2020-6-1 23:00 |

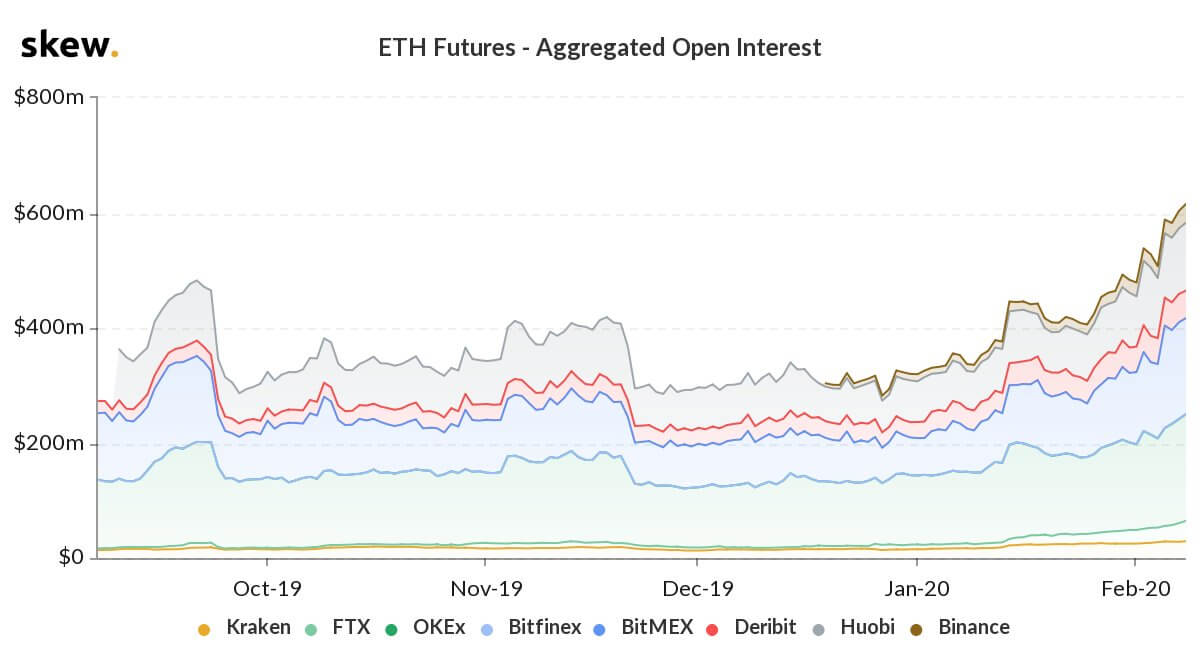

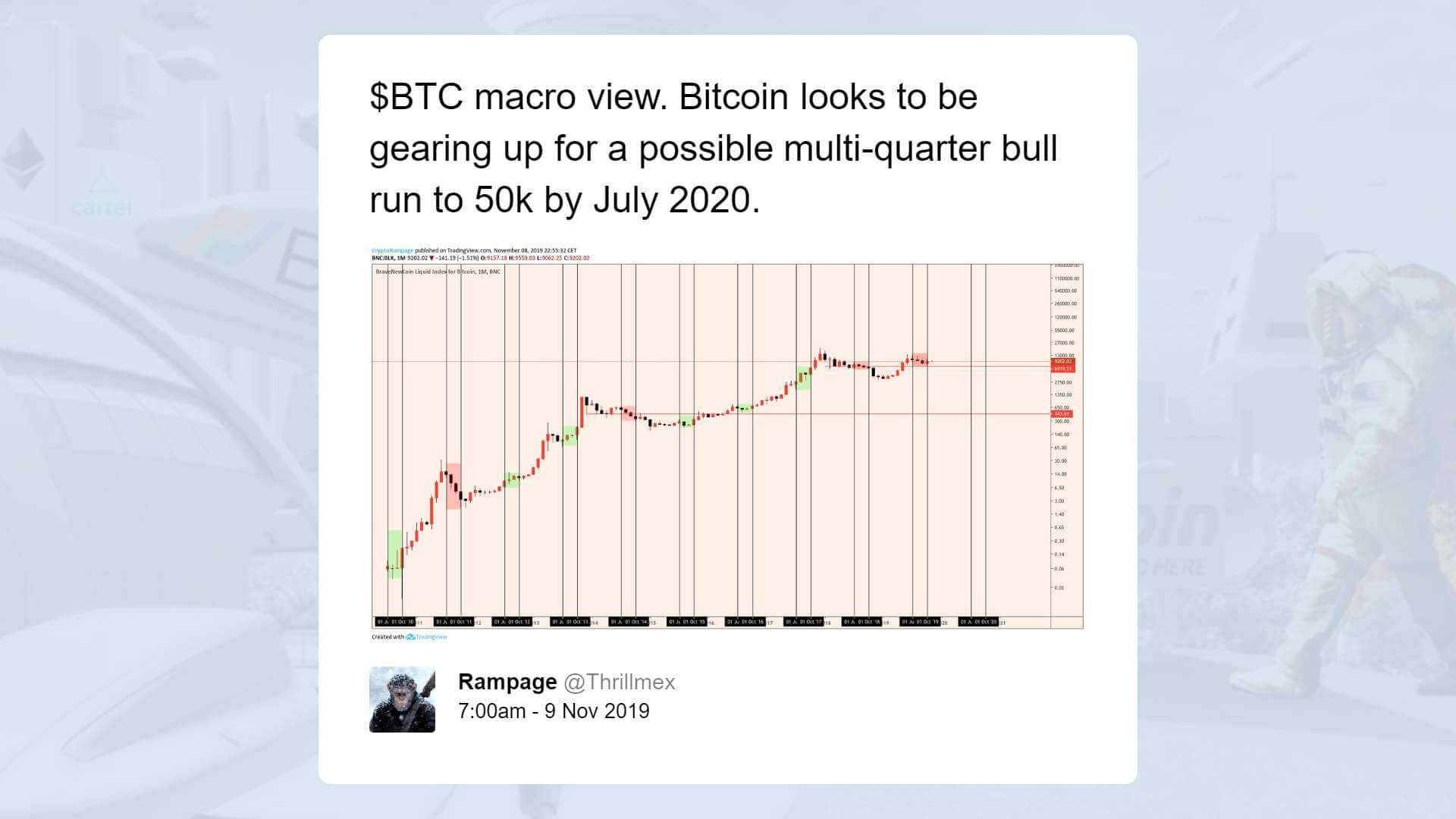

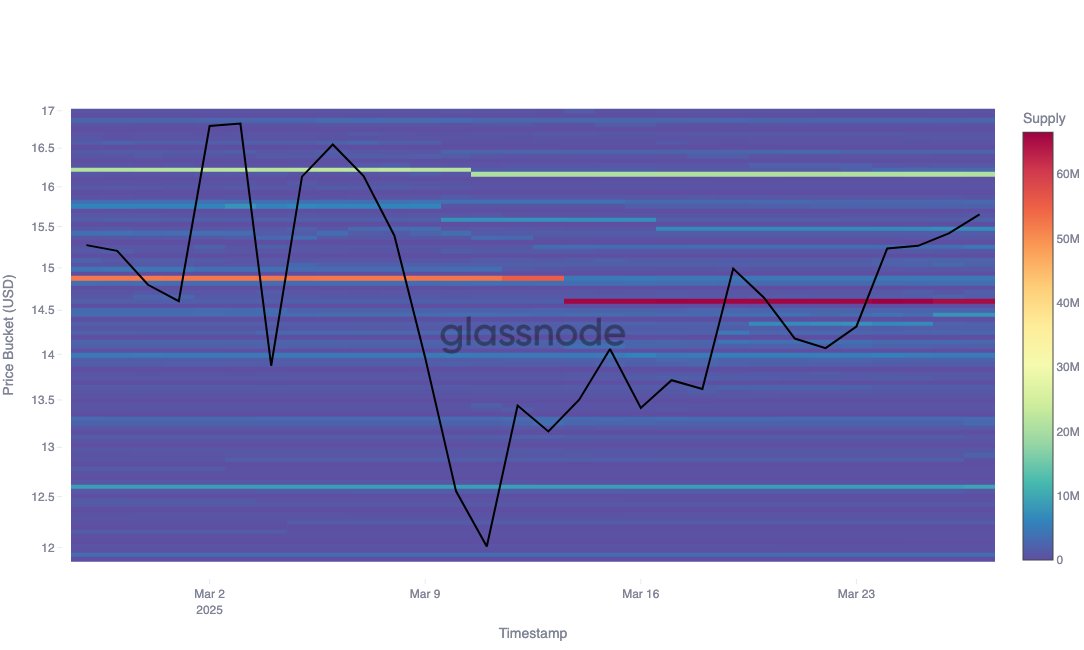

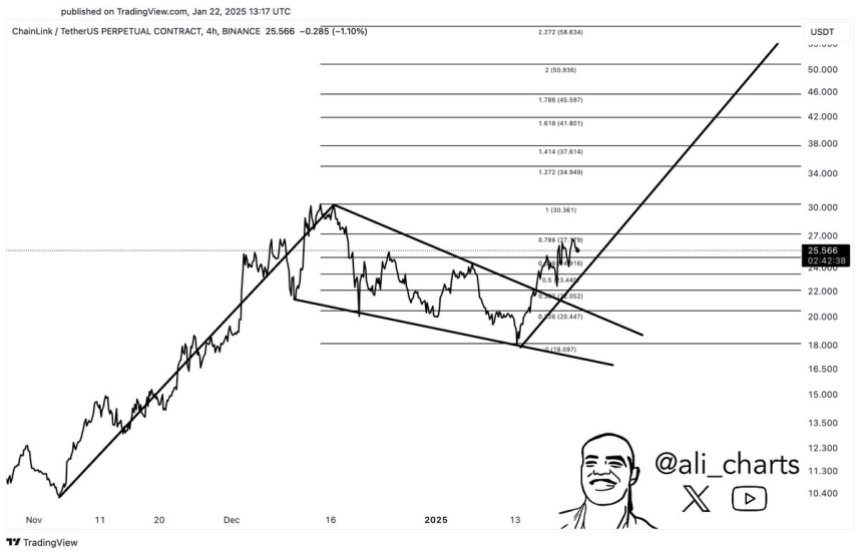

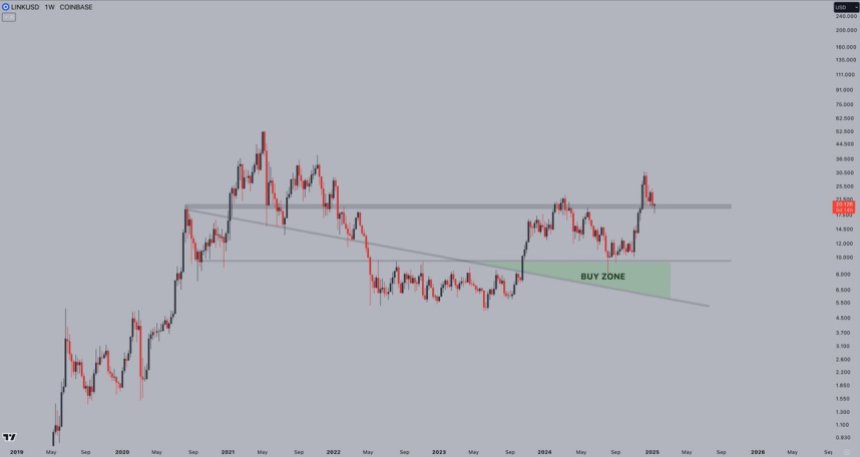

There’s no question that Chainlink has been the most bullish cryptocurrency on the market throughout the past couple of years, posting massive gains throughout 2019 and 2020 These gains allowed it to set fresh all-time highs earlier this year, and it now appears to be navigating back towards these highs Its mounting short-term strength, however, may be plagued by a massive influx of LINK into exchanged over the past day This could suggest that traders are moving their tokens out of cold storage in order to sell the pump Chainlink has seen unprecedented price action over the past couple of years, being one of the only major digital assets that has been able buck the crypto market’s widespread downtrend and even set fresh all-time highs in early 2020. Although the crypto had lost some of its momentum after setting these highs, it now appears