2018-7-3 23:14 |

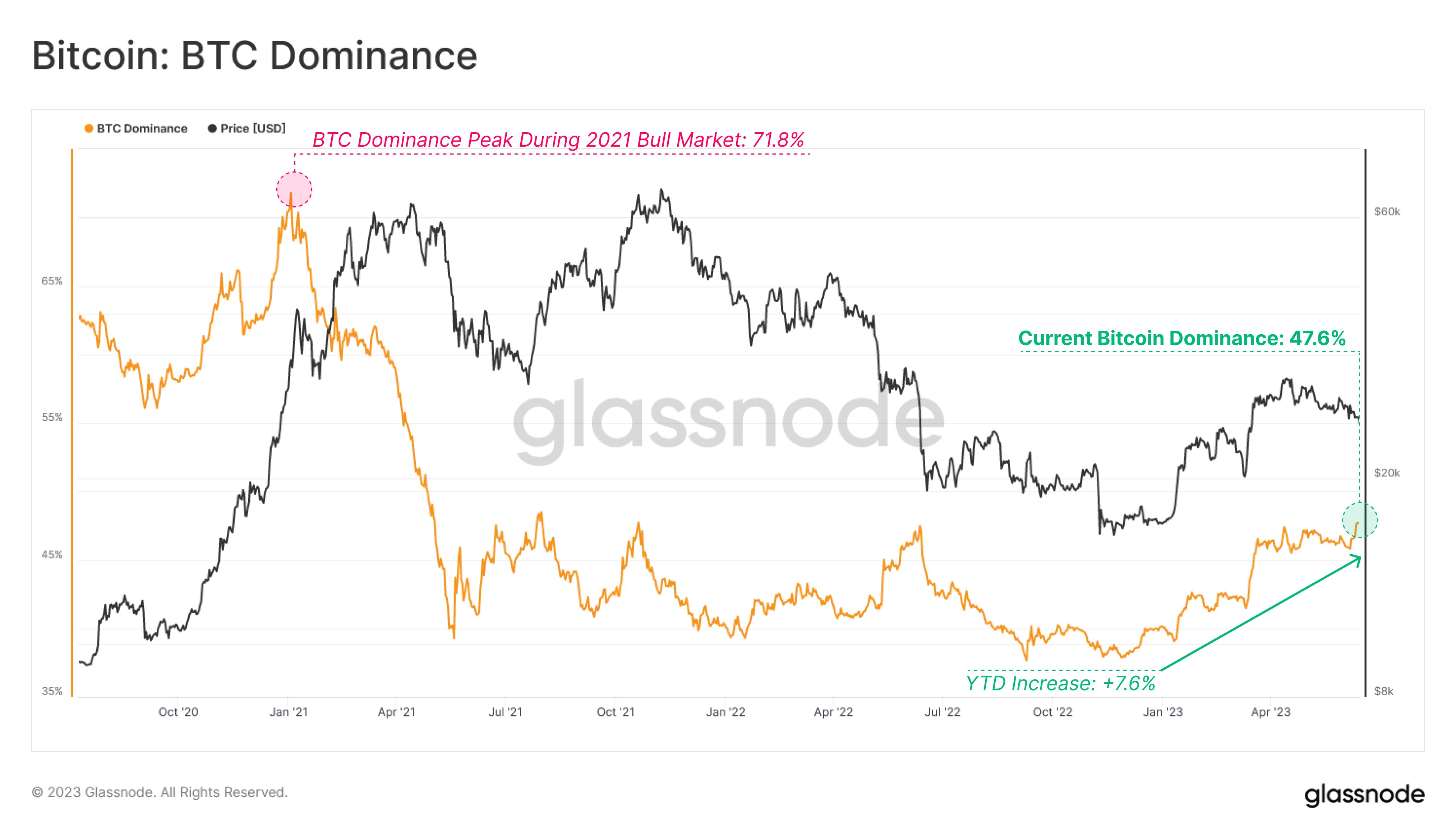

Bitcoin (BTC) dominance is the percentage of cryptocurrency’s total market capitalization accounted for by Bitcoin, and it has reached a near-three month high.

