2023-9-18 07:39 |

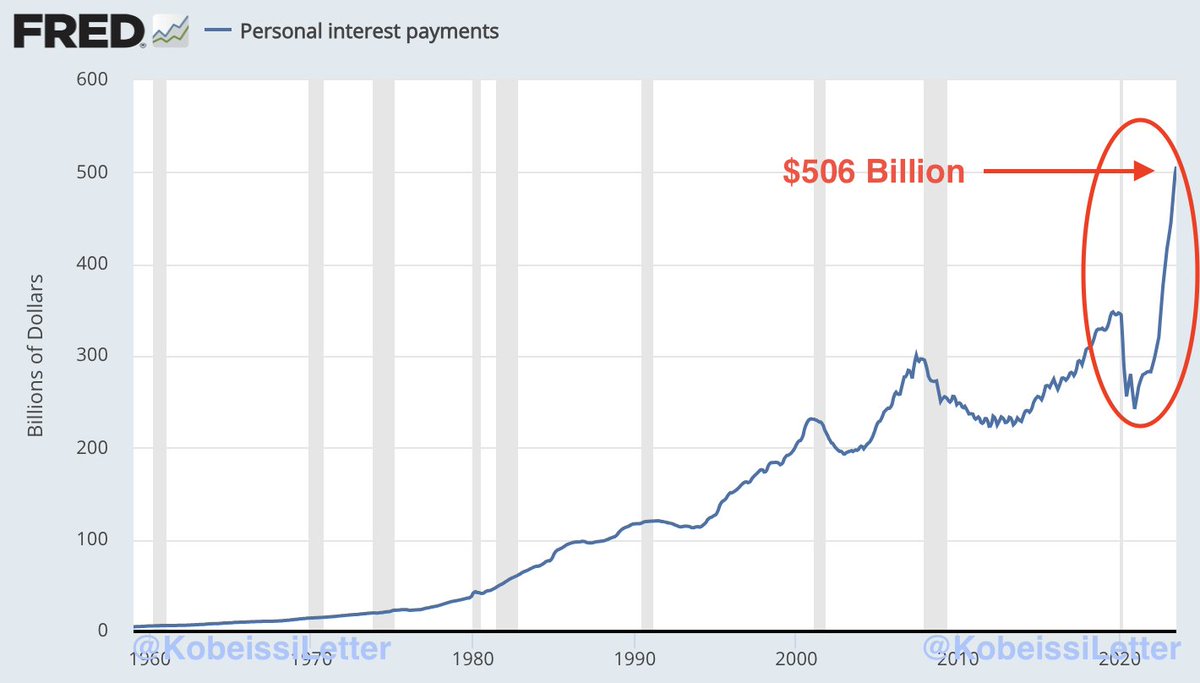

High interest rates in the United States are crippling households as interest payments skyrocket. The latest figures put personal interest payments a whopping half a trillion dollars, according to the central bank.

According to the St. Louis Federal Reserve, US personal interest payments hit a record $506 billion in July.

Interest Payments SkyrocketingDuring the first seven months of 2023, Americans paid a total of $3.3 trillion in personal interest, reported The Kobeissi Letter on September 17.

This is up a staggering 80% since 2021, and nearly above the entire 2022 total, it added. Moreover, these figures do not include interest on mortgage payments. The outlet exclaimed,

“Americans are drowning in interest.”

Personal interest payments. Source: X/Fred/@KobeissiLetterSensible rates mean that borrowing is relatively cheap, and paying it back is much easier. However, in its fight against inflation, the Federal Reserve has been aggressively hiking interest rates.

“As rates rise, individuals and the US government are facing a crisis. Interest is skyrocketing.”

Current interest rates in the US are 5.5%. However, repayments are likely to be much higher than this. Borrowing costs for everything from home equity lines of credit to auto loans and credit cards have spiked.

It is the same story with inflation, which has increased over the past 3 months to 3.7%. However, prices usually increase much more than the rate of inflation, putting extra pressure on households and individuals.

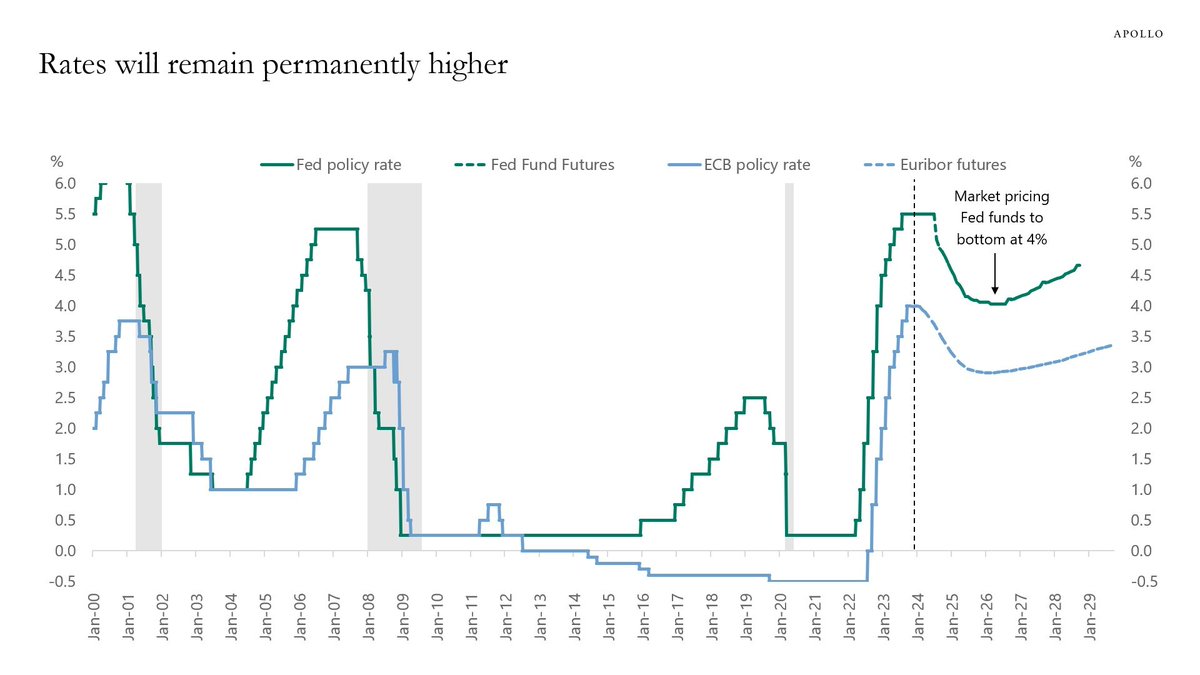

Furthermore, economists expect the Fed to hike interest rates once more this year, and they are likely to stay at peak levels longer than previously expected, according to reports.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

Last month, Fed Chair Jerome Powell hinted the central bank will likely forgo a rate increase in September. Nevertheless, he commented that inflation was still too high, adding:

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

US Personal Savings DepletedAs reported by BeInCrypto earlier this month, US personal savings have also dwindled. Furthermore, the Fed expects savings to be completely depleted by the end of this year.

This means less disposable money to spend on risk-on investments such as crypto.

Moreover, US banks are still in trouble. There has been a massive outflow in deposits recently, and the Fed’s banking bailout fund has hit record levels.

Meanwhile, crypto markets continue to trade sideways with very little impetus, especially from Uncle Sam.

The post US Personal Interest Payments Top $500B as Rate Rises Cripple Households appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Interest (BCI) на Currencies.ru

|

|