2024-11-5 22:15 |

VanEck said the Solana (SOL) network’s high user engagement and transaction volume largely reflect its low-cost, high-throughput design despite substantial revenues stemming from speculative memecoin activity.

The firm’s latest analysis comes in response to speculation that Solana’s numbers are inflated by wash trading in memecoins. Many critics argue that this makes SOL’s growth less notable than the numbers make it seem and raise concerns over its future potential.

However, VanEck head of digital asset research Mathew Sigel emphasized that Solana’s popularity among speculative traders is driven by the chain’s structural efficiencies, which attract users at a rate unmatched by other networks.

According to VanEck’s latest analysis, approximately 14.2% of Solana’s revenue is generated by wash trading — the practice of artificially inflating trade volumes through repeated buying and selling of the same asset. By comparison, Ethereum’s estimated wash trading volume accounted for 2% of its revenue this year.

Sigel stated:

“Solana’s architecture encourages high transaction activity, especially among speculative traders, which contributes to its revenue growth.”

Sigel also noted that VanEck’s addition of risk disclosures in its SOL exchange-traded product (ETP) prospectus reflects its commitment to transparency for investors. The firm has incorporated expanded disclosures regarding wash trading, potential manipulation by major SOL holders, and other market risks.

Speculation drives revenue but raises questionsVanEck’s report indicated that more than a third of Solana’s revenue is tied to memecoin and NFT trading, fueling skepticism from critics who contend that the majority of Solana’s 111 million active wallets could be Sybil accounts — artificial accounts used to inflate user counts.

The analysis found that assessing genuine user activity is challenging due to the decentralized nature of blockchain data, but VanEck contends that Solana’s structural efficiencies make it particularly suited for high-volume trading.

Solana’s low transaction fees, approximately 1/10,000th of Ethereum’s, create a conducive environment for speculative trading. VanEck noted that applications like Pump.fun have further increased memecoin activity on Solana, positioning it as a leading blockchain for speculative assets.

However, the report added that Solana’s design offers potential for use cases beyond memecoins, which could drive future diversification and revenue stability.

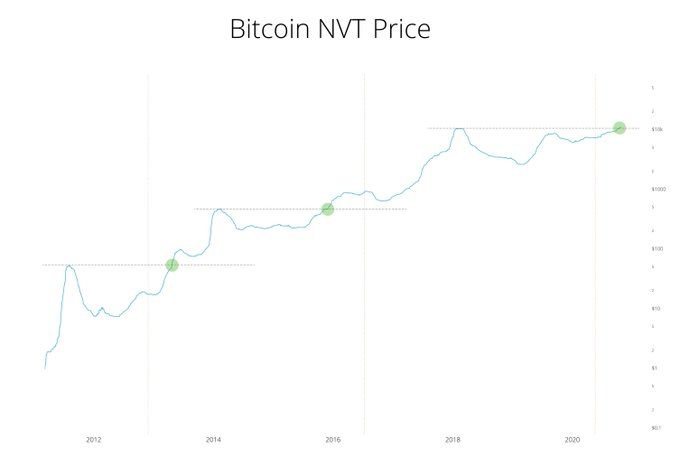

Future potentialVanEck believes that Solana’s transaction metrics might evolve, much as Ethereum’s did, to include a broader range of applications despite the current reliance on speculative memecoins to generate a significant portion of revenue.

The report compared Solana’s trajectory to those of companies like Alibaba and DraftKings, which initially faced scrutiny over user metrics but ultimately grew into more diversified revenue models.

VanEck projects that Solana, like Ethereum, could evolve away from a reliance on speculative assets toward sustainable applications in decentralized infrastructure and social media.

As Solana’s ecosystem matures, VanEck believes its high engagement levels could translate into long-term growth opportunities that align with investor expectations for diversified revenue sources.

The post VanEck counters skepticism, highlights Solana’s high transaction allure appeared first on CryptoSlate.

Similar to Notcoin - Blum - Airdrops In 2024

Data Transaction Token (XD) на Currencies.ru

|

|