2024-6-13 03:00 |

Glassnode has discussed in a new report the reasons behind Bitcoin moving sideways despite inflows into the spot exchange-traded funds (ETFs).

Why Bitcoin Has Been Stagnant Despite Spot ETF InflowsIn its latest weekly report, the analytics firm Glassnode has talked about how the impressive inflows into the US spot ETFs have failed to make the price break its sideways trend.

The spot ETFs, which the US Securities and Exchange Commission (SEC) approved in January of this year, have provided investors with an alternate means of gaining exposure to the cryptocurrency.

These funds buy and hold Bitcoin on behalf of their users, letting them get indirect exposure to the coin’s price movements without having to own the asset itself.

The more traditional investors, who don’t want to attempt to navigate cryptocurrency exchanges and wallets, have found the spot ETFs to be a comfortable investment option.

Since their launch, the spot ETFs have brought large demand for the asset. Initially, these fresh capital inflows helped BTC rise to a new all-time high (ATH), but recently, the asset has been consolidated.

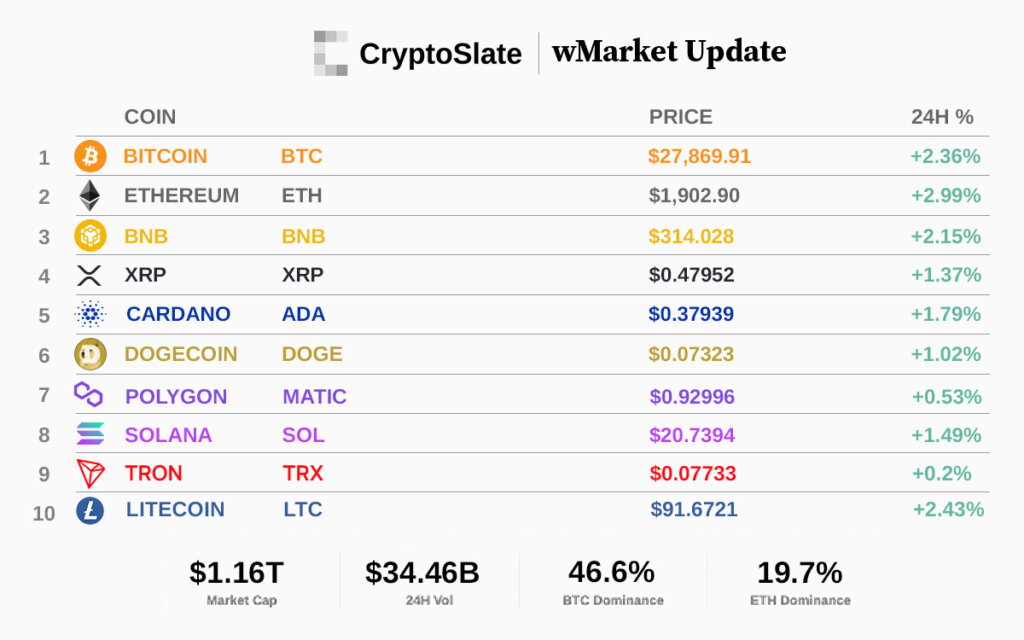

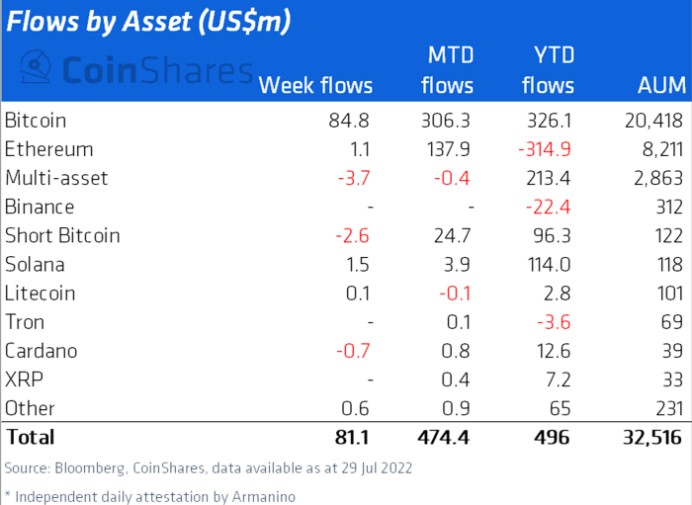

Below is a chart that shows how the combined reserve of these funds compares against the other large entities in the sector.

From the graph, it’s visible that the spot ETFs hold 862,000 BTC. This is more than what the miners (excluding Patoshi) hold (706,000 BTC) but notably less than the reserve of the centralized exchanges (2.3 million BTC).

