2022-1-20 23:06 |

Bitcoin’s fixed supply makes it a possible good inflation hedge, according to pundits. By 2140, mining blocks will no longer yield a block reward. John Cantrell believes that the hash power generated would still be enough to secure the network.

Bitcoin is one of the most valued cryptocurrencies and, indeed, the one with the largest market capitalization. The digital asset, in part, owes this value to its limited and predictable supply, which will see all 21 million Bitcoins mined by 2140. It raises the question of what happens after all the Bitcoins have been mined.

The Bitcoin Mining Schedule And The Mining ProcessEach block mined releases a fixed amount of Bitcoin. At launch, the amount was fixed at 50 BTC. The algorithm was, however, set to halve this amount after every 210,000 blocks, approximately every four years. Currently, the block reward sits at 6.25 BTC.

Bitcoin’s fixed supply and predictability make it a reliable deflationary asset. Bitcoin’s block reward has for a long time incentivized Bitcoin miners to keep purchasing expensive mining equipment to mine more Bitcoin.

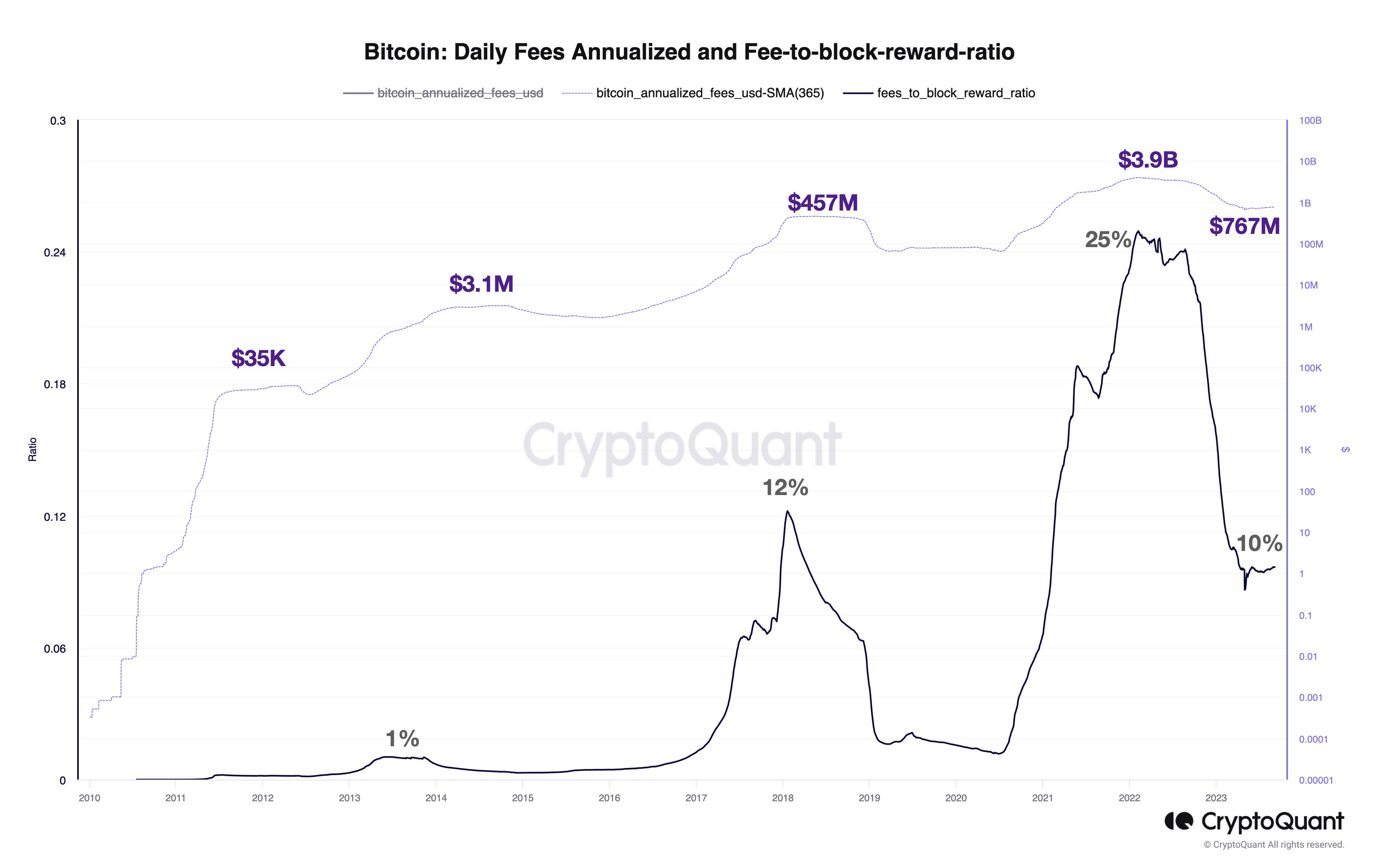

So What Happens After 2140 When There Are No Block Rewards?When the maximum supply is reached in 2140, there will be no more BTC to be given as block rewards. At this point, the only incentive to mine Bitcoin blocks will be the transaction fees obtained from each transaction on the block. However, it raises the question of whether this would be enough incentive considering the role miners play in making sure that the network is not compromised.

For the Bitcoin network to be secure, a certain level of “hash” or mining power ought to be maintained. Software engineer John Cantrell, in a thread, expressed optimism that the projected high value of the asset would make these fees enough to maintain the hash power.

“These fees will still exist in 2140 and depending on the price of Bitcoin by then they will be enough to sustain a certain amount of hash power.”

Cantrell, who regularly uses his Twitter handle to educate people on Bitcoin, disclosed that the generated hash power from Bitcoin mining machines was correlated to the proceeds obtained from mining the Bitcoin blocks. He added that the more miners made, the more they were willing to spend on mining equipment.

John expressed his belief that Bitcoin blocks will continue to be mined even after the supply limit is reached and that the hash power will be enough.

“Blocks will continue to be mined every 10 minutes and the miners of those blocks will be rewarded with the transaction fees. The question is how much hash power will there be and how distributed will it be? I’m optimistic that there will be enough.”

It is important to note that 90% of all Bitcoin that will ever be in circulation has already been mined after 12 years of the cryptocurrency’s launch. However, due to the schedule, it would take another 118 years to mine the remaining supply.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|