2023-4-18 19:30 |

Ethereum (ETH) price has failed to breach the $2,200 resistance since the completion of the Shapella Upgrade. On-chain metrics are flashing red signals as stakers remain positioned for sell-action. Will ETH lose its current support level?

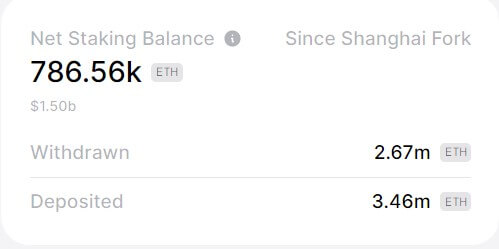

After a positive initial reaction to the completion of the Proof of Stake transition, the second-largest cryptocurrency by market cap is now facing an uncertain short-term future. Prominent data analytics firm, IntoTheBlock highlighted a surge in the volume of Large ETH transfers in the aftermath of the Shapella upgrade. As ETH 2.0 stakers began to look for alternative routes to deploy their newly-withdrawn holdings, could this impact Ethereum price negatively?

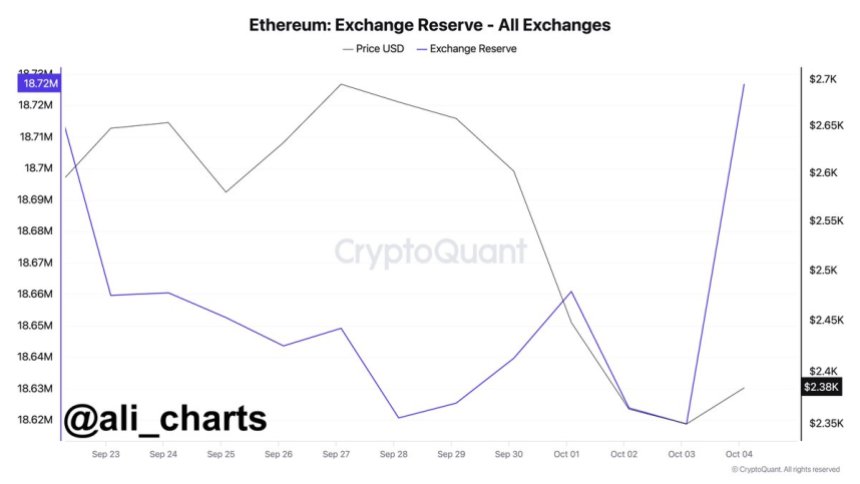

Ethereum Stakers Are Loading Up Their WagonsAccording to Glassnode, the supply of coins deposited on exchanges has increased by 100,000 ETH in the past week. Typically, this means investors looking to sell can now do so more quickly and easily.

The chart below shows how ETH Balance on Exchanges increased from 18.09 million to 18.20 million coins between April 13 and April 17.

Ethereum (ETH) Price vs. Balance on Exchanges. April 2023, Source: GlassnodeWhen more coins are held on exchanges, they are often more readily available for trading. And with more ETH 2.0 stakers withdrawing their coins, they could soon pile on selling pressure and trigger a potential price correction in the coming days.

Furthermore, an analysis of select exchanges’ aggregate order books shows that the number of ETH up for sale currently outweighs demand around the current prices.

According to the data aggregated by IntoTheBlock, around the +/-30% price boundaries, there are open sell-orders for 6 million ETH. But currently, buyers have only placed orders for 5.2 million ETH.

Ethereum (ETH) Agg. Exchange Order Books Price Distribution. April 2023. Source: IntoTheBlockWhen exchange order books have more sell order volumes than buy orders, it generally means more supply than demand for the asset being traded. This could force a price downsizing as sellers may have to lower their prices to attract buyers.

In summary, the influx of ETH coins on exchanges, potential selling pressure piled on by newly unstaked coins, and lopsided exchange order books could all combine to trigger an ethereum price correction.

ETH Price Prediction: Ethereum Bulls Could Offer Support Around $1,850The In/Out of Money, further indicates the Ethereum price is likely to retrace toward $1,980. However, the 972,000 addresses that bought 1.36 million at an average price of $1,980 could offer support.

If the slump continues, ETH could slide further toward $1,850. But here, there’s a more significant support line of 1.42 million addresses and 5.77 million coins.

Ethereum (ETH) In/Out of Money Price distribution. April 2023. Source: IntoTheBlockStill, the bulls invalidate the bearish outlook if ETH surges above the $2,100 resistance zone. But, the 632,000 addresses holding nearly 20 million ETH currently pose a strong challenge.

If the bulls can push past that level, the Ethereum price could reach $2,400 before hitting another considerable resistance of 600 addresses with 500,000 coins.

The post Will the Ethereum (ETH) Price Hold up Amidst Staker Sell-off Concerns? appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

Ethereum (ETH) на Currencies.ru

|

|