2018-8-8 05:00 |

Technically, XRP prices are breaking off the 40 day horizontal consolidation and retesting the lower limit of our 5 cent trading zone at 40 cents. Because of this and the way our XRP trade plan dictates, we suggest selling at every pull back with first targets at 30 cents and later 15 cents—our ultimate level.

We also remain cognizant that any high volume spike in prices above 45 cents cancels this projection and snaps XRP back into a range trade.

From the News As reiterated time and time again, trading with XRP is definitely cheap and convenient especially for companies who adopt xRapid and use XRP for their cross border transactions. Not only will they benefit from speed and convenience as payment settle within seconds but the mere fact there is cost cutting element is irresistible. It’s along the same lines that Mike Arrington said transacting using XRP is simple “fantastic” founding their decision to base Arrington XRP Capital, a hedge fund in XRP. In a recent interview the TechCrunch founder said they moved $50 million and paid 30 cents for a transaction which concluded in less than three seconds. It might sound like a FUD but keen XRP observers have noted a bear whale who have been unloading 1.08 XRPs from Q1 2018. Coincidentally though, XRP by the millions often change hands when there is a price spike. Could this precipitate further XRP losses or are these exchanges moving XRP to and from their accounts? XRP centric, SBI Holdings who are also the owners of VC Trade have invested in a 12 percent stake-equivalent to $9 million- at Clear Markets-a US trading firm. Clear Markets has offices around major metropolises around the world like Tokyo, New York and London. Reliable sources say the objective of this acquisition would pave way for SBI Holdings to create a derivatives market around the prices of Bitcoin and most probably XRP-though this is not yet official.#Japanese #financial services giant #SBI Holdings will expand its #crypto business portfolio by acquiring a 12% stake in Clear Markets, according to SBI’s financial results report published July 31. SBI is scheduled to acquire up to 20% in the future.

— bitofjapan (@bit_of_Japan) August 2, 2018

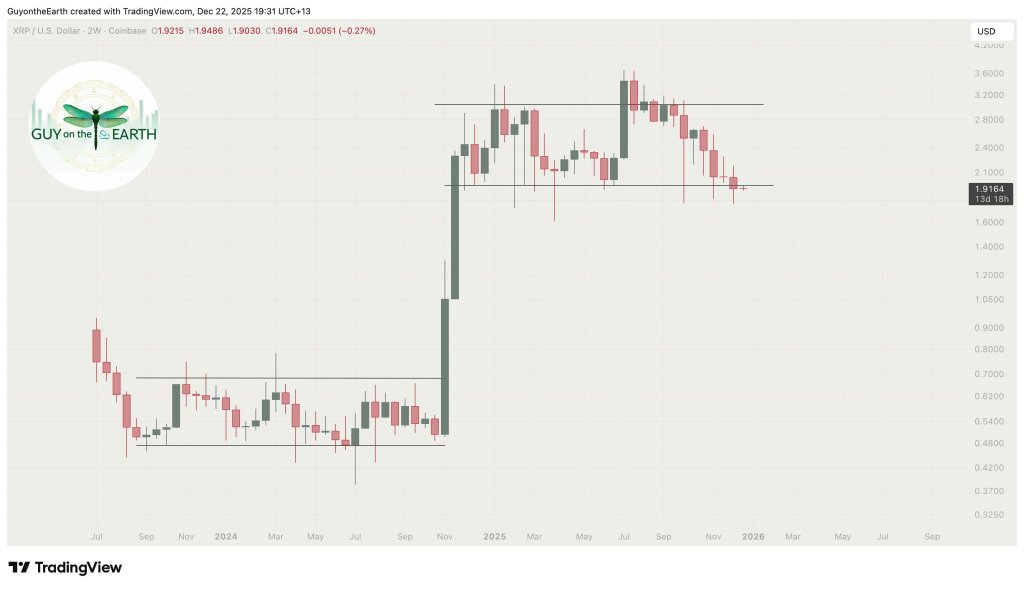

XRP Technical Analysis Weekly ChartXRP Weekly chart by Trading View

A single non-technical glance at the weekly chart hints of lower lows. Why not, XRP is still correcting trickling down for the seventh consecutive month shedding over 80 percent from their ATHs.

Besides, when we refer to previous XRP technical analysis and trade plan, we can easily see that we have a whole XRP bear candlestick printing below 45 cents following last week’s six percent losses.

Retweet if you know what happens when we reach the corner of this triangle! Hint hint.. It has horns… #XRP #XRPthebase #XRPtheHedge #BTC #ETH #LTC #Crypto #Fintech pic.twitter.com/Ljl7aBtdWR

— Willy Wonka (@WillyWonkaXRP) August 5, 2018

Now, considering the way technical formations are arranged, we might see a confirmation of last week sellers. In that case, any close below the lower limit of our support zone at 40 cents will automatically trigger sell in line with our XRP trade plan.

