2020-9-17 13:00 |

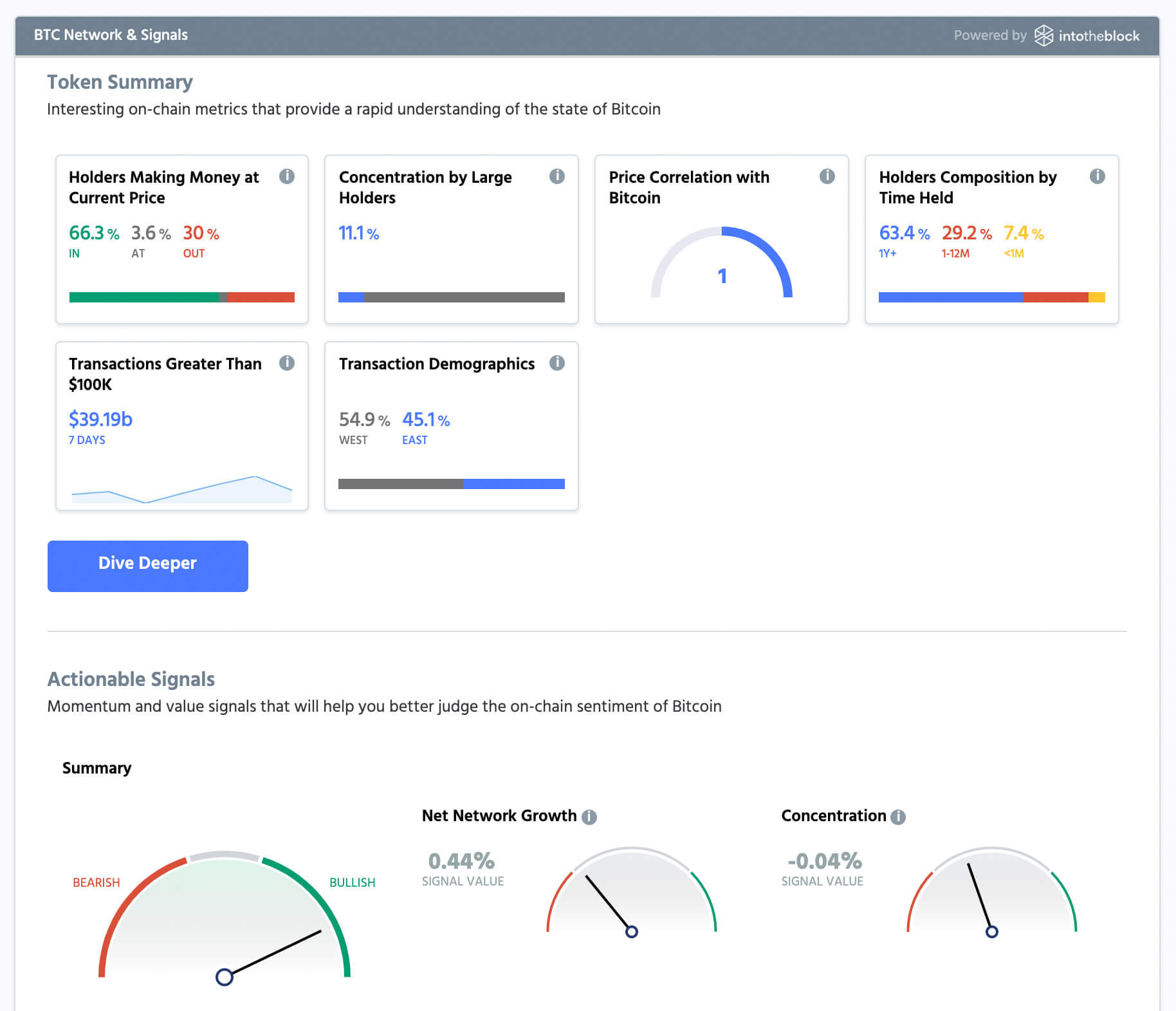

Key on-chain signals show that Bitcoin is still embroiled in a bull trend despite recent uncertainty in the cryptocurrency market. In fact, one blockchain analytics company recently shared 10 signals suggesting BTC is either a “buy” or “strong buy” on a macro time frame.

Confluence of On-Chain Trends Show Bitcoin Remains in a Macro UptrendWith Bitcoin’s strong rejection at the pivotal $12,000 resistance, some analysts have been fearful that BTC’s recent price action was nothing more than a deviation from a bear trend.

Key on-chain indicators, though, make it clear that Bitcoin remains in a macro uptrend.

CryptoQuant, a blockchain data startup, recently shared ten of these indicators suggesting that Bitcoin is currently a “buy” from a long-term perspective. The indicators mentioned by CryptoQuant are as follows:

Miners’ Position Index: All mining pools’ outflows in USD divided by the 365-day moving average of all mining pools’ outflows in USD. Puell Multiple: The daily issuance of BTC in USD by the 365-day moving average of the daily issuance value. Hash Ribbons: Two moving averages of the Bitcoin hash rate, which work in tandem to issue bullish and bearish signals. All Exchanges Outflow Mean: The mean amount of BTC transferred from all exchanges’ wallets. All Exchanges Reserve: The aggregate balance of BTC on all exchanges. Stablecoin Supply Ratio: The ratio of the Bitcoin supply and the stablecoin supply, denoted in BTC. All Exchanges Stablecoin Reserve: The aggregate balance of stablecoins on all exchanges. MVRV Ratio: The ratio between the market cap and the realized cap. Network Value to Metcalfe Ratio: The ratio between Bitcoin’s Metcalfe value and its network value. Stock to Flow: The inverse inflation rate of Bitcoin.Long-term $BTC on-chain indicators look healthyhttps://t.co/VnrIVP3lDF pic.twitter.com/cfE73acVXh

— CryptoQuant (@cryptoquant_com) September 16, 2020

The Fundamental Trends Back Up On-Chain SentimentThere are fundamental trends to back up the underlying signals Bitcoin users are forming through their usage of the leading cryptocurrency.

Dan Tapiero — a co-founder of Gold Bullion Int. and other firms — recently noted that with gold on track to become an institutional asset class, BTC could also gain steam:

“#Gold to become an institutional asset class.Favorite @TaviCosta #Gold chart makes clear case for structural bull mkt to last years. Key fundamentals set into motion. Surprised how much #spx to underperform gold but doesn’t mean it still won’t rally. +BTC too.”

Finally:#Gold to become an institutional asset class.

Favorite @TaviCosta #Gold chart makes clear case for structural bull mkt to last years.

Key fundamentals set into motion.

Surprised how much #spx

to underperform gold but doesn't mean it still won't rally.

(+#btc too.) pic.twitter.com/8Scc0EKY7O

— Dan Tapiero (@DTAPCAP) September 16, 2020

This is one of many fundamental trends that Tapiero has mentioned as a potential driver for Bitcoin’s growth in the years ahead.

Amongst other trends, Tapiero has asserted that the commitment to inflation by the Federal Reserve and the trillions in monetary stimulus from the world’s central banks are primed to drive Bitcoin and gold higher.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com These 10 On-Chain Signals Suggest Bitcoin Is Still Embroiled in a Bull Market origin »Bitcoin price in Telegram @btc_price_every_hour

Signals Network (SGN) на Currencies.ru

|

|