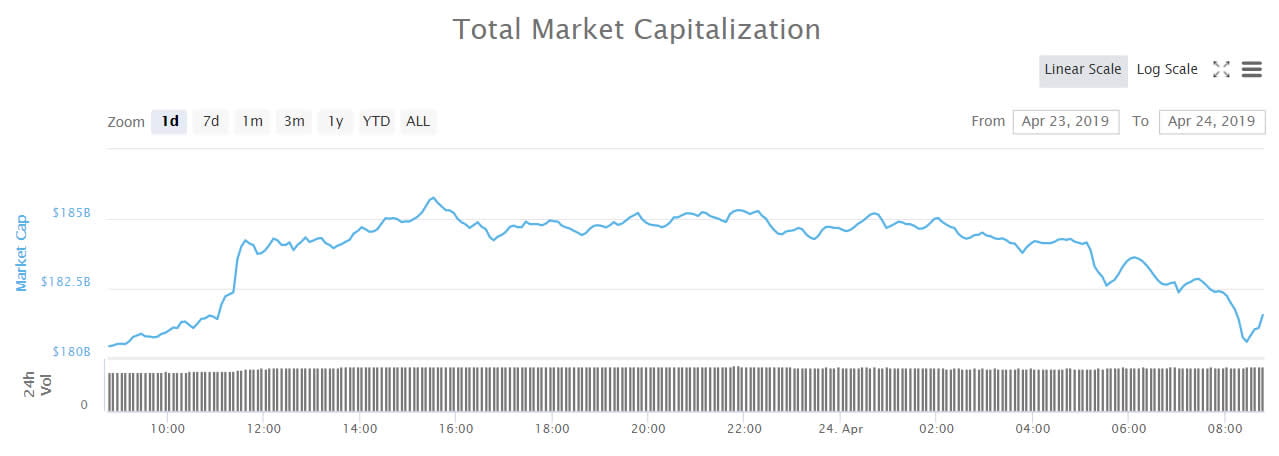

According to CoinMarketCap, BTC dominance is now 42.6% of the market, its highest since April 15th. Its increase has occurred at the same time as the market’s total value experienced a downtrend.

Since the 9th of June, cryptocurrency’s total market cap has fallen by around 25% from around $340bn to its present valuation of $256bn: a near $100bn loss. BTC dominance has risen by 3% in the past two weeks and by around 4% since the beginning of the month.

Although bitcoin has experienced a price decline, falling, over the same time period, from $7,603 to $6,600, it is below that of the market in general, suggesting investors are buying more BTC than other cryptocurrencies.

What does Bitcoin Dominance Mean?Bitcoin dominance is used to measure how much BTC is worth, as a percentage of all cryptocurrency values. During prolonged market shifts, it can also highlight whether demand for Bitcoin is staying above that of the market average.

