2022-8-11 20:16 |

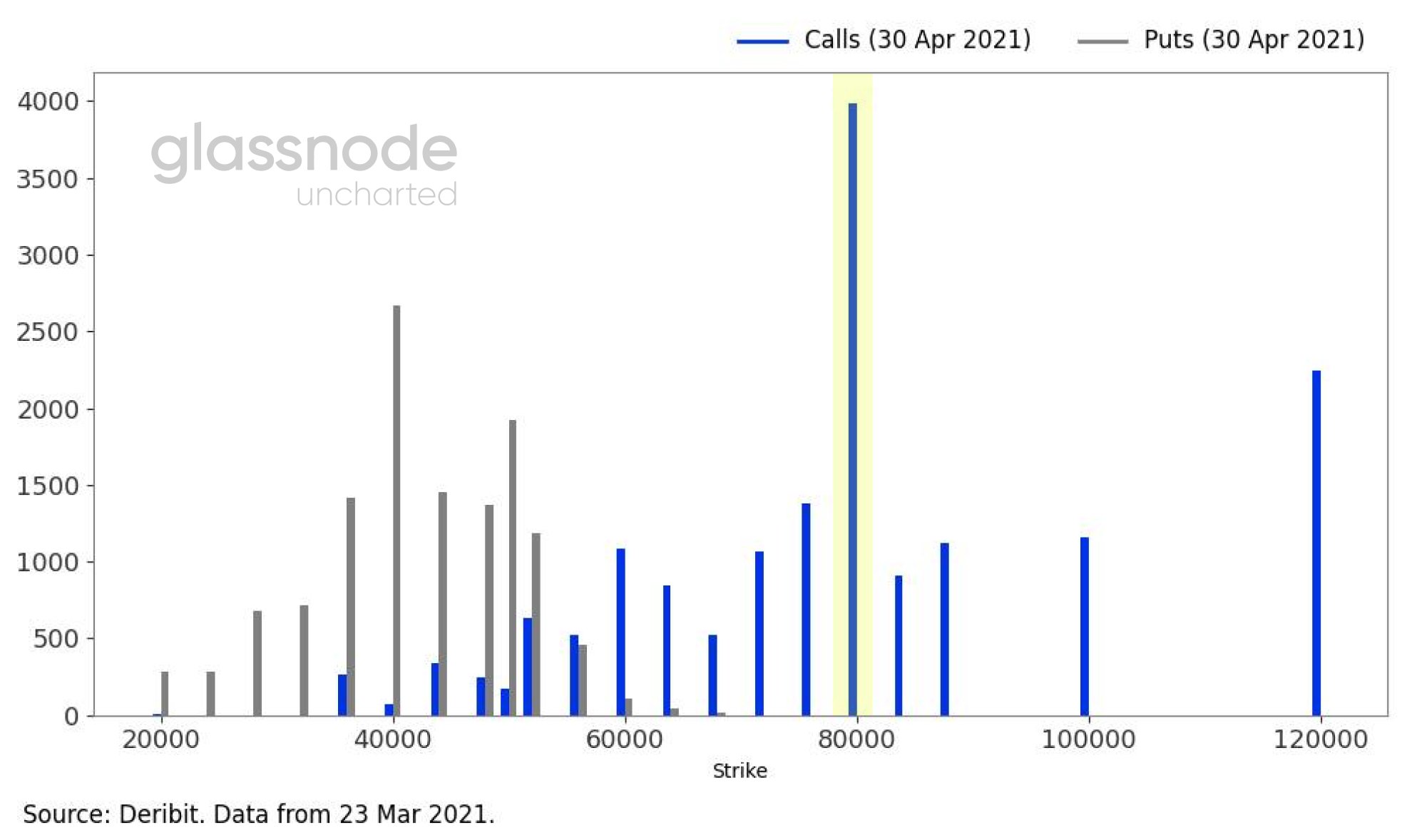

Derivatives data show a clear path to $29,000, but inflation and unemployment data will continue to be crucial to determining BTC price rallies. origin »

Bitcoin price in Telegram @btc_price_every_hour

Streamr DATAcoin (DATA) на Currencies.ru

|

|