2024-11-27 17:02 |

As United States Securities and Exchange Commission (SEC) Chairman Gary Gensler prepares to depart the Commission, spot XRP exchange-traded funds (ETFs) applications are piling up.

New York-based asset manager Wisdom Tree, managing roughly $113 billion in assets under management, has become the latest to file for a U.S.-listed XPP ETF.

WisdomTree Joins Race To Launch A Spot XRP ETFWisdomTree has filed with the State of Delaware to establish a trust entity for a proposed spot XRP ETF.

The Nov. 25 filing signals WisdomTree’s broader intent to file with the U.S. Securities and Exchange Commission.

Other companies, including Bitwise, Canary Capital, and 21Shares, have all filed with the SEC to release an ETF that tracks the price of XRP. The SEC approved spot Bitcoin and Ether ETFs in 2024 but has not responded to XRP applications as of press time.

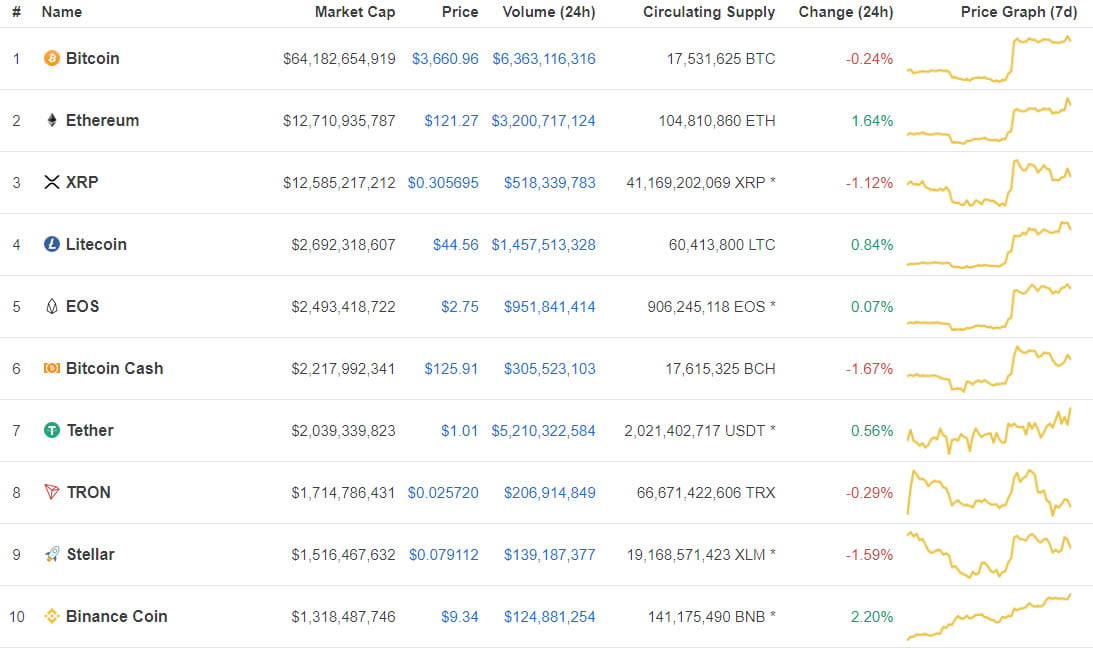

Impending U.S. Regulatory Landscape ShakeupThe spot XRP ETF filings come at a pivotal moment for the sixth-largest cryptocurrency.

San Francisco-based Ripple, the company behind XRP, scored a major victory in a four-year-long legal dispute against an SEC lawsuit when a judge ruled in July 2023 that XRP was not a security. On Oct. 17, the SEC lodged its formal appeal regarding certain aspects of the ruling, with Ripple filing its cross-appeal shortly after.

With SEC’s Gensler due to resign in January, some industry observers believe the formidable regulator will be friendlier towards the digital asset industry following his exit. Moreover, Trump may ultimately establish a regulatory regime keen on ending the protracted lawsuits against firms like Ripple. If this happens, it would likely pave the way for an XRP ETF sooner rather than later.

As of press time, XRP is trading for $1.35, according to CoinGecko data, a 24-hour drop of over 6.5%. The coin recently jumped to a new 3-year high of $1.60. However, XRP is still 57% down from its January 2018 lifetime high of 3.40.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|