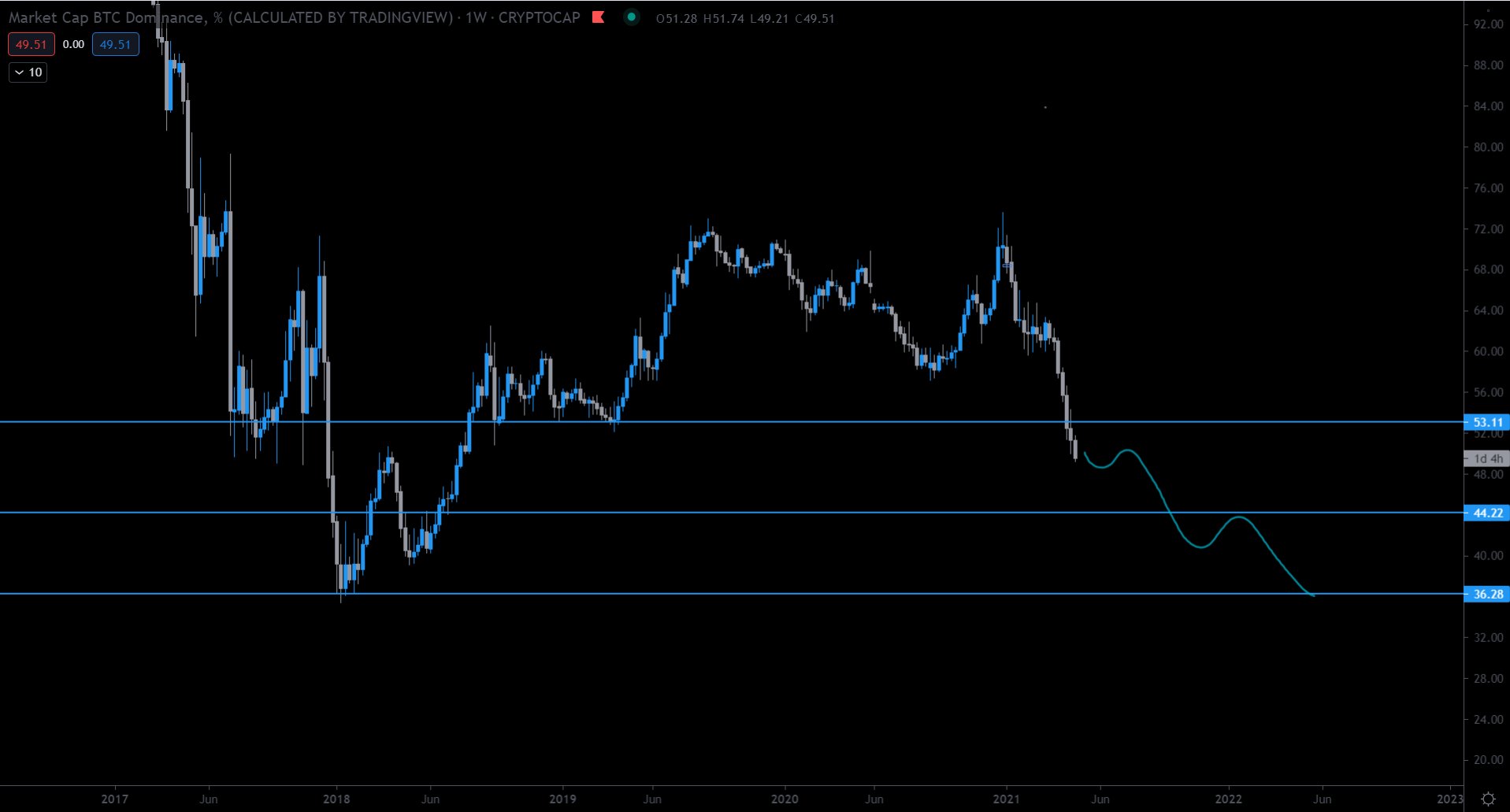

When the market’s value has begun to increase; BTC dominance has declined. Between February and June of last year, for example, Bitcoin’s market share halved from over 85% to 37%.

Although Bitcoin’s value nearly trebled during this same timeframe, other cryptocurrencies also received investor attention: Ethereum’s value went from representing 17% of the entire crypto market to 31%.

Bitcoin is the ‘gateway coin’ for a lot of investors; they buy BTC before purchasing other coins. This can be in part because of its near-universal listing on every active crypto exchange, but also because of its high-profile and low volatility (which is something of a relative statement).

Most people have heard of Bitcoin. Data collected by Google Trends highlights that although Internet searches on the platform have fallen since January, ‘bitcoin’ has been searched almost five times more frequently than ‘cryptocurrency’, even in the past 90 days.

When crypto enters a bearish trend, BTC dominance often increases. Its relatively low volatility means investors can maintain (some) value with their funds. During market declines, this makes it a convenient asset for investors looking to keep their money in cryptocurrency but wanting to minimize risk.

And for those who have the stomach, there’s always Tether.

The author is invested in BTC and ETH, which are mentioned in this article.

The post Why Bitcoin Dominance Is A Big Deal appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|