2023-5-9 11:45 |

Goldman Sachs’ latest report on Family Office Investment Insights revealed that 32% of family offices are currently investing in digital assets.

The report states that family offices invest not only in cryptocurrencies but also in blockchain technology. It includes an interest in stablecoins, non-fungible tokens (NFTs), decentralized finance (DeFi), and blockchain-focused funds.

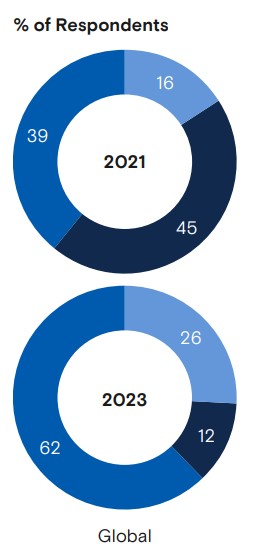

Crypto Investment Interest Wanes YoYThe report indicates that family offices are becoming more confident in investing in cryptocurrencies. The proportion of crypto investors has risen from 16% in 2021 to 26%. However, the number of family offices not invested in cryptocurrencies and showing no interest in the future has increased from 39% to 62%.

Meanwhile, those potentially interested in investing at some point in the future have fallen from 45% to 12%. Family offices have solidified their opinions on cryptocurrencies, with a larger proportion now invested in this asset class. However, there appears to be a shift towards a more polarized view. A growing number of family offices are showing no interest in investing in cryptocurrencies in the future. This trend indicates that while some investors are increasingly confident about cryptocurrencies, others remain hesitant.

Percentage of Respondents Who Are Invested in Any Form of Cryptocurrency | Goldman SachsSince major economies like the U.S., U.K., and India have imposed some degree of legislative limits, a large portion of this cynicism may stem from the absence of laws in the sector. The research emphasizes that digital assets are not FDIC insured in the U.S. This means they are not guaranteed or sponsored by any government or central bank.

Meanwhile, India has recommended a uniform framework for G20 nations to deal with cryptocurrencies. The chair’s apex bank has maintained an unfavorable position toward the asset class.

Blockchain Innovations Drive Crypto InterestAccording to the global investment data presented in the research, only 4-5% of investors include cryptocurrencies in their “other” investments. In comparison, over 30% of investors select public market equities as their primary investment choice. Both for 2021 and 2023, the average asset allocation of respondents from throughout the world comprises investments in cash and cash equivalents and fixed income.

It’s interesting to note that 35% of respondents said they would cut back on their allocation to cash and cash equivalents during the coming year. In addition to highlighting new disruptive technologies like artificial intelligence, machine learning, and digital assets, the research also emphasizes a growing interest in digital consumption due to a change in consumer behavior. This pattern suggests that investors are more interested in creative investment possibilities for portfolio diversification and increasing returns.

Primary Motivations for Investing in Digital Assets | Goldman SachsMeanwhile, the report’s findings indicate that family offices are closely monitoring the developments within the digital-asset sector. Most family offices (19%) are reportedly optimistic about the future of blockchain technology. Of the family offices invested in digital assets, 9% view crypto investments as a means of diversifying their investment portfolios, while 8% see them as a store of value.

The post 32% of Family Offices Invest in Crypto and Digital Assets: Goldman Sachs Study appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Local Family Owned (LFO) на Currencies.ru

|

|