2021-12-2 22:08 |

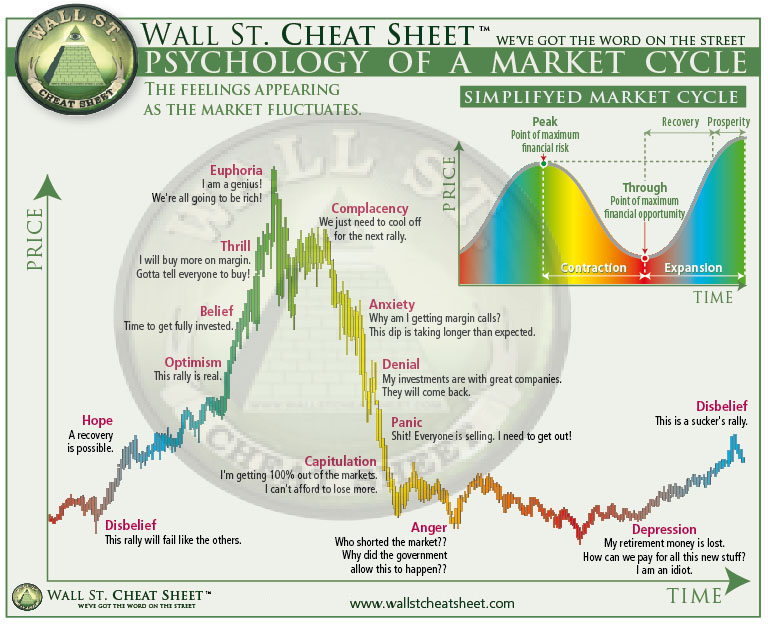

The bitcoin market is yet to officially enter a bear market as many may have already believed, given the last week’s price twist. According to yesterday’s on-chain analysis by Glassnode, last week’s price correction is actually the least severe of all corrections this year at only 20% lower than the all-time-high price.

The market also appears to be on the verge of a bull run given that Bitcoin short-term holders – or holders who have held their coins for less than five months are more likely to continue with the holding trend into the long term. The profit to loss ratio for their coins has fallen below 1 this week, meaning they are making losses in spending them. Therefore, they are likely to not sell their coins at a loss or base cost price and this could provide the much-needed support to prop up the prices in the coming days, said analysts.

“This week, price traded to a low of $53.5k, which whilst not a technical touch, does suggest a potential front-running of that psychological cost basis support level was in play. This is now the second retest of the STH Realised Price in the current trend, and if held, has similarities to major corrections observed in 2017, where it acted as a reliable support.”

According to the analysts, the bull market may return if the market successfully holds the $53k level, which has been retested twice in September and November. Meanwhile, the price rallied shortly yesterday to hit a price of $58,745 but has since retracted 2.76% in the last 24 hours.

The profit for the total supply held by short-term Bitcoin holders has increased by 60% since September while the loss decreased by 21 percent during the same period. Analysts suggest that BTC’s price is yet to bottom because most top buyers are realizing losses, the market is yet to witness sell-offs similar to those seen in May.

“More STH supply is in profit, price is retesting their cost basis, and top buyers are realizing losses on-chain. In bull market conditions, this combination usually sets out a fairly constructive short-term outlook. The key ‘watch-it’ is whether the market can convincingly hold the STH Realised Price at ~$53k.”

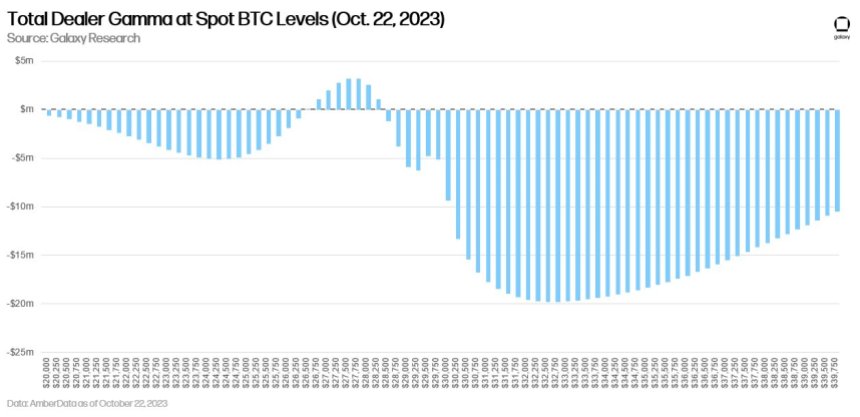

Following the November 26 Bitcoin options contract expiry, the open interests have fallen significantly this week. The perpetual futures market also this week appears to support a bullish case for Bitcoin. However, the funding rates have also declined with price meaning traders are more cautious due to the recent correction.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|