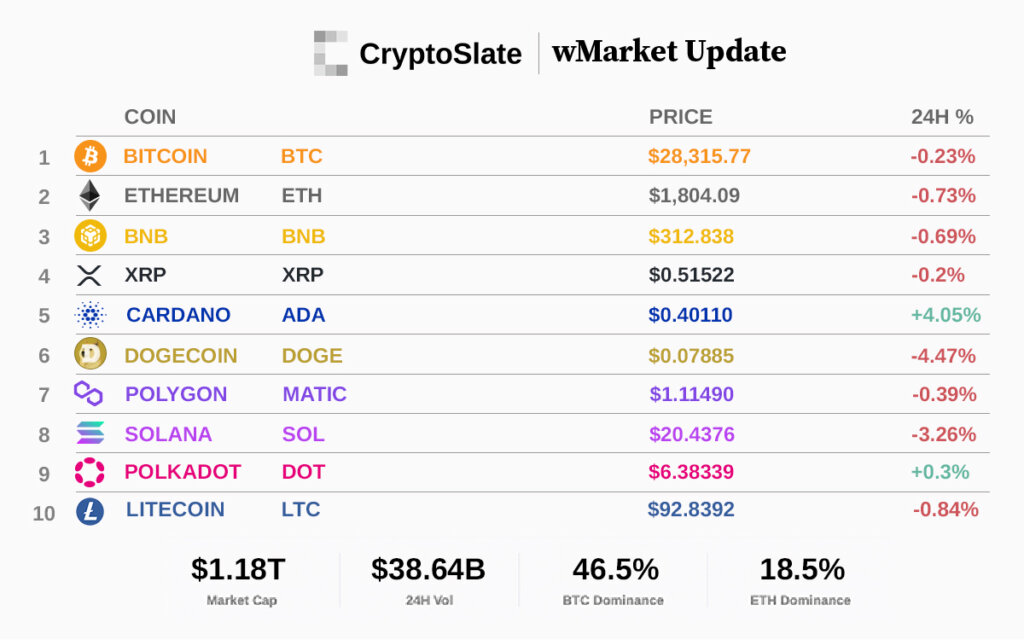

Glassnode has noted that the cryptocurrency exchange Coinbase alone holds a big part of the total exchange reserve and the US spot ETF balance through its custody service.

“With Coinbase serving both ETF clients and conventional on-chain asset holders, the gravity of the exchange in the market pricing process has become significant,” reads the report.

The data for the whale deposits to the platform reveal a rising trend until mid-April.

According to the analytics firm, a significant portion of these whale deposits had come from the Grayscale Bitcoin Trust (GBTC), adding to the selling pressure in the market.

The whale exchange inflows shooting up may partly explain why the spot ETFs haven’t proven as effective. Another factor behind the consolidation can be the trend in the futures market.

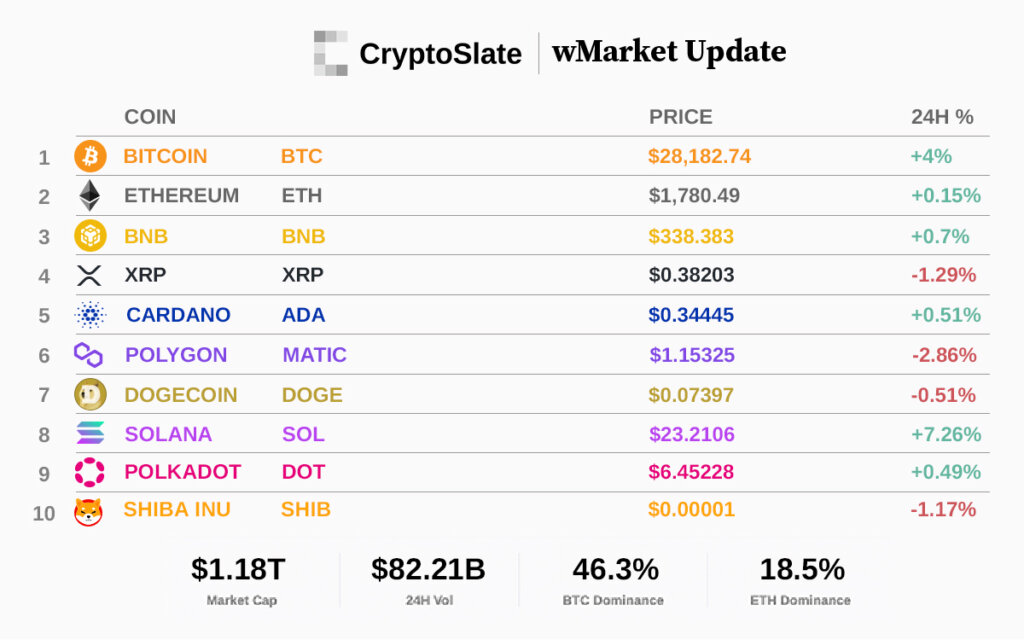

The chart below shows that the CME’s future open interest has recently been at high levels.

The report thinks this could signal that an increasing number of traders have been adopting a cash-and-carry arbitrage strategy.

This arbitrage involves a market-neutral position, coupling the purchase of a long spot position, and the sale (short) of a position in a futures contract of the same underlying asset which is trading at a premium.

This could explain why the spot ETF inflows have only been able to have a neutral impact on the prices in the Bitcoin market recently.

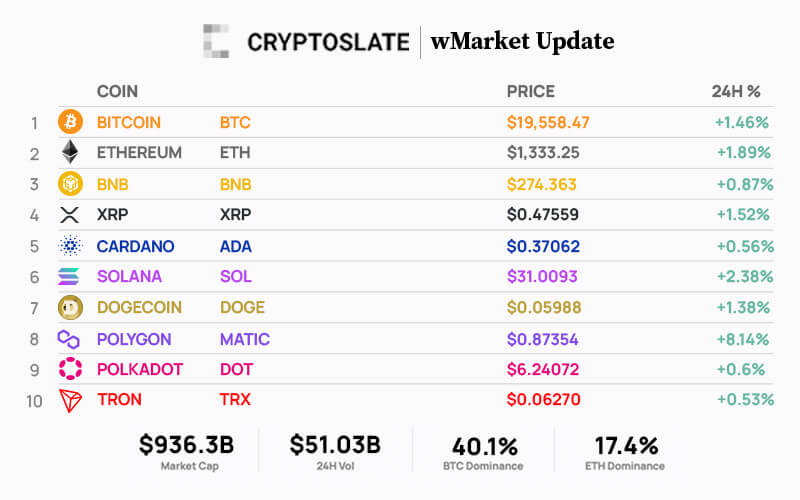

BTC PriceBitcoin has swiftly recovered more than 4% in the past 24 hours as its price is now back above $69,700.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptospot Token (SPOT) на Currencies.ru

|

|