2020-1-23 20:07 |

Dash is, like many other cryptocurrencies, an open source peer-to-peer transaction system. Building from that, Dash offers users an instant, private, and secure means of transaction both online and in-person. The mission of Dash is simple, to be a user-friendly transaction network that is suitable for mass adoption and provides scalability.

Here’s what we’ll go over in this beginner’s guide:

What is Dash? The Dash Team MasterNodes Transactions PrivateSend InstantSend Mining Dash Buying Dash Storing/Using Dash Conclusion What is Dash?Dash was created by lead developer, Evan Duffield and released on January 18, 2014 under the name XCoin (XCO). Just 10 days later, it was renamed DarkCoin, only to be rebranded as Dash in 2015. We’ll just refer to it as Dash from here on out.

Dash was created by forking the Litecoin (LTC) blockchain code, a process common throughout the industry. Duffield was able to modify the rules of the existing Litecoin chain while making alterations deemed necessary to make Dash unique.

This fork did not go so smoothly, however. In the early days of the launch, 1.9 million dash coins were mined due to a bug when the code was forked. Dash was created with a hard cap of 18.9 million coins, meaning 10% of the total supply was created prematurely. The event is sometimes referred to as “the instamine”.

This seemed like it could be the kiss of death for something that was so fresh in a market that can be extremely unforgiving. Duffield offered to relaunch the coin after identifying and fixing the coding issue, but the Dash community did not approve. He then suggested an airdrop, or free distribution of coins, but the community rejected that idea as well. The instamined coins ended up being distributed to various exchanges at low prices to be traded by users.

The instamine was a mistake on Duffeild’s part, which he readily admits,

“I can be impatient sometimes and I should have waited another week or two, to test all of the code thoroughly before launching.”

Despite the stumble out of the gate, the instamine is largely viewed as a positive for Dash. Duffield had this to say about the long-term effects of the instamine,

“Having the initial distribution up-front, before the coin gains traction allowed the Dash project to skip about two years of activity that Bitcoin went through in about a month. This was the case because initially coins were distributed and made their way to the founders, who got them for nothing. At this point, they could either sell or work on the project and make their investment worth more over time. This takes hard work and is a similar model to what we see in centralized companies. I believe all successful crypto-coins in our space have a distribution where the founders have more than 5% of the currency combined. In Dash, all of the founders combined have less than 10% total (of the current supply, not total).”

Over time Dash grew steadily in both popularity and value. The network developed a self-funding model that incentivizes both individuals and organizations to contribute to the network. This decentralized governance system is referred to as a decentralized autonomous organization or DAO.

The Dash TeamThe Dash Core DAO is made up of 30 full-time employees, 20 part-time workers, and unpaid volunteers. They are paid from Dash’s budget system built into the network to eliminate the need for donations or corporate sponsorships, things viewed as a threat to the decentralized nature of the network.

Dash is the first DAO to be powered by a Sybil proof decentralized governance and funding system. A Sybil attack is a computer security term for when a reputation system is compromised by an attacker who creates a number of false identities on the network in order to gain unauthorized influence.

Dash uses “decentralized governance by blockchain” (DGBB), or simply a “treasury system” in order to combat Sybil attacks. The treasury system allows the network to come to a true degree of consensus when it comes to proposed network changes and development funding for the DAO.

While Dash was the brainchild of Evan Duffield, he now serves as the DAO’s lead strategy advisor.

The CEO of the Dash Core Team, Ryan Taylor, represents an exciting trend. He quit a lucrative position at a multi-billion-dollar hedge fund in New York to join the Dash team. The goal of many cryptocurrencies revolves around taking power from traditional financial institutions and Dash is doing its part in this case.

Like other projects, the Dash team is a mixture of named and anonymous contributors all held accountable by the network at-large. The DAO differentiates itself from a traditional corporation as some of the high-ranking members can be removed if consensus is reached on the network. A more democratic process compared to the closed-door board room meetings of corporations.

