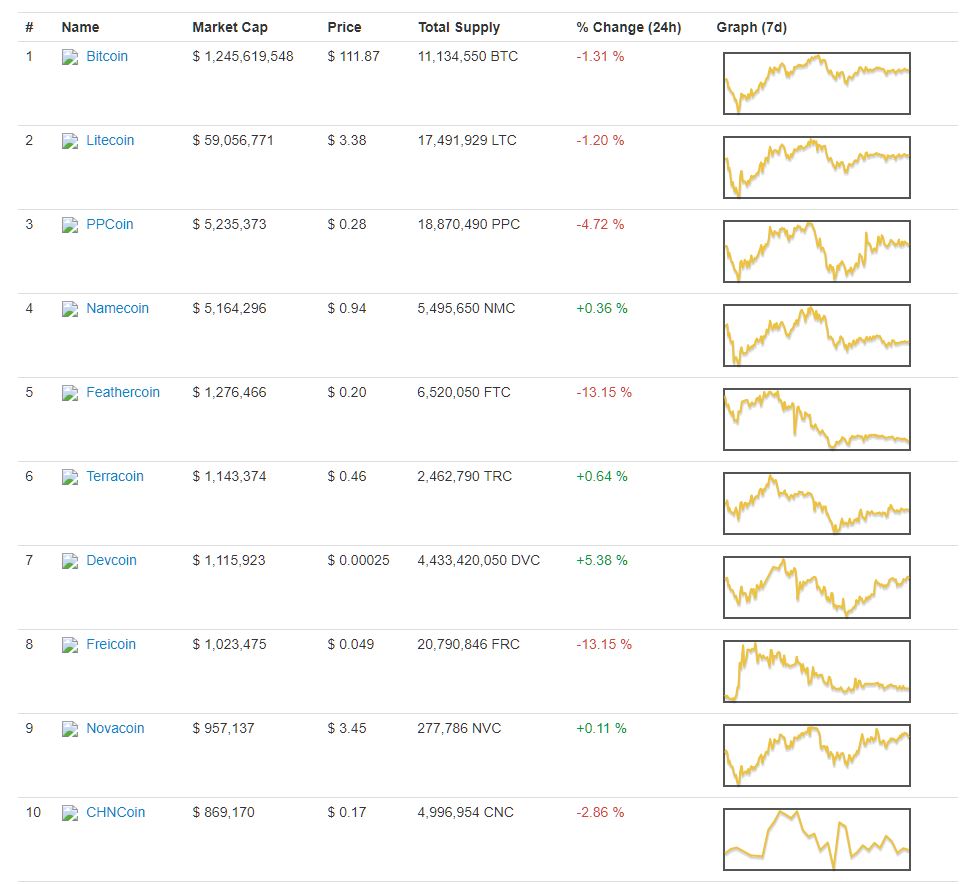

But if we look at the market from a five-year perspective, since CoinMarketCap started, that month above looks like a little blip. In the long run, we’re actually up quite a lot since 2013.

So we like to think…

It’s not all a disaster – it’s just part of a cycle. If you observe historical charts, the all-time-high reached on November 30, 2013 only occurred again on January 5, 2017. Nothing much happened in 2015 in terms of price action, and we saw the same concerns that people are feeling now. There were companies contemplating closure, lots of doubt in the market, and shade being thrown on crypto.

But if you think about it more long-term, we’ve gone through several of these cycles, having picked up real believers along the way and shedding speculators who crash out of the market. Being a nascent market, still, crypto still has this quality of epic booms and busts. (Some people call it an “accumulation game” – perhaps!)

If we look at what happened in 2018, which we’ve plotted on this chart, there have been many ups and downs as a result of news, most of which points to the market being sentiment-driven. It started with CoinMarketCap delisting Korean exchanges (Yes – we’re sorry! Gosh, guys) due to its skewing of global numbers with its “kimchi premium” that nobody outside of Korea could take advantage of…

Institutional and regulatory news, such as ETF approvals and security regulations, impacted prices; together with factors like banning of cryptocurrency ads, and famous people who hate on crypto, such as Bill Gates, who thinks crypto kills people.

