2023-4-14 07:53 |

Large numbers of Ethereum and Bitcoin options contracts are set to expire, but will markets react this time?

Derivatives traders have been favoring Ethereum options over Bitcoin options recently. As a result, around 260,500 ETH options contracts are about to expire.

The number of Bitcoin options due to expire is a fraction at just 30,500 contracts. Furthermore, there is often market volatility when options and futures expire. Crypto markets have been rallying recently and are likely due for a correction.

Bitcoin options are derivatives contracts that allow traders to speculate on the price of BTC. They allow speculators to buy or sell Bitcoin at a specific price, the strike price, at a certain date of expiry. Additionally, they are more flexible than futures which have fixed expiry dates.

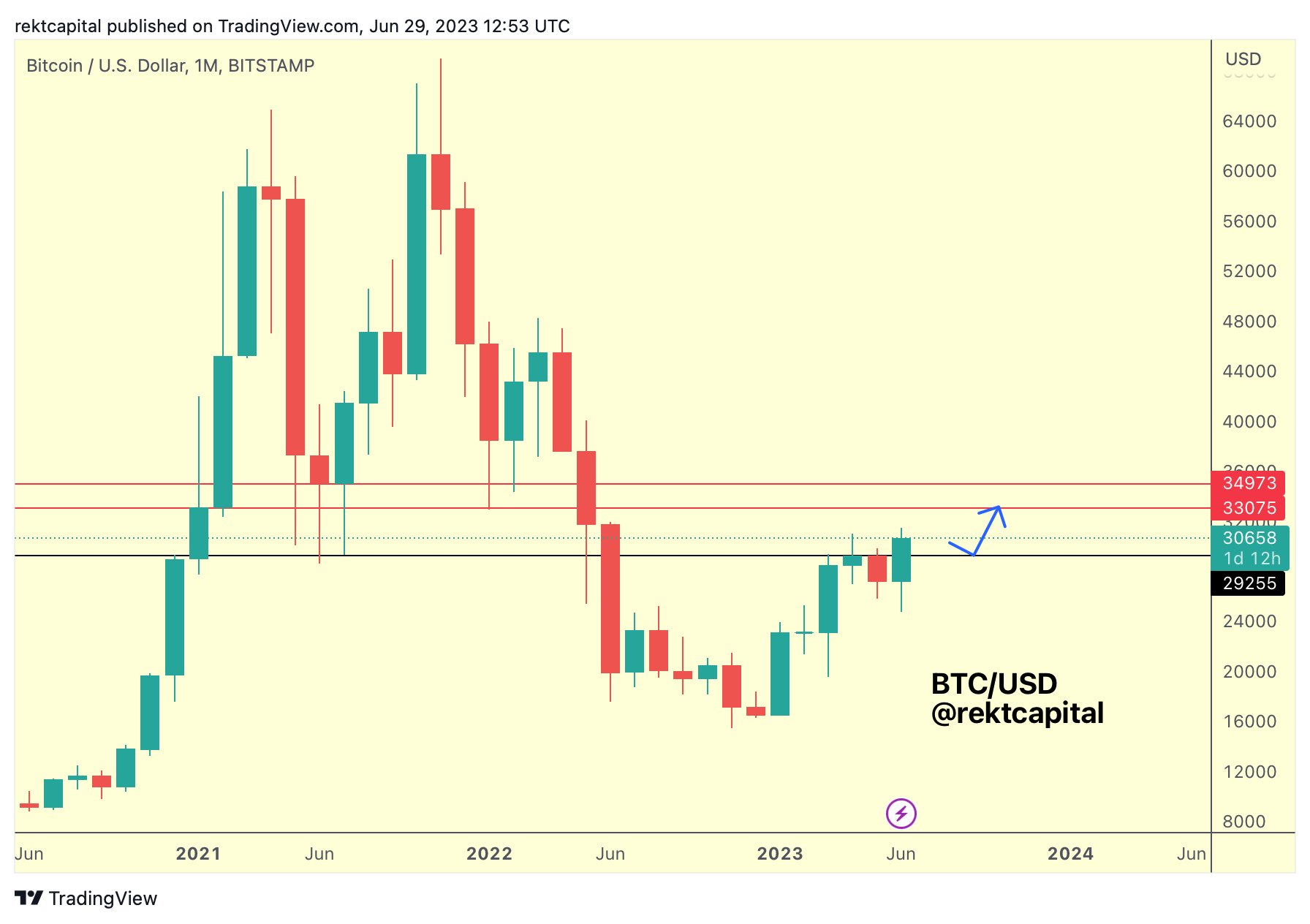

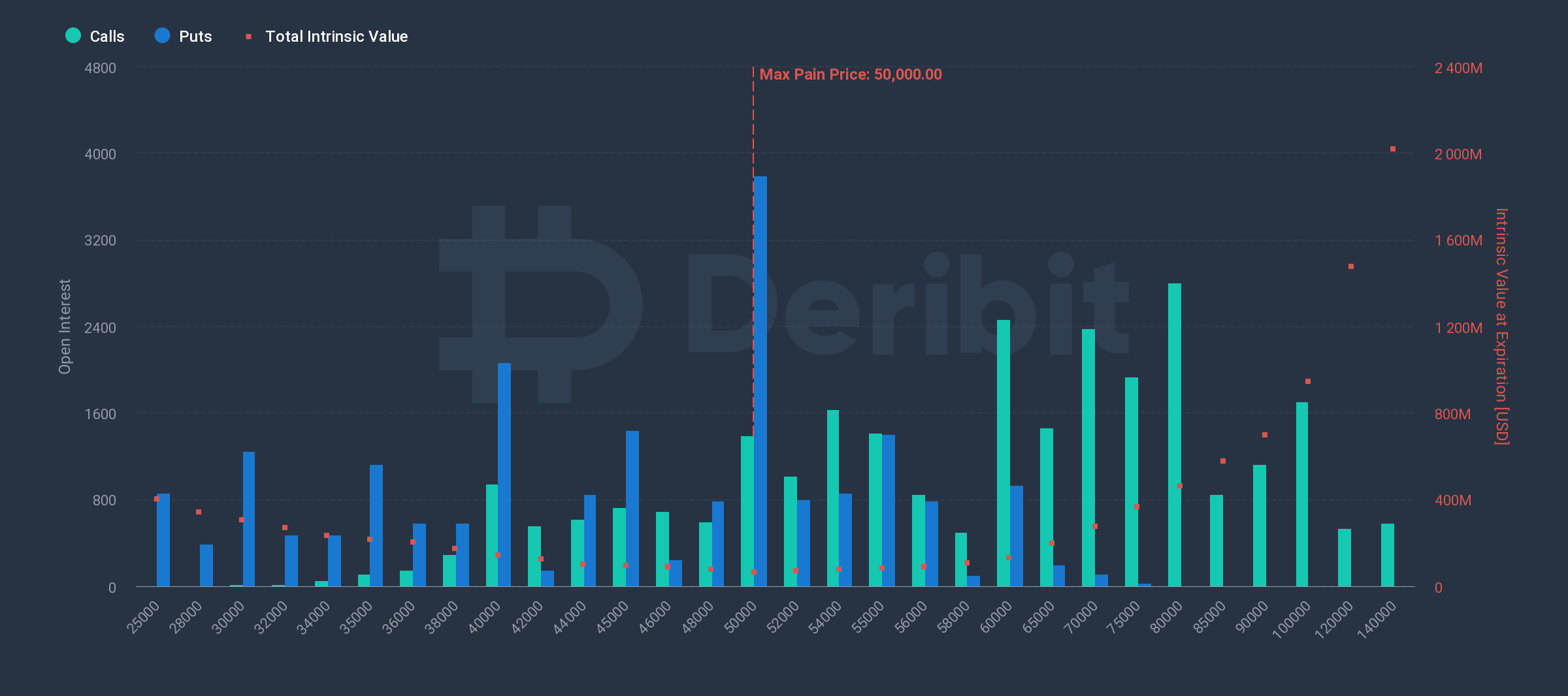

Bitcoin Options NeutralAccording to Greeks.live, there is a put/call ratio of 0.99 on the Bitcoin options. Furthermore, the max pain price is $29,000, and they have a notional value of $0.93 billion.

The put/call ratio is calculated by dividing the number of traded put (short) contracts by the number of call (long) contracts. A value below 1 is bullish as more traders are buying long contracts than shorts. The current ratio is pretty evenly matched between bulls and bears.

The max pain price refers to the strike price with the most open contracts. Furthermore, it is the price at which the asset would cause financial losses for the largest number of contract holders at expiration.

Bitcoin Options Open Interest – Twitter/@GreeksLiveThe put/call ratio for the Ethereum options is 0.83, and the max pain price is $1,850 with a notional value of $5.5 billion. This suggests a slightly more bullish outlook for Ethereum derivatives traders.

Ethereum has surged today following the successful Shapella upgrade on April 12. ETH is up 10.3% on the day, tapping an eleven-month high of $2,114 at the time of writing.

Crypto Market OutlookCrypto market capitalization is at its highest level since May 2022. As a result, the figure has reached $1.33 trillion, according to CoinGecko.

BTC has not been in the driving seat this time, as it has only managed a 2% rise on the day. The asset was trading at $30,773 at the time of writing.

BTC/USD 24 hours – BeInCryptoThe neutral options ratios suggest that there will not be a massive impact on markets when they expire. However, the eleven-month market high may be due for a correction soon.

The post Will The Upcoming Bitcoin Options Expiry Quash the Crypto Rally? appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|