MasternodesPerhaps the largest difference between Dash and other blockchains like Bitcoin is its use of a two-tiered network. On Bitcoin’s single tier system, all functions are carried out by the miners who maintain the network. Dash’s network features a tier of mining systems that compile common transactions and create new blocks just like Bitcoin, but it also has a system of Masternodes that operate on a second tier.

Masternodes are computers granted special permissions carry out more sensitive functions that are unique to the Dash network, such as PrivateSend, InstantSend, and governance functions for the DAO. When a Masternode joins the network, the system requires 1000 DASH as collateral to deter Sybil attacks like we mentioned earlier.

While Masternodes are not performing proof of work jobs like miners, they are responsible for vital network functions. This means that the system is designed to split block rewards between miners and Masternodes. Each of the two sides earns 45% of the block reward, while the remaining 10% goes towards Dash’s treasury system.

Each Masternode operator receives one vote for consensus deliberations regarding use of treasury funds. Typically, the fund pays out the money needed to keep the DAO operational. But the system also allows for Masternodes to vote on spending decisions, such as if a programmer decided to launch a side project that would directly benefit Dash’s network.

Transactions PrivateSendPrivateSend is a transaction function of the Dash network that is designed to obscure the sender of funds on the blockchain. PrivateSend is a coin-mixing process based on CoinJoin, an anoymization method originally designed for Bitcoin transactions.

Basically, if you want to make a payment, you would find other users also trying to make a transaction. Your coins would essentially be put into a pool and broken up and the desired amounts would be delivered to the recipients but in denominations that would obfuscate the amount sent and by whom.

In the current iteration of PrivateSend, the system ensures privacy by compiling matching inputs from several senders and combining them into a single transaction that executes multiple outputs. Because of the multiple senders, the transactions cannot be traced with certainty. PrivateSend guarantees fungibility on the network as all coins will be valued equally.

Masternodes on the network carry out the coin mixing and obfuscation of transactions. Specialized equipment carrying out tasks like this means that miners are not slowed down due to added computing strain.

The Dash PrivateSend Process

InstantSendInstantSend is a design feature to push through urgent transactions on the Dash Network. It allows for near instant transfers of funds, locking inputs to specific transactions to be verified by a Masternode consensus. InstantSend acts as a protection against double-spending.

Double-spending would go something like this. Say you have 100 DASH in your wallet and you decide you want to send all 100 to your friend, but first you tried to send it to an exchange wallet. The Masternode that was handling the transaction would identify that the same 100 coins were being spent simultaneously and either reject the second transaction or both.

The InstantSend function is intended for urgent transactions that would most likely take priority over every day transactions that would be handled by minders. For example, you’d probably want to pay for a cup of coffee using a normal Dash transaction. But if you were trying to make a larger purchase, something that would be worth thousands of dollars, both parties may want that money to go through instantly instead of sitting in a queue on the network.

Mining DashDash was created as a fork of the Litecoin, which was created as a fork of the Bitcoin blockchain. This means, while each coin offers its own utilities, they are based on the same principles. The blockchain is a decentralized ledger of transactions that is maintained using a mechanism of consensus. In the case of Dash, Litecoin, and Bitcoin, the mechanism of choice is a proof of work (PoW) system.

Proof of work mining means that miners using specialized hardware are solving problems presented by an algorithm — called X11 in Dash’s case — for the chance to validate transactions as they occur on the network. As these transactions are validated, they eventually fill a block. When a block is completed, the miner who finished it is rewarded with a specified amount of the network’s native currency, in this case, Dash itself.

As networks grow, the mining process needs to become more difficult to keep the network from out-processing its own transactions. Dash could be mined using central processing units (CPUs) and graphics processing units (GPUs), but these methods are no longer cost-effective. Specialized hardware called application integrated circuits (ASICs) are now required to efficiently solve Dash’s proof of work problems.