Over the last five years, we’ve also seen different types of cryptocurrencies applying to be listed on CoinMarketCap. From clones to pre-mine coins (no longer in favor for the most part), to PoS to ICOs starting end 2016, and then Bitcoin forks in 2017 – there are a lot of them, try searching on CoinMarketCap – until today, when we’re seeing more security tokens requesting to be listed. We won’t presume to predict what’s next, but what we’ve seen so far is an evolving and improving set of cryptocurrencies year after year.

Speaking of listing, we only really hit a strong trajectory on crypto listings in the last year and a half or so. The steep increase in cryptocurrencies show that there are now more projects and more demand for secure representations of value than ever.

With all these in mind, we do think that there are now more reasons to believe than ever before, in the last five years that we have been in this space. And more so for those who have been around for the entirety of the last decade!

One of the encouraging signs comes from the interest that enterprises have shown towards the technology. Even though many of them are still firmly in the “blockchain not crypto” camp, and are built on proprietary technology and closed sharing (arguably, defeating some of the purpose of having a blockchain in terms of transparency), it is still a good omen that they are actively researching the use of the technology, and establishing consortia that can further these research goals.

Mainly, we think that the use cases, while still limited and not necessarily reflective of what future implementations might look like, highlight some of the possibilities for large scale rollout. From food source tracking…

… to global supply chain management…

… to the provenance of luxury, high value goods…

… and other futuristic communication among cars on a blockchain, these are all possibly good uses of the technology, that have by now sparked some new ideas among the enterprising people around us.

Of course, ICOs have brought another surge of energy into the space, fueling the imaginations of the public about the opportunities that are being presented to them through crowdfunding. People with a good idea and skills are really starting to believe that they can work on what they believe in, through the ICO mechanism.

In this chart of mainnet launches by market capitalization in 2018, we see ever more interesting ideas in the form of self-healing chains, interoperability, scalability and governance solutions, and more.

Beyond the ideas that ICOs have brought to crypto, they have also attracted funding and interest from investors – even the institutional funds, who are starting to invest in pure-play coins (like Bitcoin) to the underlying technology in either token or equity rounds. These are imperative for the continuing development of the technology and talents, even as the number of ICOs has fallen over the last quarter.

Another indication of growth that we look at internally is the “transactions per day” statistic on each blockchain. On this log scale graph, we can see that the growth in transactions has increased significantly over the last nine years on Bitcoin, and even more exponentially for the more recently-launched chains.

While the activity can be cyclical, which is to be expected as sentiments change, this just shows us that we need to focus on what matters: To increase real use and adoption of the technology, which is the main way to ensure that our vision for a decentralized future is actually brought to life.

One of those ways, then, is through the use of decentralized applications (dApps). A steady increase over the last year, we can see how front-facing and consumer-focused dApps can contribute to transaction volume and amount over time.

While many of these apps tend to be gambling dApps, it highlights the fact that gambling is still quite a natural use case when it comes to crypto (this is a factual statement – not an ethical assertion.) That’s because regular apps are still easier to play, with better user experiences and interfaces, something that dApps still have to grapple with. For example, imposing upon users think about how much gas to send for each transaction, or having to wait for more than two seconds (a long duration in regular app time) for their transactions to be confirmed, creates significant barriers and gaps in the enjoyment of dApps.

Another phenomenon we are cheered by comes in the form of physical acquisition and use of crypto. We can get crypto from ATMs around the world today. We see cafes and even pawnbrokers accepting crypto everywhere, globally.

So with large scale implementation, to global crowdfunding, increased investing interest in crypto, more transactions on chain and tangible uses of cryptocurrencies in real life, we think that we are still on the right track here.

Things are never completely rosy and perfect, and we understand that.

When we look at exchanges currently on CoinMarketCap, the total number of active exchanges we have listed over the years only barely edge out the inactive exchanges. Many of these have closed down, due to hacks, regulation, running out of cash, and so on.

The reality is that competition among exchange was, and continues to be, extremely stiff.

In fact, in just this year alone, we see that the number of new exchange requests has outstripped the new cryptocurrency requests that we receive. I was just joking about this the other day, that for each time someone proposes a “partnership opportunity” with CoinMarketCap, I can auto-respond with “Which exchange do you want me to list?” and it would be the right response 90% of the time.