When that pans out, then we shall trade according to our well laid out XRP trade strategy, unloading on every high with first targets below 20 cents.

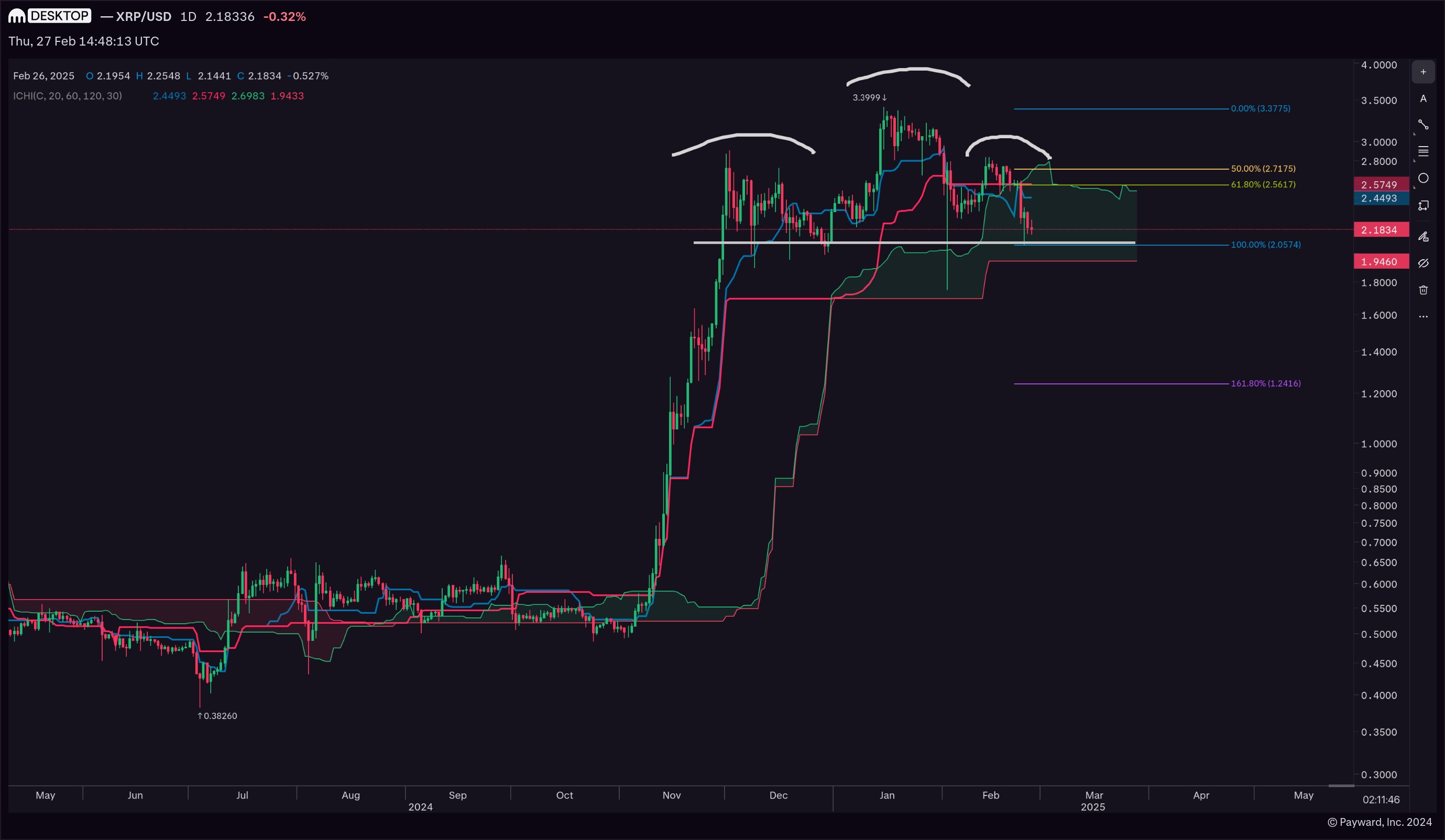

Daily ChartXRP Daily Chart by Trading View

Overly, the altcoins market has to contend with sell pressure. With every lower lows, the path of least resistance is definitely on the down side.

Thus far, XRP is down four percent in the last day following the precedence set by Aug 6 bear candlestick which saw prices conclusively closing below the trade range and 45 cents.

In any case, I recommend selling on every high with stops at Aug 6 highs at 45 cents and targets as aforementioned above.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post XRP Technical Analysis: XRP Here To Stay Regardless of Price appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) íà Currencies.ru

|

|