2018-7-31 17:13 |

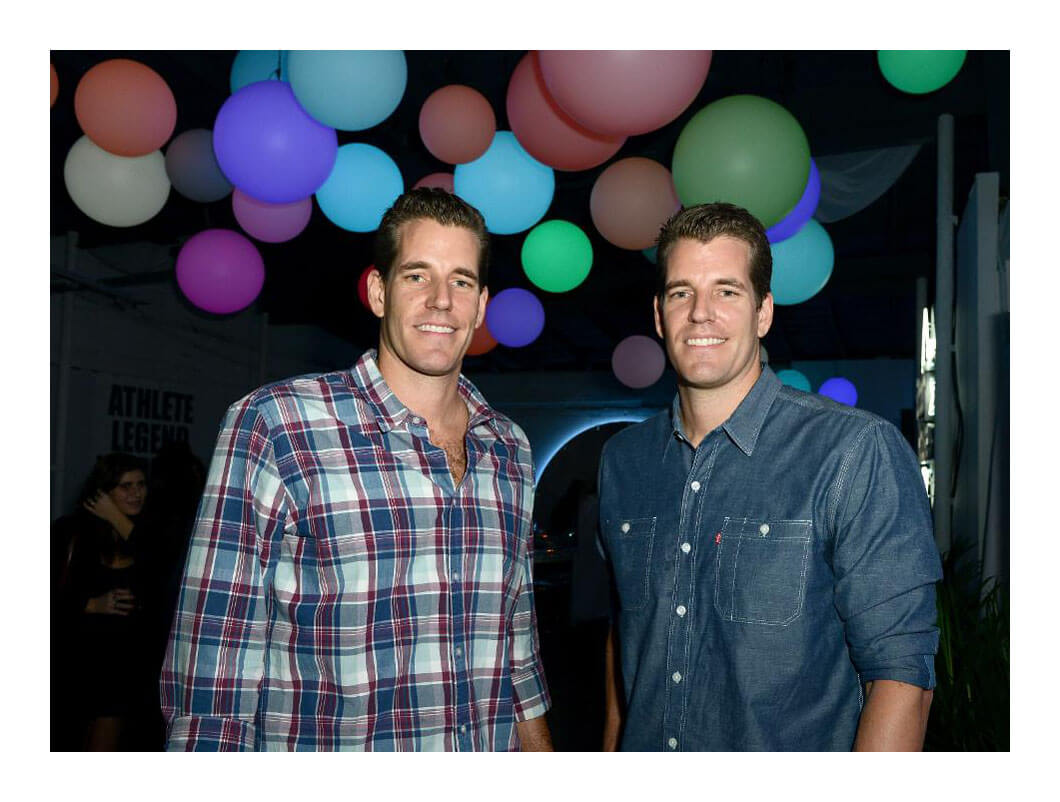

Last week, the ETF application of the Winklevoss twins who are operators of the cryptocurrency exchange Gemini was rejected by the US Securities and Exchange Commission (SEC). Markets, which had earlier reacted positively and moved beyond the $8,000 mark, fell after the rejection became public. The price of Bitcoin went down from $8,300 to $7,800, marking a 6-percent decrease.

Recovery Followed Soon AfterAfter the drop, prices went back close to their normal level within 12 hours. Bitcoin was trading at $8,250. In fact, on July 28, the price of the coin increased by 5 percent within just 50 minutes. Fundstrat founder Tom Lee was delighted with the change and said that the ability of the crypto to leave past disappointments behind and continue a recovery in a swift manner is a sign of a positive change in the market. He said:

“It’s a sign of a positive change in crypto that bitcoin has essentially shrugged off the Winklevoss ETF rejection. If this took place in April-June (more bearish period), the crypto market would have seen a sizable sell-off. In short, affirming why technicals improving.”

The price of Bitcoin had shown a strong upward run since July 22, when prices went from $7,200 to $8,300, reaching a high of $8,500 briefly. Volumes have remained stable, and the cryptocurrency’s momentum had remained undisturbed, leaving out the small break on July 27, when the ETF was rejected.

Did the Markets Overreact to the Rejection?According to analysts, the sudden rise in the price and volume of Bitcoin is due to the anticipation of the crypto community around Bitcoin exchange-traded funds (ETFs). CEO of eToro Yoni Assia said:

“There are many existing alternatives for an ETF, I think having institutional demand flow through those is as important. ETF is simply a regulatory signal from the SEC it’s a valid asset class.”

Currently, as the Winklevoss ETF application has been rejected, the possibility of keeping the crypto community engaged lands partly on the shoulders of the VanEck-SolidX partnership. Another ETF product that could be approved by the SEC is that of the Chicago Board Options Exchange (CBOE). Earlier, an SEC commissioner even rebuked the agency’s decision of rejecting the Winklevoss ETF application even though it satisfied necessary conditions.

CBOE and VanEck have better chances of getting accepted as they are very strictly regulated entities that have worked very closely with the financial regulators in the past. Moreover, they have decades’ worth of experience in managing ETF products.

Tom Lee Cheers Bitcoins Price Recovery After Winklevoss’s ETF Was Rejected was originally found on [blokt] - Blockchain, Bitcoin & Cryptocurrency News.

Similar to Notcoin - Blum - Airdrops In 2024

Safe Exchange Coin (SAFEX) на Currencies.ru

|

|