that buyers are gearing up to make another big push higher. LINK is now moving to retest its all-time highs after breaking out yesterday evening. Analysts do believe that its ongoing uptrend will continue holding strong until it reaches the upper-$4.00 region. There is one trend, however, that could spell trouble for its short-term price action, and on-chain data clearly elucidates this. Chainlink Pushes Towards All-Time Highs as Bullishness Mounts At the time of writing, Chainlink is trading up over 4% at its current price of $4.38. This marks a notable upswing from recent lows of under $4.10 that were set yesterday evening alongside Bitcoin’s dip to $9,300. The rebound from this level has allowed the crypto to set fresh weekly highs, and it is currently trading up significantly from lows set well within the sub-$4.00 region. As for how high this uptrend could lead the cryptocurrency in the near-term, one analyst recently put forward a chartshowing an upside target at $4.86. Image Courtesy of Crypto Michael This is where its all-time highs – which were set back in early-March – currently sit, and a break above this level would open the gates for it to see serious upside. This On-Chain Trend Could Spell Trouble for the Crypto’s Uptrend There is one on-chain trend that could spell trouble for whether or not the crypto is able to climb to these highs. According to a recent post from analytics platform Glassnode, the balance of Chainlink on exchanges has risen drastically over the past 24-hour as its strength mounts. “LINK Balance on Exchanges (1d MA) increased significantly in the last 24 hours. Current value is $318,256,509.23 (up 4.8% from $303,624,657.71),” they noted while pointing to the chart seen below. Data via Glassnode This data metric suggests that the crypto’s investors are beginning to move their holdings out of cold storage and into exchanges. These investors may be undertaking these actions in order to have the ability to readily sell the pump should the crypto rally to the resistance at its all-time highs. Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

Cash & Back Coin (CNBC) на Currencies.ru

|

|