2021-5-11 13:00 |

Over $1.74 billion worth of cryptocurrencies were ‘liquidated’ yesterday as the market saw a deep pullback, data from multiple sources shows.

Interestingly, the dump came right after pet coins like Shiba Inu (SHIB), Hokkaido Inu (HOKK), Akita Inu (AKITA), and others pumped by several hundred percent in a single week.

Liquidations, liquidationsAs per markets tool Bybt, over 246,000 traders were liquidated in the past day with the single largest single liquidation order occurring on crypto exchange Huobi—a Polkadot (DOT) value to the tune of $8.51 million.

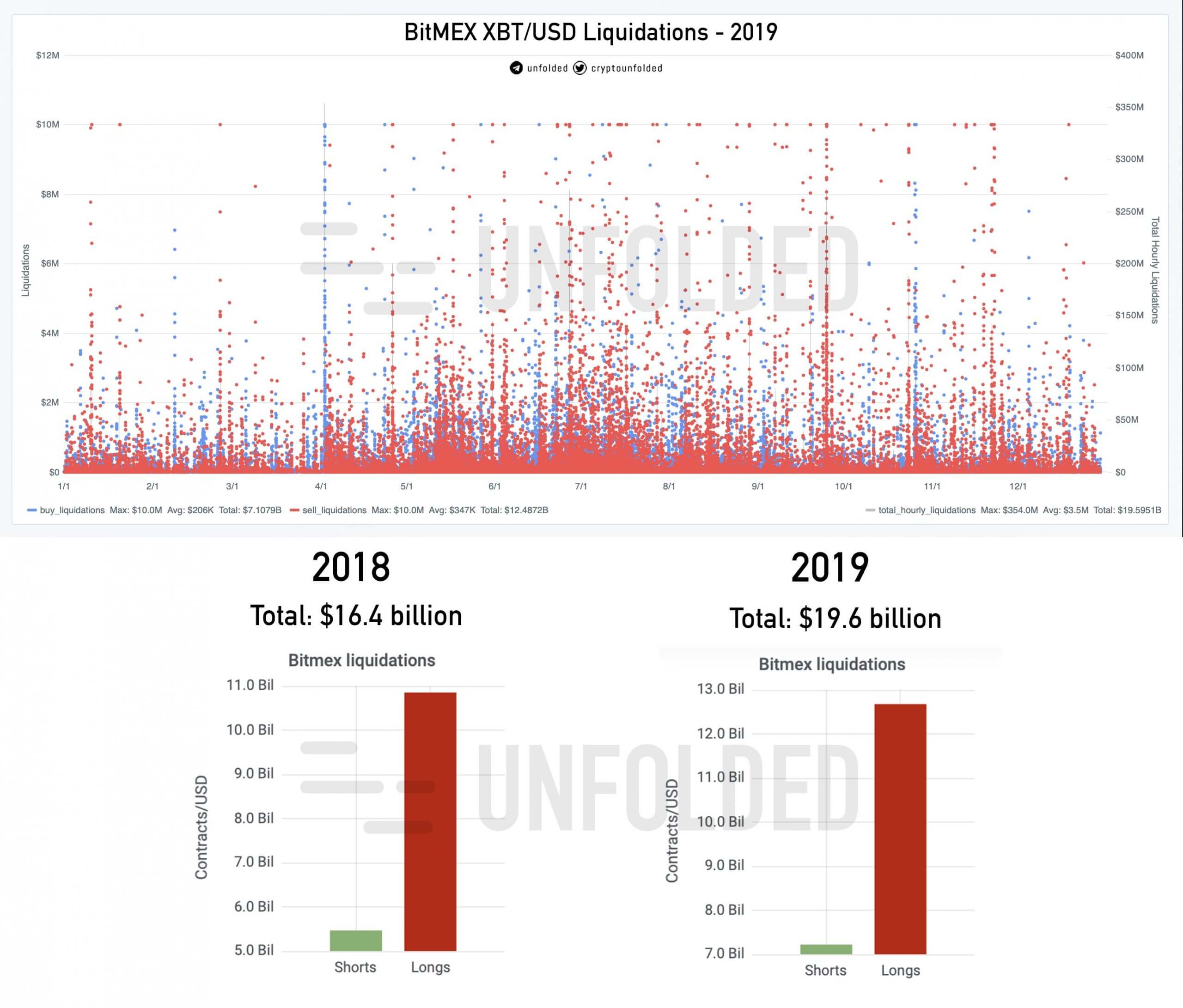

Polkadot fell to as low as $32 on Huobi. Image: DOT/USD via TradingView.‘Liquidations’ occur when traders borrow excess capital from brokerages/exchanges (i.e., ‘margin’ or trading futures) to place bigger bets on the assets they trade. They pay a fixed fee for doing so, while exchanges close out these positions at a predetermined price—when the trader’s collateral is equal to the loss on that position. Such a trade is then said to be liquidated.

Last weekend, traders likely borrowed in excess of what their books would have allowed and contributed to what became an overleveraged market. Yesterday, when prices dropped, the liquidation levels of other traders had likely triggered, leading to a cascading effect.

Inside the frenzyOf the $1.74 billion, $1.3 billion came from ‘long’ positions (those betting on higher prices), while the remaining came from ‘shorts’ (those betting on lower prices; they were likely liquidated due to higher leverage even as price moved downward).

Over $439.87 million worth of Bitcoin (BTC) trades were liquidated, a similar amount in Ethereum (ETH) was liquidated, $137.36 million in XRP was liquidated, $95.49 million of Dogecoin (DOGE) was liquidated, and $71.23 million in EOS was liquidated.

Image: BybtOf all exchanges, Huobi saw the largest chunk of liquidations with $453 million, followed by Bybit and Binance at $298 million and $263 million respectively.

Meanwhile, the market even saw $40.19 million worth of SHIB trades—whose futures launched just yesterday on FTX and Binance—get liquidated.

Other petcoins like HOKK, AKITA, HUSKY, and BDOG fell by several percent in the hours after they pumped, likely by traders taking profits on the meme tokens.

The post $1.7 billion liquidated as crypto markets dumps after ‘petcoin’ frenzy appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|