2020-8-4 16:00 |

DeFi is currently the best place in crypto to make a quick buck. However, profitable yield farmers would tell you that it’s a multi-step process, laying through dozens of transactions. And though Uncle Sam hasn’t yet wrapped his head around the latest harvest, you can be sure he still wants his cut.

Crypto Taxation Still a HeadacheDepending on circumstances, cryptocurrencies are either treated as property or as income. When you sell or exchange crypto, you report capital gains/losses similar to selling stocks or property. When you lend out your crypto, the interest accrued is taxed as income.

Capital gains can be short-term or long-term. In the case with DeFi, your profits fall into the short-term category, which means that you will be holding assets for less than 12 months. Short-term capital gains are taxed according to your tax bracket. It’s also important to report losses so that you can get a tax deduction.

2020 Tax brackets. Source: Debt.orgThe interest you earn by lending your crypto via DeFi protocols is taxed like salary and wages.

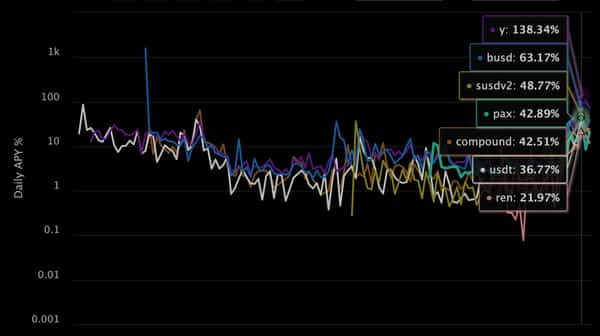

For instance, Compound cTokens accrue interest by becoming more expensive, so the interest is received when converting cTokens back to other assets. Hence, interest rates on cTokens are taxed as capital gains rather than as income.

The major complication, of course, is reporting the USD value of each transaction you make within the DeFi ecosystem. For active yield farmers, this can become incredibly tedious.

Many transactions on Uniswap, for instance, involve multi-step conversion, and every step should be reported in USD. Finally, if you end up lending your crypto along the way and the interest is paid each block, you will need to report each instance of receiving interest.

Unfortunately, even well-established centralized crypto exchanges like Coinbase and Binance don’t provide customers with accurately compiled 1099-B forms that outline gains and losses. Here third-party tools come into play.

Yield Farmers Rejoice, Automation Saves the DayBlockchain and smart contract technology reduces much of the labor needed when it comes to documenting taxable events.

Though most of the automated solutions are focused on centralized exchanges, TokenTax is stepping into the DeFi ecosystem.

We are pleased to announce we are fully integrated with @1inchExchange!!!

Just enter your ETH address and your full trade history will be imported into your account. pic.twitter.com/ZMyeMCrYpe

— TokenTax (@TokenTax) August 3, 2020

TokenTax offers tools for tracking activity on major DeFi platforms like Uniswap, 1inch, and Compound. Using these tools, you can download your DeFi history in CSV format using just your wallet address.

Besides TokenTax, there is also CryptoTrader.Tax, a company focused on compiling crypto tax reports. While it’s mostly focused on centralized crypto exchanges, it supports imports from IDEX and Exodus.

If the DeFi craze continues, the range of tax reporting tools is likely to widen as well. Putting these tools to good use as they emerge also means avoiding a letter from the IRS and keeping your yield farm in the green.

origin »Defi (DEFI) на Currencies.ru

|

|