2023-7-11 17:18 |

Key takeaways

Aave community members to vote on GHO’s deployment on Ethereum

The stablecoin has been live on the Ethereum blockchain’s Goerli testnet since February.

Aave DAO to vote on GHO’s deployment on EthereumThe Aave DAO community members are set to start voting on whether to deploy the GHO stablecoin on the Ethereum blockchain. The members will commence the vote later today.

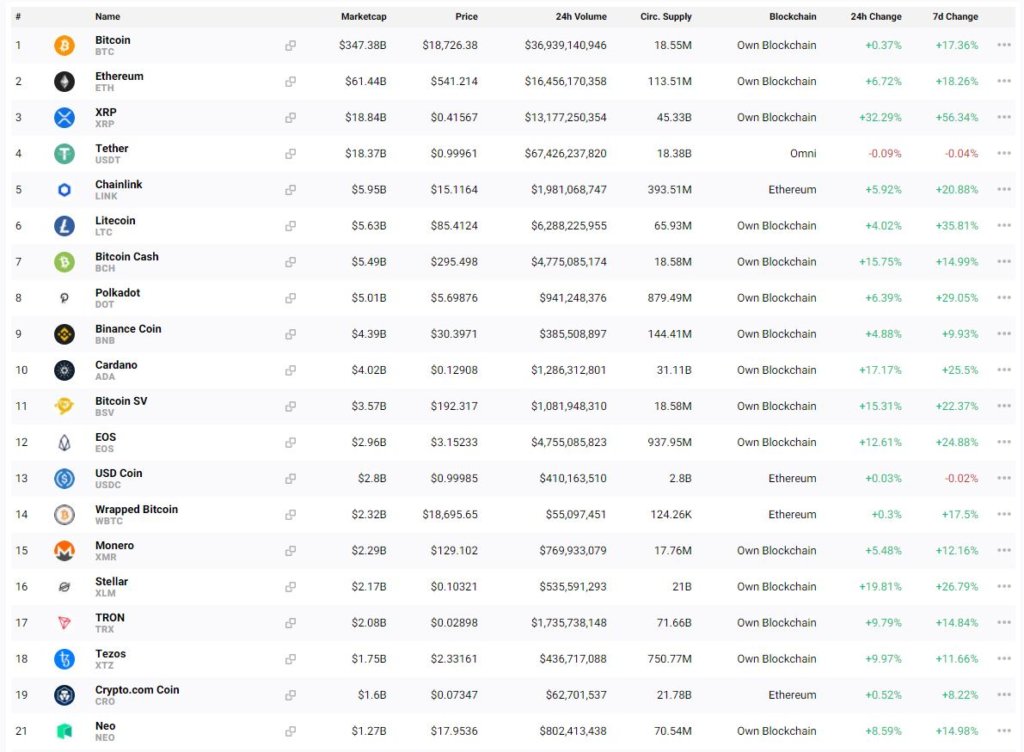

Aave is one of the leading cryptocurrency platforms in the world, allowing users to earn yields on their staked tokens. GHO is the stablecoin developed by the Aave team.

Users can mint the GHO stablecoin against a diversified set of crypto assets. According to the development team, GHO holders will continue to earn interest on the supplied collateral, similar to the other lending services on Aave.

The proposal, if approved, would introduce GHO through so-called “facilitators.” thus, making it possible for Aave version 3 (V3) to mint the stablecoin against token holdings available on the platform.

The proposal stipulates that;

“If approved, the introduction of GHO would make stablecoin borrowing on the Aave Protocol more competitive and generate additional revenue for the Aave DAO by providing to the DAO treasury 100% of the interest payments made on GHO borrows.”

GHO has been available on the Ethereum blockchain since FebruaryThis latest cryptocurrency news doesn’t come as a surprise, as the GHO stablecoin has been live on the Ethereum blockchain’s Goerli testnet since February. So far, there have been no major bugs that affected the stablecoin on the Ethereum blockchain.

AAVE, the native coin of the Aave ecosystem, is up by more than 3% in the last 24 hours. At press time, the price of AAVE stands at $72.74 per coin.

The Aave team pointed out that it would allow users to mint GHO tokens against their supplied collaterals once the stablecoin launches on the Ethereum network.

The GHO stablecoin would be backed by a wide range of cryptocurrencies chosen by users. Furthermore, borrowers would continue to earn interest on their collateral assets.

Similar to other algorithmic stablecoins, GHO would be pegged at $1. However, with GHO, users would be required to supply collateral (at a specific collateral ratio) before they can mint GHO.

In addition to that, when users repay their loans, the GHO protocol burns that user’s GHO stablecoins.

The post Aave DAO to decide on GHO Stablecoin on Ethereum appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|