2020-8-11 19:44 |

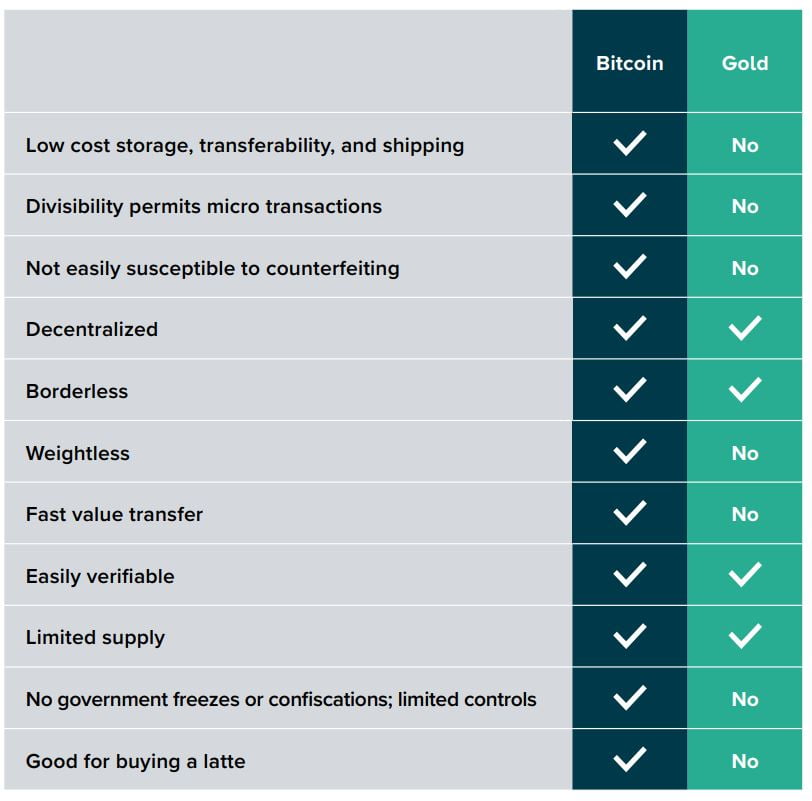

When viewed from a traditional investing lens, bitcoin may seem like a risky bet. The technology is still relatively new, the price is notoriously volatile and it’s not uncommon to hear investors caution newcomers not to invest more than they can afford to lose in BTC.

But the performance of Off The Chain Capital, a digital currency investment firm that focuses on value investing in bitcoin, tells a different story. As one of the best-performing funds in the space, it has shown that reliable performance and BTC can go hand in hand.

“We’re trying to buy dollars-worth of bitcoin with 50 cents,” explained Brian Estes, the managing member and chief investment officer for Off The Chain. “We’re the only value manager in the space that we know of. Everyone is trying to do venture capital investing, and we’re using a Warren Buffet style for finding deeply discounted investment opportunities.”

With over $30 million worth of assets under management, the fund has reached number one blockchain fund rankings from financial services companies Vision Hill Group and Hedge Fund Research, Inc., according to Estes. The fund does not use leverage, is long only and has very little turnover. It also maintains a particularly bullish outlook on BTC in the near future — it utilizes four models to determine the future price of bitcoin and all four indicate that it could be over $100,000 by the end of 2021.

According to a performance report shared with Bitcoin Magazine, Off The Chain Capital was up 29 percent in July 2020, marking a 101 percent increase across the year to date. Over the last three years, Off The Chain reported returns that far outpaced both the S&P 500 Index and the price of bitcoin itself. Its dollar-weighted (actual) returns for investors in this period was more than five times that of bitcoin and 27 times the S&P 500.

But what may be most remarkable about this performance is the fact that the fund is proving a value narrative for bitcoin, demonstrating that there is a conservative, successful investing approach to be taken with the original cryptocurrency.

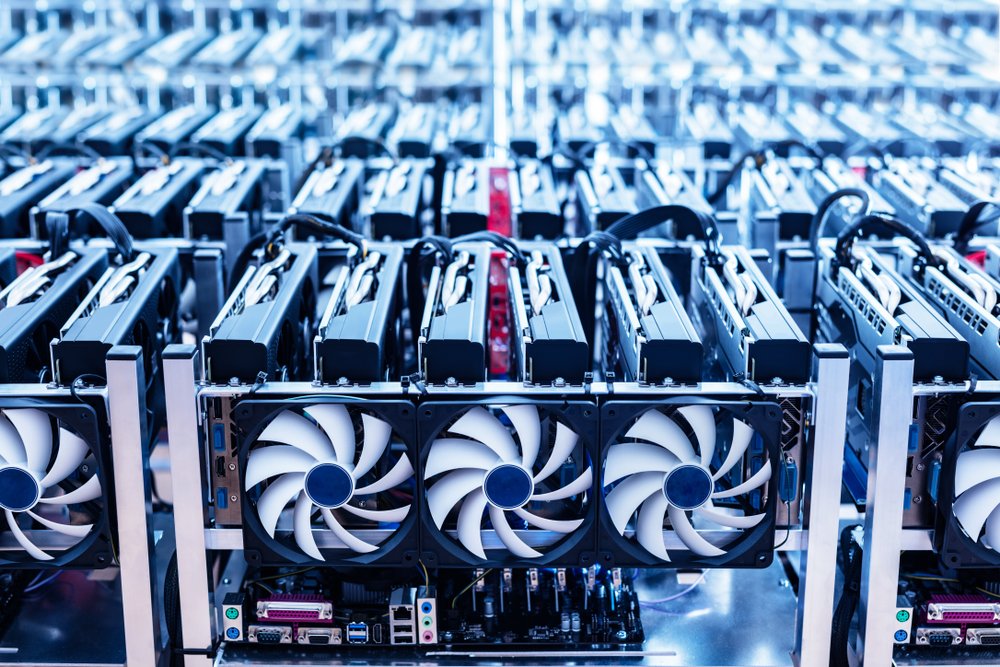

For instance, Estes said that Off The Chain is the world’s largest buyer of Mt. Gox bankruptcy claims, which yields up to 90 percent discounts on bitcoin for the fund. It also enters hash rate contracts with miners that yield 40 percent discounts on BTC.

“Because Off The Chain uses a Graham/Dodd, Warren Buffett value style, the fund captures all of the upside and provides a cushion when the markets decline,” Estes explained. “This value style of investing gives investors a margin of safety in the portfolio.”

This narrative-shifting progress could go a long way in bringing the mission of Bitcoin to a wider audience. Many people first discover bitcoin as an investment asset, but a good portion of those people may be turned off by its relatively volatile performance up to this point. Off The Chain Capital could be shifting that perspective.

“In order for Bitcoin to go mainstream, we have to find ways to bridge the crypto world with the rest of the world,” said Perianne Boring, president of the Chamber of Digital Commerce and fellow at Georgetown University Center for Financial Markets and Policy. “The value approach to investing in crypto assets merges a traditional investment thesis with this new asset class.”

As the fund continues to tell a new story for Bitcoin investing, it may usher in more traditional interest and approaches from the rest of the world as well.

Off The Chain will be closed to new investors beginning October 1, 2020. The current minimum investment is $1 million. For more information, visit offthechain.capital.

The post With Value Approach, Off The Chain Capital Is Changing The Bitcoin Investment Narrative appeared first on Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|