2023-5-19 01:20 |

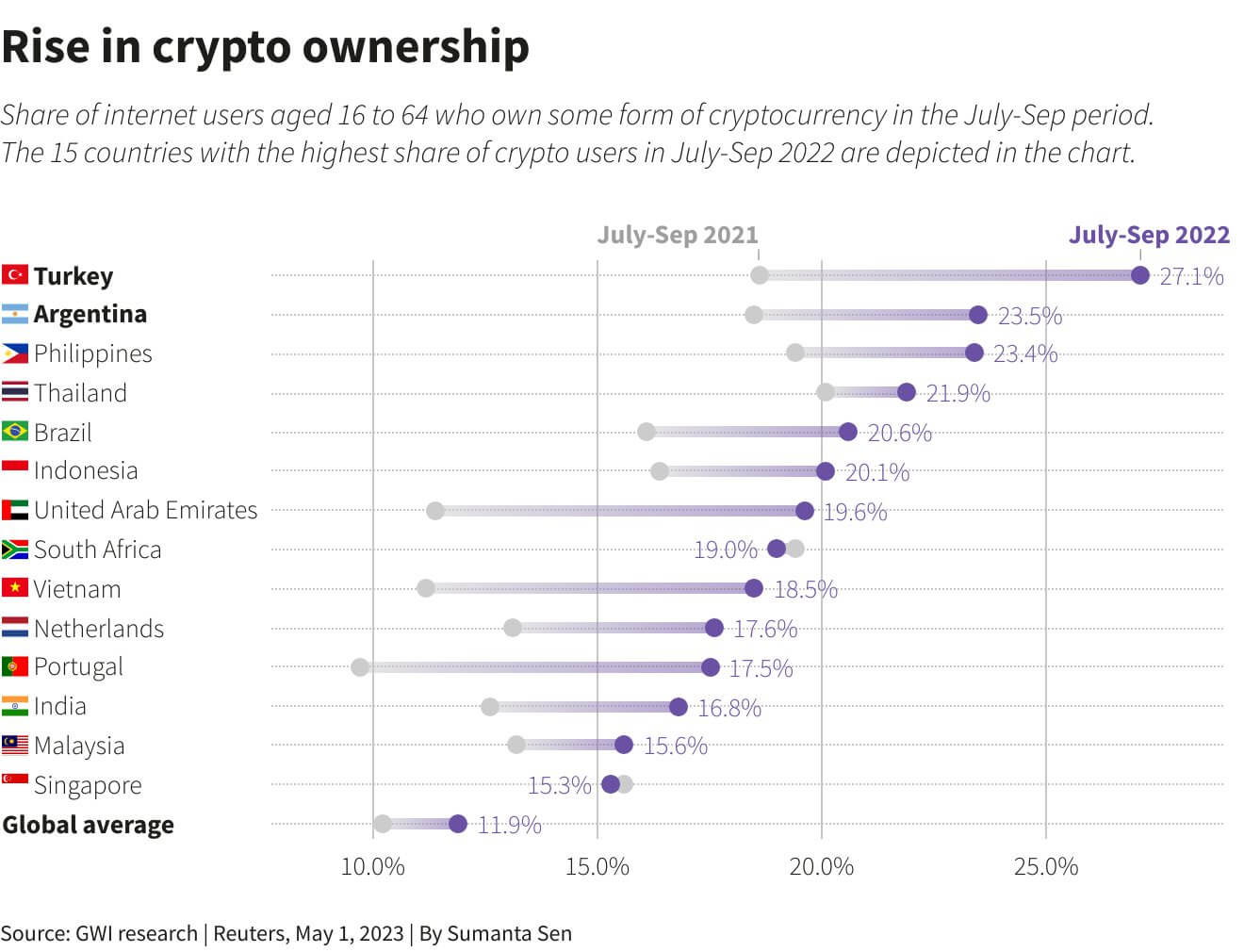

Turkey has seen a huge increase in cryptocurrency ownership as the country’s inflation rates skyrocket, according to GWI Research. With a 27.1% increase in ownership from July-September 2021 to July-September 2022, Turkey had the biggest growth in cryptocurrency ownership, according to the survey, which looked at people between the ages of 16 and 64. Argentina and the Philippines were close behind, with increases of 23.5% and 23.4% in crypto ownership rates.

The soaring inflation rates in these nations can be blamed for the rise in crypto possession. The Turkish Lira had a sharp collapse in late 2021, losing 44% of its value in relation to the US dollar. Early in 2022, the country’s inflation rate exceeded 30%; by the end of the year, it was a startling 72.31%. The daily trading volume of cryptocurrencies in Turkey reached an average of $1.8 billion due to these economic considerations.

The use of cryptocurrencies in these nations has broad ramifications. Over 2.4 million Turks, or about 2.94% of the population, are now considered Bitcoin owners. The devaluation of the Turkish Lira, which impacted many Turkish families’ savings and investments, has improved the environment for the adoption of cryptocurrencies. Additionally, the Turkish populace has come to favour cryptocurrencies due to their simplicity of use and perception of them as a hedge against inflation.

Trading is the only available alternative for people interested in the field due to Turkey’s lack of a regulatory framework, which has allowed cryptocurrency trading to grow. However, as the government prepares to introduce its central bank’s digital currency, the digital lira, in 2023, regulatory adjustments are anticipated in the upcoming years. Higher taxes and more precise regulations for cryptocurrency-related activity are predicted, yet a total ban on cryptocurrencies seems unlikely.

A loss of faith in fiat money and demand for alternative stores of value in Argentina and the Philippines has also sparked the popularity of cryptocurrencies. The public’s increased interest in cryptocurrencies is a sign that digital assets are becoming more widely accepted and that decentralised financial systems are becoming more prevalent.

Significant trading volumes are seen on major Turkish cryptocurrency exchanges like BtcTurk and Paribu, indicating that the rise in cryptocurrency ownership in these nations is not going unnoticed. Another sign of cryptocurrencies’ expanding societal influence is their growth into other industries, like sports sponsorship and university courses.

Cryptocurrencies have become popular for people looking to secure their wealth as the global economy struggles with the pandemic’s aftermath and inflationary pressures. The rise in cryptocurrency ownership in Turkey, Argentina, and the Philippines demonstrates the growing acceptance and acknowledgement of cryptocurrencies as an alternative financial tool in times of economic upheaval, even though difficulties and concerns still exist.

Similar to Notcoin - Blum - Airdrops In 2024

Crowdvilla Ownership (CRV) на Currencies.ru

|

|