2023-10-10 13:30 |

More and more cryptocurrency market analysts are beginning to embrace a bullish narrative. It seems that both technical indicators, on-chain, and market sentiment, suggest confidence in an emerging cryptocurrency bull market.

In addition, the price of Bitcoin, which at the time of this writing is battling resistance at $28,000, also offers hope for a continuation of the uptrend.

BeInCrypto has collected the TOP 3 Bitcoin price peak predictions for the ongoing market cycle. If the largest cryptocurrency has indeed reached the bottom of the cycle at the $15,476 level in November 2022. So, where is its potential peak?

Bitcoin Price Peak Predictions: $137,000 in August 2024According to analyst @Washigorir, the price of BTC is likely to reach $137,000 in less than a year. According to him, this is possible as early as August 2024, just a few months after Bitcoin’s next halving. This event is currently projected for April 17, 2024.

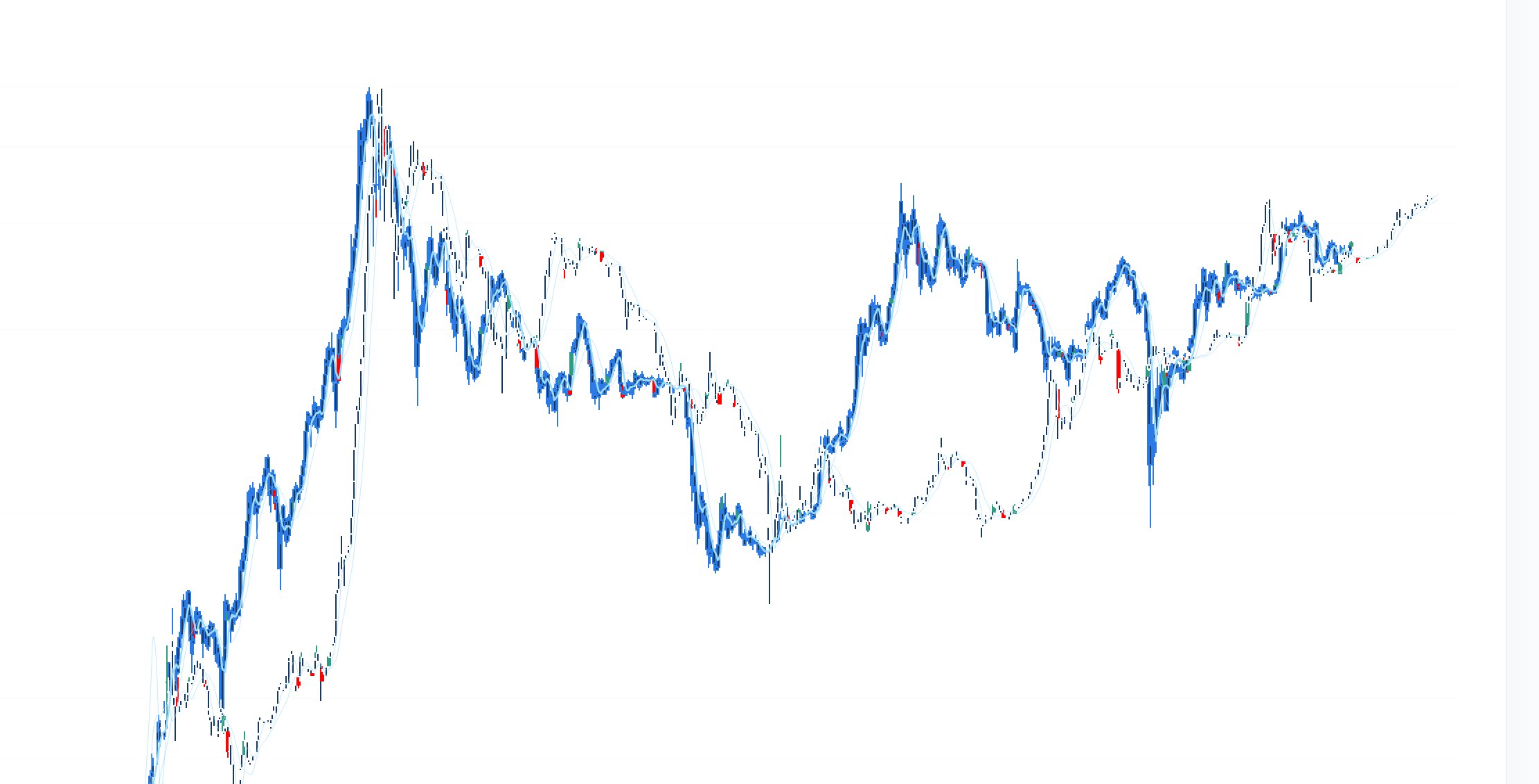

For his bold Bitcoin price peak prediction, the analyst uses two complementary methods. The first is the BTC realized price indicator. This on-chain metric divides the realized market capitalization by the current supply (green line).

He also included two deviations from the realized price on his chart – blue, which marks market lows, and red, which marks peaks.

BTC/USD chart and peak prediction / Source: XThe second method is diagonal trend lines (black). Which connects the bottom of the previous cycle to the peak of the next cycle. Although it appears to follow historical trend lines, this method seems highly subjective.

The angle of the line, which determines where it intersects with the chart of the realized price, can be selected in many ways.

Nevertheless, the end result of @Washigorira’s prediction is the $137,000 level, to be reached as early as August 2024.

Ambitious Range of $200,000 – $250,000The second Bitcoin price peak prediction comes from analyst @seth_fin. In his chart, he uses the famous Pi Cycle indicators – for both market peaks (red) and market lows (green).

Above all, his chart fits the narrative of Bitcoin’s cyclicality triggered by every four-year halving (black lines). The BTC price usually reaches the peak of the next cycle about 12-18 months after this event.

