2024-8-23 06:00 |

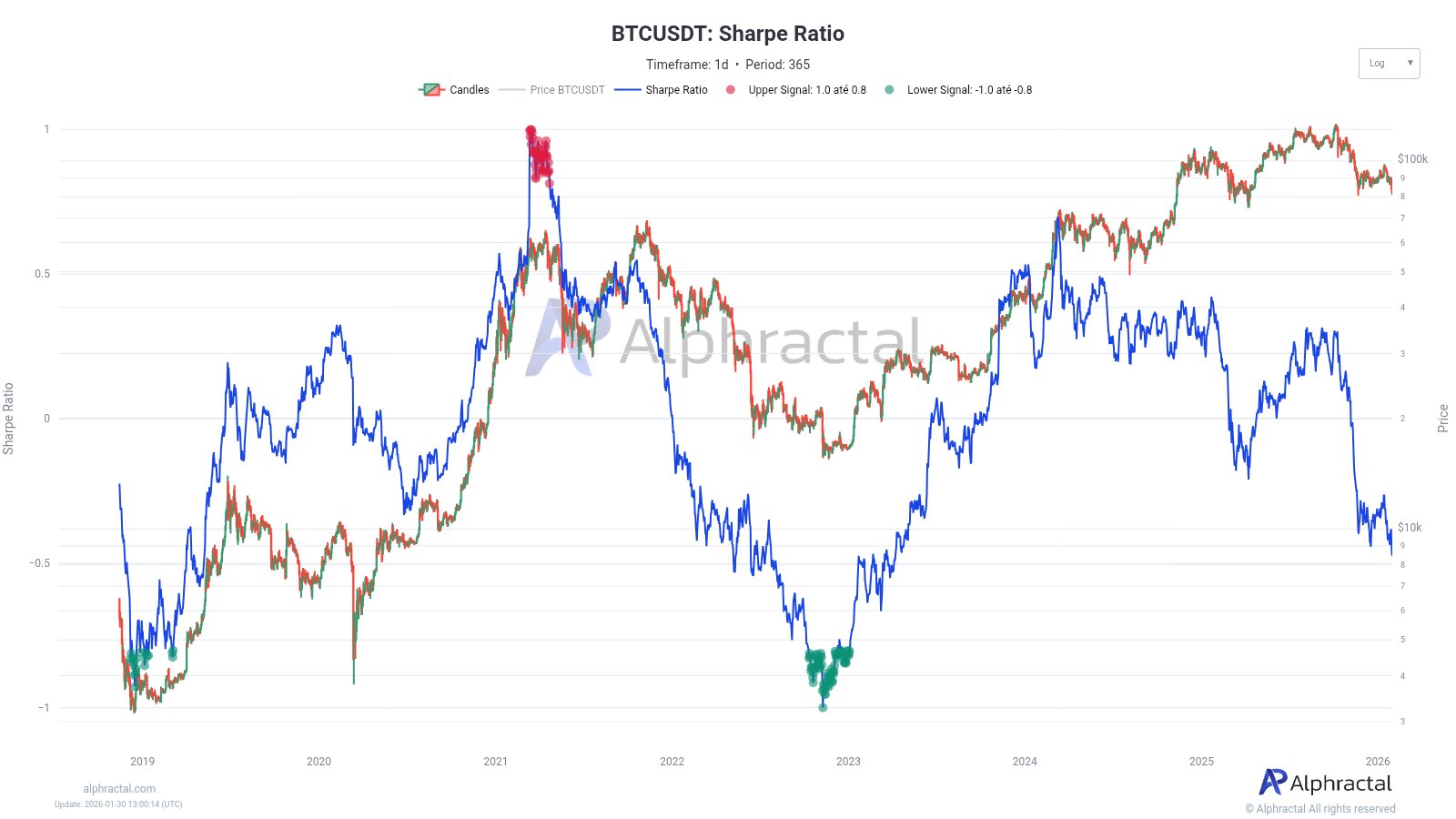

With each month, the Bitcoin performance can vary widely depending on how investors are feeling toward the market. Years of monthly return data available for the cryptocurrency have led to investors and analysts trying to pinpoint the cryptocurrency’s next move based on historical performance. As the month of August draws to a close, Bitcoin investors are already looking toward September in hopes that the new month will come with better tidings.

Bitcoin Looks To End August On A Negative NoteDespite starting out on a high note, the Bitcoin price saw multiple crashes in August as the month drew out further. The first week of the month came with a 30% crash for the BTC price, which translated to a market-wide crash that saw altcoins suffer particularly.

Since then, there has been a recovery in the Bitcoin price but it is far from its starting point. This price decline means that the month of August has followed the trend of the last two years, coming out in the red. So far, according to data from Coinglass, the Bitcoin price price is down 6.03% in the month of August, at the time of writing.

The performance this month is not exactly out of the ordinary as the Bitcoin price has had more red months than green months since its inception. The data begins in 2013, and it provides 12 years of monthly returns since then. Out of those 12 years, the BTC price has closed in green in 8 different years, leaving only four green August closes for the cryptocurrency.

So far, the only times the digital asset has closed the month of August in the green looks to be during bull markets. This is seen in 2017 with a 65.32% increase, as well as 2020 and 2021 with positive returns of 2.83% and 13.8%, respectively.

Will September Be Better?Historically, the month of September has been even worse for the Bitcoin price compared to August. In 11 years, there have been 8 months of negative returns compared to 3 months of positive returns. This has brought the average monthly return for September to -4.78%.

With August performing so poorly, expectations are that the month of September could go in the opposite direction. However, not everyone agrees with this point of view. Crypto analyst @btc_charlie on X (formerly Twitter) has warned that September may not go as planned.

He points out that the same people who are saying that prices will go up are the same people who missed the Bitcoin bottom and top. Instead, he directs investors to look at the average monthly returns for September, which are negative, when making their decisions.

origin »Bitcoin price in Telegram @btc_price_every_hour

Streamr DATAcoin (DATA) на Currencies.ru

|

|