2024-4-8 19:37 |

Global asset behemoth BlackRock has added four major U.S. banks as authorized participants (APs) to the iShares Bitcoin Trust (IBIT) as the fund continues to attract billions of dollars from traditional retail and institutional investors.

New members include Goldman Sachs, a Wall Street powerhouse with a history of trashing cryptocurrencies for years.

BlackRock Adds Wall Street Giants Goldman Sachs, Citigroup To Its Bitcoin ETFBlackRock has added five big Wall Street firms as partners for its spot Bitcoin ETF.

According to a prospectus filed with the U.S. Securities and Exchange Commission on April 5, BlackRock named Citadel Securities, Goldman Sachs, UBS, Citigroup, and clearing house ABN AMRO as “authorized participants” for its iShares Bitcoin Trust (IBIT).

Authorized participants are a key part of the ETF operational mechanism, creating and redeeming shares of the fund to keep the price of IBIT in sync with that of Bitcoin (BTC). They join previously authorized participants Jane Street Capital, JP Morgan, Macquarie Capital, and Virtu Americas, which were named a day before the ETF went live.

According to Bloomberg’s senior ETF analyst Eric Balchunas, the new additions suggest that “big-time firms now want a piece of the action and/or are now OK being publicly associated w[ith] this.”

Here's current list of ETFs and their APs. Up until now Citi, GS, UBS and Citadel were not named in any of these ETF filings. So they either new OR they were ashamed before to be ID-ed but are now cool. Either way, likely a result of the ETFs' mega-flows/success. pic.twitter.com/TRkpllJ1Js

— Eric Balchunas (@EricBalchunas) April 5, 2024The partnership with Goldman Sachs is particularly noteworthy as one of the bank’s top executives remains a crypto skeptic. During a recent Wall Street Journal interview, Sharmin Mossavar-Rahmani, the chief investment officer of Goldman Sachs Asset & Wealth Management, asserted that crypto was “not an investment asset class,” and that she and her bank’s customers are “not believers in crypto.”

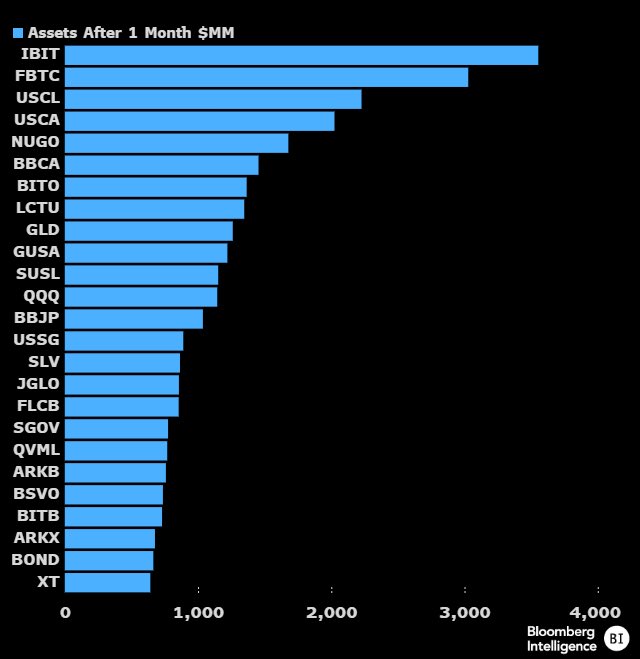

BlackRock’s IBIT continues to lead in terms of trading volume and assets under management, followed by Grayscale’s and Fidelity’s funds. IBIT assets hit nearly $18 billion on April 1, as per BitMEX Research data.

As the spot products continue to gain traction among investors, BlackRock’s expansion of its AP list is a bullish development that could further boost the growth and stability of IBIT.

Similar to Notcoin - Blum - Airdrops In 2024

EthereumFog (ETF) на Currencies.ru

|

|