2022-12-20 10:30 |

Grayscale’s CEO says the company has been through the crypto winter before.

Sonnenshein expects more regulation and consolidation in the cryptocurrency industry.

However, he believes crypto, as an asset class, is here to stay.

More regulation is expected in the cryptocurrency industryGrayscale CEO, Michael Sonnenshein, told CNBC in an interview on Monday, that he expects more regulation in the cryptocurrency industry.

"It is a #crypto winter, we've been through this before. At the moment, what you're going to see is more regulation and more consolidation in the industry," says @Grayscale CEO @Sonnenshein. "I've never been more confident that crypto as an asset class is here to stay." pic.twitter.com/SqWhfvkUvp

— Squawk Box (@SquawkCNBC) December 19, 2022

While talking to CNBC’s Squawk Box, Sonnenshein stated that it is the crypto winter, and the company has been there before.

“It is a crypto winter, we’ve been through this before, unfortunately, we are going through it again, and we may have to go through it again in the future. At the moment, what you’re going to see in this crypto winter would be more regulation and more consolidation in the industry. We’ve seen time and again bad actors weeded out of the ecosystem, and crypto emerges more resilient and stronger each time we see a winter.”

When asked if he expects the situation to play out the same way this time around, the Grayscale CEO said he does. He added that;

“I’ve been in the crypto space for nine years. I’ve been through all kinds of cycles, and I’ve never been more confident and optimistic that crypto as an asset class is here to stay.”

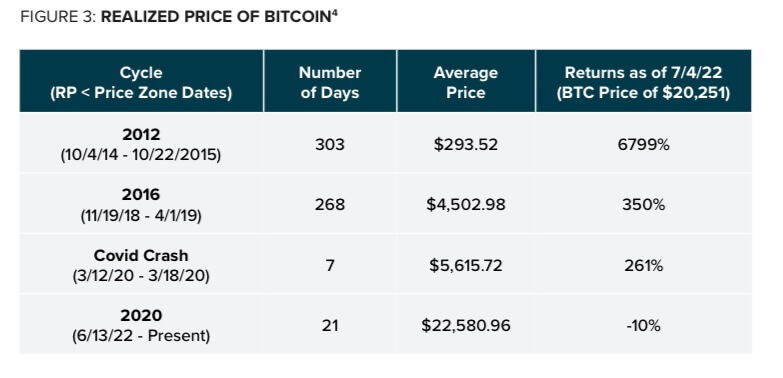

The Grayscale Bitcoin Trust continues to underperformThe Grayscale Bitcoin Trust (GBTC), the leading investment product offered by Grayscale, has been underperforming in recent months.

Last week, the Grayscale Bitcoin Trust (GBTC) shares hit a record-high discount rate relative to the price of Bitcoin, surpassing 50%.

Concern about Grayscale’s reserves, higher fees and other challenges are the reason behind the discount. Our analyst believes that the discount will not close any time soon.

The increase in discount came shortly after the US Securities and Exchange Commission (SEC) reaffirmed its reasons for denying Grayscale’s application to convert the GBTC into an exchange-traded fund (ETF).

The post We are going to see more regulation and consolidation in the industry, says Grayscale CEO appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Vice Industry Token (VIT) на Currencies.ru

|

|