With ICOs being ever harder to raise, many have turned to starting exchanges as a way to experiment and build profitability instead. While this might be a good plan for the most part, exchange economics are very tough; judging from the number of listing requests alone, just sheer competitive pressures will make it difficult to operate an exchange on a break-even basis.

That brings us to another issue, that of exchange volume. We get messages every day about this or that “scam exchange with fake volumes” and requests to take them down. Almost every exchange has been called a scam in their lifetime of existence.

This is a prevalent problem, and it’s not possible for CoinMarketCap to apply outright biases and police these exchanges about their operations or volume. What we have done this year, though, is to introduce the Adjusted Volume metric, to give our nuanced opinion about any suspicious activity that we see.

This is our view on how to be transparent: Instead of applying any black-box algorithm claiming to be “transparent” based on traffic stats or other obscure metrics, we report the exchange’s volumes straight, and we tell our users what could be potential issues with that reported number. The users can then make their own decisions about whether they like or want to use whichever exchange they choose.

This applies to crypto prices as well. Almost every day, we get people complaining about how the prices are “manipulated” and how the “volumes are clearly fake”. While it is true that prices can deviate from page views, a sign of interest in the cryptocurrencies, we do have to take into account the overall sentiment and news that might have driven the differences.

(By the way, the above chart was used as an example only – it’s the third most-viewed cryptocurrency on CoinMarketCap, after Bitcoin and Ripple, and so we picked it for illustration.)

Further, we still see scams and hacks happening weekly. Not all of them are as epic as Bitconnect or Coincheck, but even issues such as email spoofing can cause serious damage in terms of the impression of the crypto space among retail investors. Each time that a scam or hack happens, we are left worse off as a whole, inviting stronger scrutiny and sending burnt investors running away. This is something we believe we should address more strongly as an industry.

Another thing that baffles us to some extent, is the fact that people still refer to cryptocurrencies as “rivals”. In our view, if we project ourselves into a sovereign future, each crypto will serve its own purpose and will have its own fans. There is no reason to think that it is completely competitive and zero-sum, even if there may be one or two cryptocurrencies that become the most-preferred cryptocurrency.

People want to support the team they like, and that’s understandable. But dominance does change over time, and even though the Flippening hasn’t happened, the Ripplening has – in terms of page views. The number of page views for Ripple has even surpassed that of Bitcoin in the past year.

So having a more positive conversation around cryptocurrencies, and celebrating the wins, will bring more people into the space who are excited to root for the mainstream adoption and long-term wins for cryptocurrencies.

Now if you really zoom out and take a larger view of what’s happening, from our perspective…

Most people are still spending the majority of their time on the front page of CoinMarketCap. The total page views for the first and second page and all cryptocurrencies page almost rival the close to 1 million long tail pages on all of CoinMarketCap. This is something that we can work on, to encourage discovery of other up-and-coming cryptocurrencies too.

That’s not to say that things haven’t been getting better organically. The number of pages per person over time has increased, going from about 1.7 pages to almost 3 pages on average now. This trend continues to grow, even after the period of the end-2017/early-2018 bull run, where the numbers did spike as people did more ICO research then.

Overall, though, it is slightly funny (and kind of sad) that our overall site traffic is still 90.2% correlated with Bitcoin price. It used to be 95% correlated, so it has been getting better, but it often serves as a reminder to us that we should focus on the long term instead of patting ourselves on the back, or feeling down about any state of affairs.

After all, the most watchlisted coins still center around just the coins on the first page of CoinMarketCap, while there is a world of more than 2000 cryptocurrencies out there. With some of our educational initiatives, such as this blog, our newsletter, and the content we have been putting on our social channels, we hope that we can help to bring up the profiles of more cryptocurrencies and exchanges out there.

So, what time is it where you are now? According to CoinMarketCap, the most popular time to check cryptocurrency and exchange info is midweek at lunchtime. No matter where you are or which meal you’re reading this over – make sure you go to CoinMarketCap and check out a new cryptocurrency you’ve never seen before, now.

If you have any questions, get in touch! Join us on Telegram, and let’s continue the conversation there. Till the next instalment of According to CoinMarketCap, keep at it!

The post According to CoinMarketCap (2018 Edition) appeared first on CoinMarketCap.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tattoocoin (Standard Edition) (TSE) на Currencies.ru

|

|