2024-12-10 17:30 |

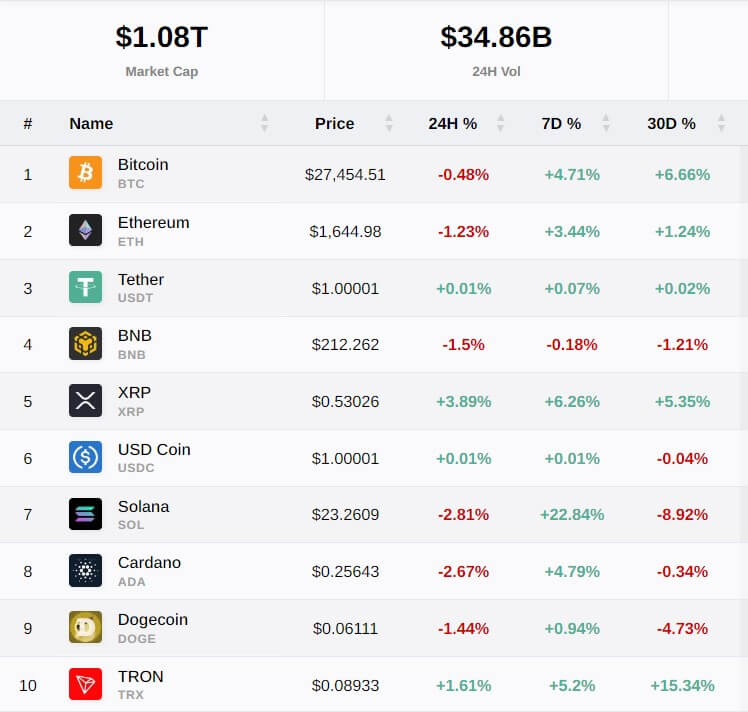

A crypto analyst from A Chain of Blocks has challenged conventional wisdom about XRP’s price ceiling, arguing that market capitalization is an irrelevant metric for predicting the token’s potential value. The analyst bases this assessment on treating XRP as a commodity rather than a security, drawing parallels with traditional commodities like oil.

Against the backdrop of recent regulatory scrutiny, the analysis mentions Brad Garlinghouse’s Harvard Business School background and leadership as Ripple’s CEO. The token has demonstrated remarkable resilience, posting over 300% gains since recent legal developments, despite criticism from figures like John Reed Stark who continue to question crypto’s legitimacy.

The analyst dismantles traditional market cap constraints by comparing XRP to commodity markets. Just as oil’s value isn’t limited by market cap calculations, XRP’s potential price trajectory should be evaluated based on utility, supply dynamics, and market demand rather than arbitrary capitalization limits.

Supporting this thesis, the analyst points to Ripple’s proven track record, processing over $70 billion in digital asset transactions. This real-world utility, combined with XRP’s finite supply characteristics, forms the foundation for potential price appreciation that could far exceed current expectations.

Technical Indicators and Price TargetsThe analysis includes technical metrics showing RSI at historical highs, suggesting strong momentum. Key price targets include:

Support zones: $1.00-$1.41 (Fibonacci retracements) Near-term resistance: $3.37 (triangle breakout target) Long-term potential: $20-$100 range based on utility scalingRead Also: Here’s Why Kaspa (KAS) Price Could Surge 50x

The analyst emphasizes that traditional market cap limitations shouldn’t constrain price projections, suggesting that $100 or higher prices are possible based on adoption rates and utility growth. This perspective aligns with Ripple President Monica Long’s remarks about the expanding role of digital assets in global payments.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

The post Top Analyst Insists Ripple (XRP) Could Spike to $100, Disregards Despite Market Cap Concerns appeared first on CaptainAltcoin.

Similar to Notcoin - Blum - Airdrops In 2024

Ripple (XRP) на Currencies.ru

|

|