Buying DashDash is one of the more common cryptocurrencies and is available for trading on many exchanges, including Binance, Bitfinex, and Kraken.

Bitcoin is the most commonly paired cryptocurrency that can be traded for Dash, but there are some exchanges that allow for a direct exchange between Dash and fiat currency, like the US dollar, British pound, South Korean won, etc.

Sometimes the easiest method is to create an account on an exchange that allows for bank account or credit card purchases and buying Bitcoin. You can then transfer that purchased Bitcoin to an exchange that allows for Dash/BTC pairings and making a trade.

Check out our How to Buy Dash Guide to see the exact process.

Storing/Using DashUpon making a trade for Dash it will be stored on a wallet set up for you on the exchange. Most of the time it is in your best interest to move your coins onto a wallet that you have full control over. Leaving your coins on an exchange could potentially expose you to hackers and you could lose everything.

The most secure way to hold onto your Dash is a hardware wallet. The most popular hardware wallets are available from Trezor, KeepKey, and Ledger. These pieces of hardware store your private keys, or the code needed to move funds on the blockchain.

Another secure way to store your Dash coins is on a desktop wallet. There are a number of wallets that are compatible with Dash, but if you are looking for a way to store your coins with all of the features introduced by the developers, the Dash Core wallet is the way to go. It allows full access to InstantSend and PrivateSend functions.

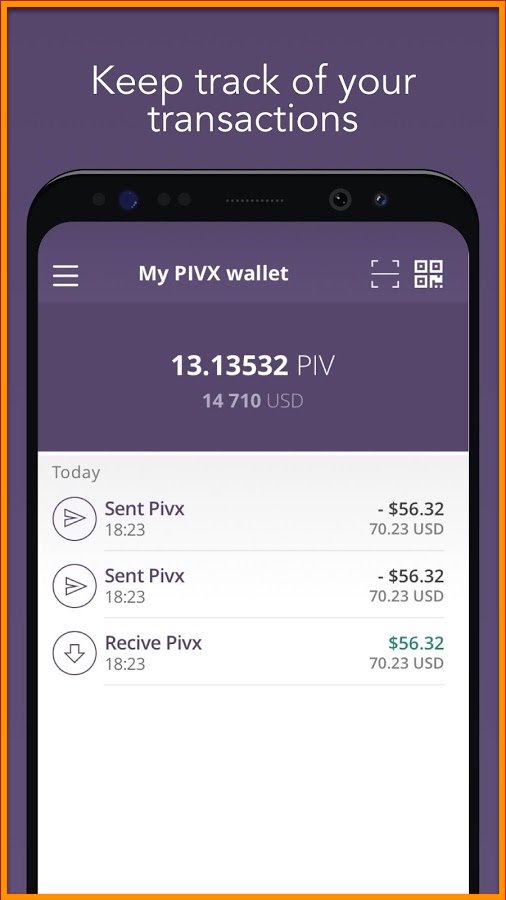

Dash can also be stored on mobile wallets available for both Android and iOS devices. Jaxx is the most popular choice that is compatible with both operating systems.

ConclusionThe simplicity of Dash’s mission is its biggest strength. The cryptocurrency market is swarming with projects promising the moon and more. Some will tell you that they will change the way we’ll vote in the future, that record keeping will never be the same, even offering outlandish technological breakthroughs that are merely theoretical due to current technological limitations. The Dash team forgoes the delusions of grandeur and promises a payment system that has the security and speed that you just cannot get from traditional transaction instruments. Currently, a lot of cryptocurrencies are somewhat clunky and subject to the limiting user interfaces of the various wallets. Dash is looking to solve that by delivering a user-friendly, secure, and scalable transaction system, truly living up to the term digital cash.

The post What is Dash Cryptocurrency? | The Ultimate Beginner’s Guide appeared first on UNHASHED.

Similar to Notcoin - Blum - Airdrops In 2024

Dash (DASH) íà Currencies.ru

|

|