Bitcoin price peak predictions and subsequent halving / Source: XThe analyst then forecasts the further course of the Pi Cycle indicators, which seem to move along the track of an ascending sinusoid. Moreover, he connects the previous two peaks and uses the extension of the trend line thus formed to predict the peak of the Bitcoin price.

According to @seth_fin, at the end of a mature bull market, Bitcoin will likely end its uptrend somewhere in the $200,000 – $250,000 range. This would be an increase of about 10x from the current price.

In a commentary on the chart, the analyst stresses that the possibility of such a scenario is due to the similarity to the 2015 fractal and requires the absence of a black swan like the COVID-19 crash of 2020.

Read More: Best Upcoming Airdrops in 2023

Bitcoin Price Peak Predictions: ATH Is Already in the First PhaseThe latest Bitcoin price peak prediction comes from analyst @CryptoYoddha. Interestingly, his chart does not include a prediction of the absolute peak of the cycle but only his suggestions for the first phase of the rally.

He uses a long-term parallel channel for his analysis. Its upper range (red) marks the area of historical and future peaks. While the lower range (blue) marks the areas of market macro bottoms.

In addition, he uses the famous 200-week moving average (200W MA, red). Which in previous cycles has been considered an indicator of the level of maximum pain for the BTC price.

However, we know that in generating the bottom of the current cycle, it was lost, and Bitcoin was below it for several months.

Bitcoin prediction for 2024 / Source: XThe most significant part of @CryptoYoddha’s analysis is the fractal similarity with the previous cycle. Unlike previous analysts, he contends that the first phase of the upside, expected to occur even before the halving, will already push past the all-time high (ATH).

He takes the area around $72,000-$74,000 in the median area of the channel (gray) as his target.

After that – based on the similarity with the previous cycle – a correction and a possible black swan would be expected. The final Bitcoin price peak prediction in his analysis remains outside the published charts.

However, it’s reasonable to anticipate that it will approach the levels discussed in the second prediction – above the $200,000 area.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here.

The post Top 3 Bitcoin (BTC) Price Peak Predictions for This Cycle appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Castle Peak (CPG) на Currencies.ru

|

|